In today’s financial landscape, a strong credit score is crucial for accessing better loan terms, lower interest rates, and favorable insurance premiums. Credit scores act as a numerical reflection of your creditworthiness, influencing everything from mortgage approval to rental applications. If your credit score is less than ideal, you might find yourself paying significantly more for financing or even facing outright denials.

The good news is that improving your credit score quickly is achievable with the right strategies and discipline. Understanding the factors that affect your credit score and implementing targeted actions can expedite the recovery process. This article explores practical methods to boost your credit score promptly, backed by data, real-life examples, and actionable insights.

Understanding the Fundamentals of Credit Scores

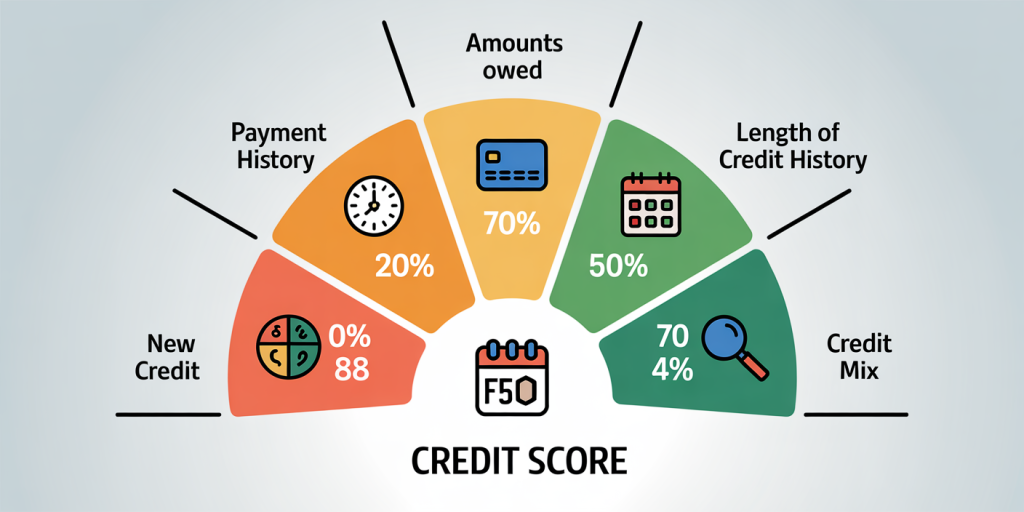

Credit scores generally range from 300 to 850, with higher scores indicating better creditworthiness. The most widely used scoring model is the FICO score, which considers five key components: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%). Each component contributes differently to the overall score, meaning that improving one area can have a more significant impact than others.

For example, payment history is the largest factor, accounting for over a third of your credit score. Missing payments, late payments, or defaults can drastically lower your score. Conversely, timely payments can enhance your credit profile rapidly. According to Experian, individuals who resolve overdue accounts and maintain on-time payments can see score improvements within 30-60 days.

Additionally, credit utilization — the percentage of your available credit that you are using — is the second most critical factor. Experts recommend keeping your credit utilization below 30%, but lowering it further, such as under 10%, can produce a much quicker uplift to your score.

Rapidly Reduce Credit Utilization for Maximum Impact

One of the fastest ways to improve your credit score is by reducing your credit utilization ratio. This metric calculates how much of your total available credit you’re currently using. For instance, if you have a credit card limit of $10,000 and use $3,000 of it, your utilization rate is 30%.

Real case studies show that consumers who reduce their utilization from above 50% to below 30% often see score increases above 40 points in as little as one billing cycle. This can be done in several ways, such as paying down existing balances, spreading debt across multiple cards to lower individual card utilization, or requesting credit limit increases.

Example: Jane had a credit utilization rate of 55% with total outstanding balances of $5,500 on a $10,000 limit. After paying off $3,000 and requesting a credit limit increase to $12,000, her utilization dropped to 18.3%. Within 30 days, her FICO score improved by 45 points, allowing her to apply for a better mortgage rate.

| Strategy | Before Utilization | After Utilization | Score Increase | Timeframe |

|---|---|---|---|---|

| Pay down balances | 55% | 18.3% | +45 points | 30 days |

| Spread balances across cards | 60% | 25% | +38 points | 1-2 billing cycles |

| Request credit limit increase | 40% | 22% | +30 points | 1 month |

Reducing utilization is particularly effective because credit bureaus update information monthly, meaning changes in balances can reflect quickly in your credit report.

Prioritize On-Time Payments and Set Up Automated Alerts

Payment history weighs heavily on your credit score calculation. According to a report by the Consumer Financial Protection Bureau (CFPB), payment punctuality influences more than one-third of the FICO score. Missing payments or paying bills late, even by a few days, can lead to significant score drops.

