Your credit score is one of the most important financial indicators you possess. It determines whether you qualify for loans, credit cards, or favorable interest rates, impacting your financial health and purchasing power. Understanding what affects your credit score and how to improve it can help you secure better financial opportunities and build a strong credit history.

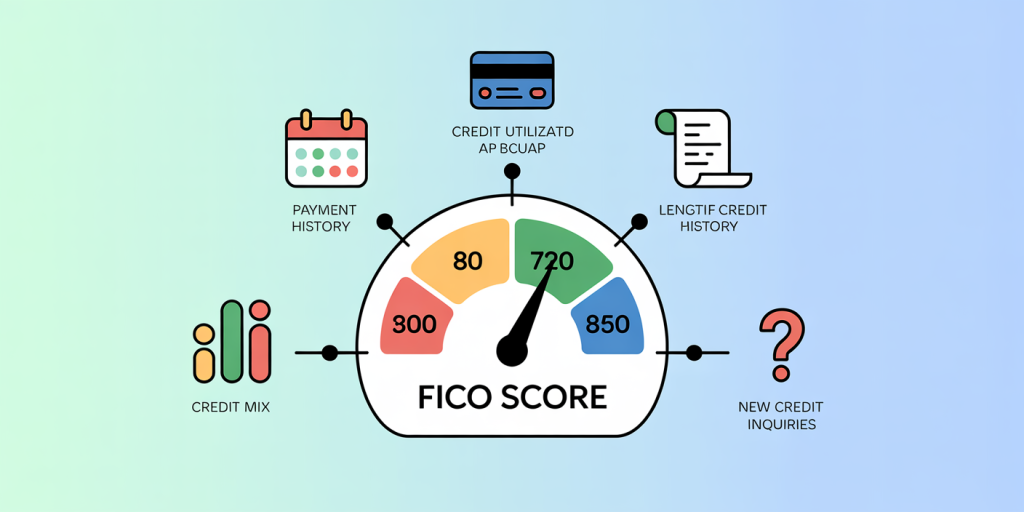

Credit scores are multi-faceted, influenced by various factors such as payment history, credit utilization, length of credit history, types of credit, and new credit inquiries. This article will explore these key components, demonstrate how negative actions impact your score with real examples, and provide actionable steps to fix and improve your credit standing. Additionally, it will discuss future trends in credit scoring and how technology might reshape this critical financial metric.

Key Factors That Influence Your Credit Score

A credit score is typically calculated by credit reporting agencies—Equifax, Experian, and TransUnion—using complex algorithms. The most widely used credit scoring model is the FICO score, which ranges from 300 to 850. According to FICO, the score hinges on five primary categories:

Payment History (35%)

Payment history is the most influential factor in your credit score. It tracks whether you make payments on time for credit cards, loans, mortgages, and other debts. Late payments, defaults, and bankruptcies dramatically lower your score.

For example, a study by the Consumer Financial Protection Bureau (CFPB) found that individuals who missed payments had an average FICO score decrease of 90 points. In real life, someone who pays a credit card bill 30 days late could see that event dropped to their credit report, causing a score decrease by approximately 60–110 points depending on other factors.

Credit Utilization Ratio (30%)

Credit utilization refers to the percentage of your available credit that you’re currently using. Ideally, keeping this ratio below 30% is recommended. For instance, if you have a credit card limit of $10,000, maintaining a balance below $3,000 will positively affect your credit score.

In a notable case, a consumer with $20,000 in total credit limits maintained a $15,000 balance, resulting in a high utilization rate of 75%. Their credit score was significantly lower than peers who used more conservative amounts, even though both made all payments on time.

Length of Credit History (15%)

The length of your credit history includes how long your accounts have been open and the age of your oldest account. Lenders prefer borrowers with a longer credit history as it provides more data to assess risk.

Statistics from Experian show that individuals with a credit history older than 10 years have an average score 50 points higher than those with histories under 3 years. For example, employees who opened their first credit card at age 21 tend to have higher credit scores by age 35 compared to those starting at 30.

Types of Credit and New Credit Inquiries

Mix of Credit Accounts (10%)

Having a healthy mix of credit types, such as installment loans (mortgages, car loans) and revolving credit (credit cards), can improve your score. This diversity shows lenders that you can manage different types of credit responsibly.

For example, a 45-year-old borrower with a mortgage, a car loan, and two credit cards generally scores higher than someone with only credit cards, assuming similar payment histories and utilization rates.

New Credit Applications (10%)

Applying for new credit results in hard inquiries, which can temporarily lower your score. Multiple inquiries in a short period signal potential risk, especially if you apply for several credit lines in a few months.

A consumer who applies for multiple credit cards within 60 days could experience a 5 to 10-point drop per inquiry. However, credit scoring models often treat rate shopping for the same loan (e.g., mortgage or auto loan) within a short window as a single inquiry, mitigating damage.

