Establishing or restoring credit is a critical financial milestone that can open doors to better loan rates, higher credit limits, and improved financial security. However, finding the right credit card that suits individuals with limited or damaged credit history can be challenging. With an abundance of options, it’s essential to identify cards that offer favorable terms, supportive features, and are geared toward credit improvement. According to Experian, approximately 26% of U.S. consumers have credit scores below 600, indicating a significant demand for credit-building tools. This article explores the best credit cards for building or rebuilding credit, providing practical insights, comparisons, and examples for informed decision-making.

Understanding Credit Building and Rebuilding

Credit building involves establishing a positive credit history for those new to credit or with little prior activity. On the other hand, credit rebuilding refers to improving a credit score after negative events such as late payments, defaults, or bankruptcy. Both processes require consistent, responsible use of credit products over time.

For instance, consider Jane, a recent college graduate with no prior credit history. She aims to build credit to finance a car loan. Similarly, John, who faced financial hardships and several late payments, wants to rebuild his credit score to qualify for a mortgage. Both scenarios emphasize the significance of choosing the right credit card to facilitate credit development, with manageable fees and terms that promote responsible credit habits.

Key Features of Credit Building and Rebuilding Cards

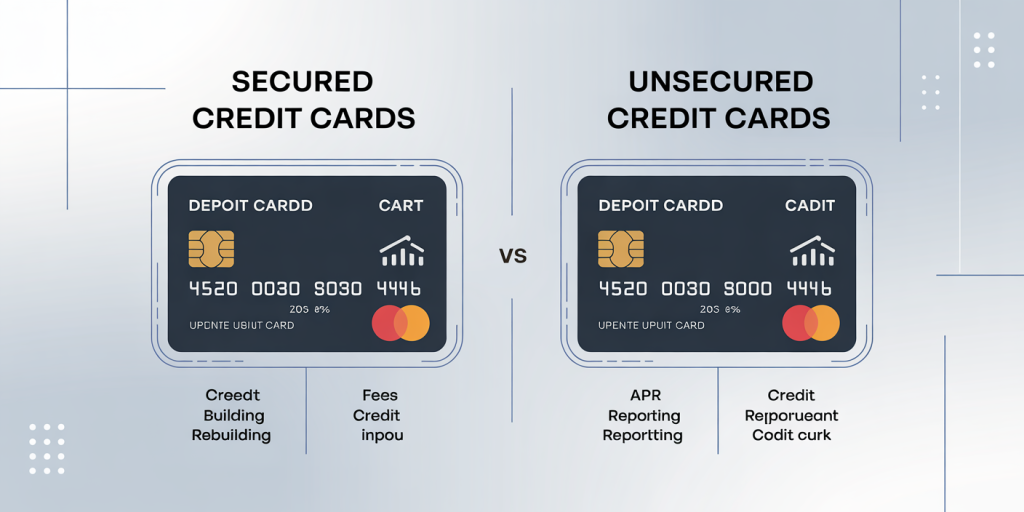

Credit cards designed explicitly for credit building tend to share several important features: Secured Credit Limits: Many cards require a cash deposit as collateral to minimize risk to lenders. This deposit typically becomes the credit limit. For example, a $300 deposit usually sets a $300 credit limit. Reporting to Major Credit Bureaus: Success in credit improvement critically depends on the card issuer reporting the cardholder’s payment activity to the three major credit bureaus—Equifax, Experian, and TransUnion. Low or No Annual Fees: Since users often have tight budgets, having manageable or zero fees helps avoid additional financial strain. Reasonable Interest Rates: While interest is best avoided by paying balances in full, lower APR candidates help those who occasionally carry a balance. Transition Path to Unsecured Cards: Many cards offer opportunities to graduate into unsecured cards, which come with better terms and higher limits.