The most efficient way to improve your payment history is to start making all payments on time. If you’ve missed payments in the past, ensure you bring accounts current and avoid future delinquencies. Automating payments through your bank or credit card provider eliminates the risk of forgetting or delaying bills.

Practical example: Matthew had missed three student loan payments over the past year, which lowered his credit score by approximately 75 points. After enrolling in autopay and setting reminders for other bills, he resumed timely payments. Within six months, credit bureaus updated his record to reflect positive payment activity, improving his score by 50 points.

Payment reminders from mobile apps or financial institutions can also alert you a few days before due dates, allowing you to prepare funds in advance. This practice is vital for consumers with a history of late payments or who juggle multiple accounts.

Dispute Inaccurate or Outdated Information on Your Credit Report

Errors on your credit report can harm your score unfairly. The Federal Trade Commission (FTC) estimates that one in five consumers has an error on at least one of their credit reports. Common inaccuracies include outdated late payments, incorrect account balances, duplicate accounts, or accounts that don’t belong to you.

Review your credit reports regularly from the three major bureaus (Equifax, Experian, and TransUnion), which are available free annually via AnnualCreditReport.com. Identifying and disputing these errors can lead to rapid credit score improvement, sometimes within 30 to 45 days, once corrected.

Case study: Sarah noticed a medical collection on her Equifax report that was settled last year. She disputed the error by providing proof of payment. Equifax investigated and removed the collection account, resulting in a 35-point increase in her score within six weeks.

It’s important to remember that disputing negative but accurate information will not remove it; only incorrect or unverifiable data can be disputed successfully. Nevertheless, eliminating inaccuracies can be a powerful step in fast-tracking credit restoration.

Avoid Opening Too Many New Accounts at Once

Many consumers aiming to improve their credit scores make the mistake of opening multiple new credit accounts simultaneously. While new credit can diversify your credit mix, each hard inquiry applied during a credit application can reduce your score by up to 5 points temporarily.

New accounts also reduce the average age of your credit history, which contributes to 15% of your overall rating. The shorter your credit history, the less trustworthy you appear to lenders.

Data insight: A study from FICO involving 100,000 credit users found that individuals opening 3+ new credit lines within 6 months often saw their scores drop by 20-40 points.

Instead, it’s advisable to space out new credit applications and only apply when necessary. Focus on improving existing accounts first by paying down balances and making timely payments rather than opening new credit cards or loans.

Leverage Debt Consolidation and Negotiation Options

If you are burdened with high-interest credit card debt or multiple loans, debt consolidation can improve credit score by simplifying payments and reducing utilization ratios. Debt consolidation involves combining several debts into a single loan or credit line, often with a lower interest rate.

Beyond simplifying payments, paying down your debt with a consolidation loan lowers your revolving credit balances, positively impacting utilization rates — which, as discussed, comprise 30% of your credit score.

Example: David consolidated four high-interest credit card debts totaling $15,000 into one personal loan with a 12% interest rate, down from a combined average rate of 22%. By making consistent monthly payments of $450, he reduced outstanding credit card balances to nearly zero in 18 months. Within six months, his credit score jumped by 60 points due to improved utilization and favorable payment history.

Moreover, negotiating with creditors to pay off accounts with settlements or removal of negative items can further enhance scores. Some creditors may agree to “pay for delete” arrangements, where they remove a negative collection from your report in exchange for payment.

Looking Ahead: The Future of Credit Scoring and What It Means for You

The credit industry is evolving, incorporating alternative data and machine learning to create more inclusive and precise credit assessments. Traditional credit scoring often overlooks consumer behavior outside of credit usage, such as rent payments, utility bills, and even social media profiles.

Companies like FICO and VantageScore have begun integrating rental payments and subscription services into credit reports, potentially benefiting the 67 million Americans with thin credit files (Consumer Financial Protection Bureau, 2023). These developments promise faster improvements for responsible consumers who manage finances outside traditional credit.

Blockchain technology and decentralization may further revolutionize credit reporting by giving consumers more control over their financial data and enabling real-time updates. As fintech innovation accelerates, timely and transparent credit management tools will empower individuals to enhance their creditworthiness more quickly and efficiently.

In the foreseeable future, the concept of “fast” credit improvement may shift from monthly cycles to real-time scoring, benefiting those who adopt proactive financial habits today.

Improving your credit score rapidly is not only possible but highly actionable with a strategic approach. By focusing on reducing credit utilization, maintaining consistent on-time payments, disputing inaccuracies, avoiding excessive credit inquiries, and considering debt consolidation, you can significantly elevate your credit score in a matter of months. Staying informed about emerging trends in credit scoring will further position you to adapt and take advantage of new opportunities to build a strong financial profile.

Deixe um comentário