Below is a comparative table summarizing credit score component weights and their typical impact:

| Credit Factor | Weight (%) | Potential Impact | Example Case |

|---|---|---|---|

| Payment History | 35 | High – Late payments drop scores 60-110 points | Late loan payment decreased score by 90 points |

| Credit Utilization | 30 | Medium-High – >30% utilization lowers score | 75% utilization resulted in substantial decrease |

| Length of Credit History | 15 | Medium – Longer history adds ~50 points | 10+ years history vs. <3 years difference |

| Credit Mix | 10 | Low-Medium – Good mix improves score | Mortgage + car loan + cards higher than cards only |

| New Credit Inquiries | 10 | Low – Multiple inquiries cause minor 5-10 point drops each | Several card applications within 60 days drop score |

Common Issues That Negatively Affect Credit Scores

Late or Missed Payments

Even a single missed payment can have a significant negative impact on your credit score. The derogatory mark stays on your credit report for up to seven years, though its impact lessens over time. For example, late payments on a mortgage are notorious for causing dramatic score drops because mortgage lenders view these as a major risk.

High Credit Card Balances

Exceeding recommended utilization can signal financial distress to lenders. One practical example is a consumer with a $5,000 credit card limit who carries a $4,800 balance for several months. Despite paying minimum payments on time, the high balance reduces their credit score because credit bureaus assess how much credit is actively used relative to available credit.

Defaulting on Loans or Declaring Bankruptcy

Defaults and bankruptcies are severe derogatory marks. According to the Federal Reserve, a bankruptcy can reduce a credit score by 130 to 240 points and remains on a credit report for up to ten years. Such events make it difficult to secure future loans without significantly higher interest rates.

How to Fix and Improve Your Credit Score

Pay Bills On Time, Every Time

Consistent on-time payments are the simplest and most effective way to improve your credit score. Setting up automatic payments or calendar reminders can prevent missed payments. For example, a case study in a financial wellness program showed that automatic bill pay reduced late payments by 25%, resulting in an average 20-point credit score increase after six months.

Reduce Credit Utilization

Focus on paying down existing balances or increasing credit limits responsibly. If a consumer with a $3,000 balance on a $10,000 limit pays down to $1,500, their utilization drops from 30% to 15%, boosting their credit score approximately 20 points. Avoid closing old credit card accounts, as that reduces available credit and can increase your utilization ratio.

Dispute Errors on Your Credit Report

Sometimes, inaccuracies or outdated information can unnecessarily lower your score. The Fair Credit Reporting Act (FCRA) allows consumers to dispute information with credit bureaus. For instance, John Doe found an erroneously reported late payment on his report. After disputing and having it corrected, his score increased by 40 points within a month.

Limit New Credit Applications

Space out credit applications over time to reduce multiple hard inquiries that can drag your score down. When shopping for loans, try to keep rate inquiries within a short window (generally 14-45 days depending on the score model) to minimize impact.

Using Credit Monitoring and Financial Tools

Modern financial technology offers several tools designed to help consumers monitor and improve their credit scores: Credit Monitoring Services: These services update you on changes to your credit report and alert you to potential fraud or errors. According to a 2023 survey from NerdWallet, 60% of consumers who subscribed to these services reported improved credit awareness and proactive management. Credit Builder Loans and Secured Cards: These products enable consumers to build positive payment histories when traditional credit options are limited. For example, a secured credit card requiring a $500 deposit can help build a credit record safely. Debt Repayment Calculators: Using these tools helps prioritize high-interest or high-utilization accounts, accelerating credit improvement.

Future Perspectives on Credit Scoring

Credit scoring models are evolving to better evaluate consumer risk in the digital age. Emerging trends may reshape how creditworthiness is determined:

Incorporation of Alternative Data

New credit models like FICO XD and VantageScore now factor in utility payments, rent, and even phone bills to provide a more holistic view of credit behavior, especially for thin file consumers with limited traditional credit history.

Artificial Intelligence and Machine Learning

AI-driven models can analyze complex behavioral patterns beyond conventional metrics, potentially reducing bias and offering more personalized risk assessments. A 2023 study showed that lenders using AI-based credit models approved 10% more creditworthy applicants previously underserved by traditional scores.

Increased Focus on Financial Wellness

Financial institutions are adopting more consumer-centric approaches, offering credit coaching, personalized advice, and targeted products to foster responsible credit use, improving scores sustainably.

Blockchain and Decentralized Credit Data

Blockchain technology promises more secure and transparent credit data sharing, potentially reducing fraud and enabling consumers to control their credit histories better.

Understanding what affects your credit score and how to repair it offers a path to stronger financial health. From payment behavior to credit utilization, each factor plays a crucial role. Using strategic financial management, monitoring tools, and awareness of emerging trends can help you maintain a robust credit profile and unlock new opportunities in an increasingly digital economy.

Deixe um comentário