Top Credit Cards for Building Credit: Secured vs. Unsecured Options

Choosing between secured and unsecured credit cards depends on your current credit profile and financial readiness. Below is a comparative table of popular credit cards aimed at credit building or rebuilding based on fees, credit line size, APR, and special benefits.

| Credit Card | Type | Deposit Required | Annual Fee | APR Range | Credit Reporting | Special Perks |

|---|---|---|---|---|---|---|

| Discover it® Secured | Secured | $200+ | $0 | 22.24% variable | Yes | Cashback Match first year |

| Capital One Platinum Secured | Secured | $49-$200+ | $0 | 26.99% variable | Yes | Credit limit increases possible |

| Petal® 2 “Cash Back, No Fees” | Unsecured | None | $0 | 19.99%-29.99% | Yes | Cashback rewards, no fees |

| OpenSky® Secured Visa | Secured | $200+ | $35 | 17.39% fixed | Yes | No credit check on application |

| Credit One Bank® Platinum | Unsecured | None | $0-$99 | 23.99%-29.99% | Yes | Cashback on purchases |

Real-case scenarios show that secured cards like Discover it® Secured serve as excellent starter cards due to no annual fees and rewards programs. Jane used the Discover® secured card, made timely payments on a $300 credit line, and within 8 months, her credit score rose from 580 to 700, allowing her to qualify for an unsecured card.

Conversely, users with somewhat better credit may choose an unsecured card, such as the Petal® 2, which requires no security deposit but takes into account income and spending patterns rather than traditional credit scores. John, rebuilding his credit after financial setbacks, was approved for Petal® 2 due to his steady income and improved financial behavior. After 12 months, John saw an increase in credit score from 620 to 670 without any missed payments.

Practical Tips for Maximizing Credit Card Use in Credit Building

Merely obtaining the right credit card is not sufficient; responsible usage is essential for improving credit scores.

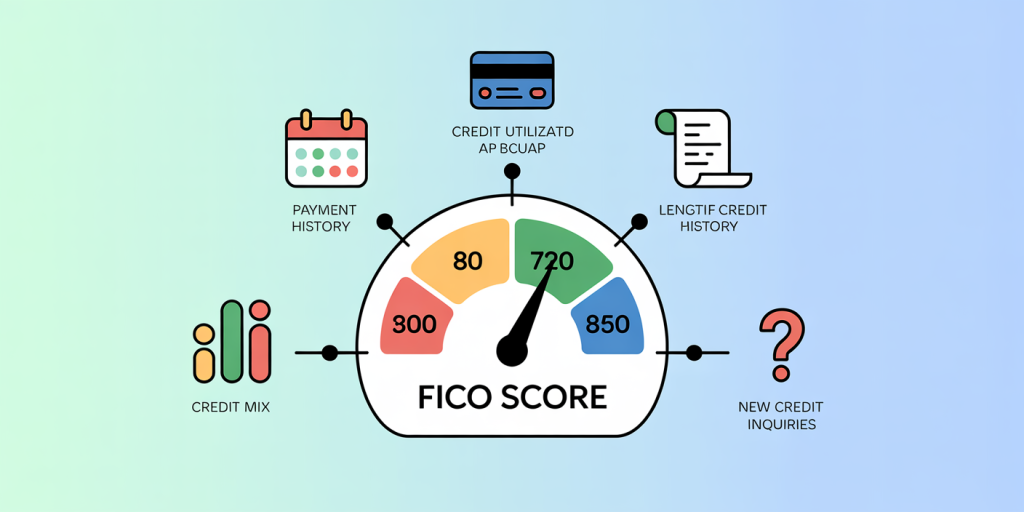

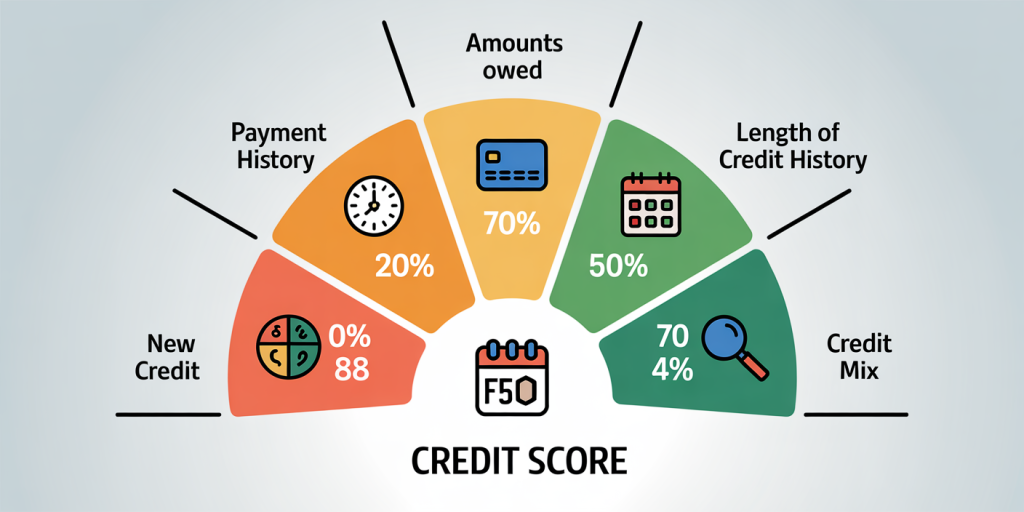

1. Make Timely Payments Every Month: Payment history accounts for 35% of a credit score, making on-time payments the single most critical factor. Even one late payment can drop the score by 50 to 100 points. 2. Maintain Low Credit Utilization: Keeping the credit utilization ratio (credit used divided by credit limit) under 30% shows lenders you can manage debt responsibly. For example, if a card’s credit limit is $500, it is optimal to keep the balance below $150.

3. Regular Monitoring and Credit Reports: Regularly checking credit reports for errors or fraudulent activity helps maintain accurate records. Industry data reveals that 1 in 5 credit reports contain errors that could negatively impact scores.

4. Graduating to Better Cards: After several months or years of responsible use, many secured card issuers allow cardholders to upgrade to unsecured cards with higher benefits and no deposit requirements.

How Credit Card Companies Assess Creditworthiness for These Cards

Credit card companies use a combination of credit score, income, employment status, and sometimes alternative data, such as bill payments or banking activity, when deciding on eligibility.

For newcomers or those with poor credit, secured cards are more accessible as risk is mitigated by the deposit held. For example, Capital One offers variable deposit amounts based on credit profile, sometimes as low as $49 for a $200 credit limit.

Unsecured cards like Petal Bank’s use machine learning algorithms that consider up to billions of data points to evaluate creditworthiness beyond traditional scores. This allows fairer access for individuals without an extensive credit history.

Applications denied by one issuer do not mean failure; users can explore secured card options or alternative lenders. Increasing income or reducing debt prior to application enhances approval chances.

Comparative Analysis: Secured vs. Unsecured Credit Cards

Choosing between secured and unsecured credit cards is subjective but can be guided by the following circumstances:

| Factor | Secured Card | Unsecured Card |

|---|---|---|

| Approval Ease | Easier, deposit reduces risk | Harder, requires better credit or income verification |

| Credit Limit | Usually equals the deposit amount | Typically higher and variable |

| Rewards & Perks | Limited but improving | Usually better, such as cashback |

| Fees | Often low or no annual fees | May have annual fees or higher APR |

| Credit Impact | Positive with regular reporting | Positive, sometimes faster credit score improvement |

For example, Sue, with a credit score under 580, found it nearly impossible to get approved for any unsecured cards and opted for the OpenSky® Secured Visa with a $300 deposit. She experienced steady credit improvement and eventually graduated to an unsecured card after 18 months. Meanwhile, Mark, who had a credit score around 650 with no recent negatives, qualified for the Petal® 2 unsecured card directly and benefited from cashback rewards and no fees.

Future Perspectives in Credit Building Cards

The credit landscape is evolving with fintech innovations and a growing recognition of alternative credit data. Future credit cards for building and rebuilding credit are likely to leverage non-traditional data sources such as rent payments, utility bills, and even social behaviors to better assess creditworthiness.

Technological advancements in AI-driven credit models promise to provide more customized and fair credit card offerings. Additionally, the rise of financial education initiatives integrated into cardholder apps can empower users to make smarter credit decisions, further reducing risks of debt traps.

From a regulatory standpoint, there is an increasing push toward greater transparency and consumer protections, meaning future cards may feature clearer terms and better support tools for vulnerable populations.

In practice, this means consumers with damaged or no credit histories will have more options. For example, new offerings might include secured cards that can automatically adjust credit limits based on on-time payments verified through connected payment apps, or cards that offer tiered rewards aligned with credit-building milestones.

To summarize, the interplay between improved data analytics, consumer protection policies, and evolving financial technologies heralds a more inclusive and supportive environment for credit newcomers and rebuilders alike.