Building wealth is a fundamental financial goal for individuals and families worldwide. A key concept in personal finance that often arises in discussions about wealth creation is the difference between assets and liabilities. Understanding this difference is crucial because it influences how money flows in and out of your life, ultimately determining your financial position. This article explores the distinction between assets and liabilities, demonstrates how each affects wealth accumulation, and provides practical examples and data to clarify which financial elements truly build wealth.

Understanding Assets and Liabilities: A Financial Foundation

At the core of financial literacy lies the need to distinguish assets from liabilities accurately. Simply put, an asset is something that puts money in your pocket. Conversely, a liability is anything that takes money out of your pocket. This definition was famously highlighted by Robert Kiyosaki, author of *Rich Dad Poor Dad*, who emphasized that the wealthy focus on accumulating assets, while the poor and middle class often accrue liabilities thinking they are assets.

For example, a rental property that generates monthly income after expenses is an asset because it increases your cash flow. On the other hand, a personal vehicle, while valuable, is usually a liability since it depreciates and entails maintenance costs without generating revenue.

To put these ideas into perspective numerically, consider the personal balance sheet formula:

Net Worth = Total Assets – Total Liabilities

A positive and growing net worth over time generally indicates successful wealth-building. According to a 2020 Federal Reserve survey, the top 10% of American households held approximately 70% of the nation’s wealth, largely due to their asset holdings in investments, real estate, and business ventures, highlighting the power of focusing on assets.

Types of Assets: Building Blocks of Wealth

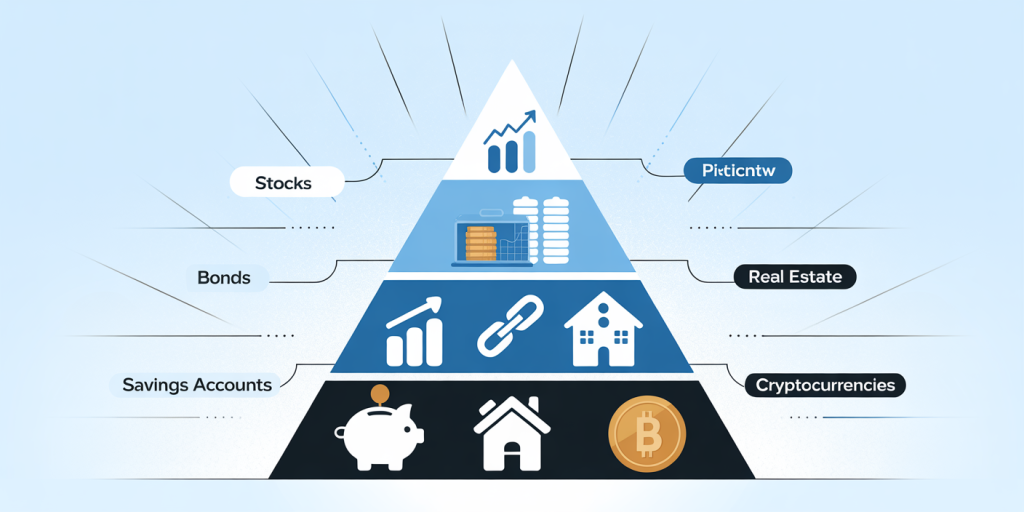

Assets come in various forms, each contributing uniquely to wealth accumulation. Broadly, assets can be divided into financial assets like stocks, bonds, and savings accounts, and tangible assets like real estate, precious metals, or collectibles. The key characteristic of an asset is its ability to generate income or appreciate over time.

For example, stocks and bonds provide dividends and interest plus potential capital gains. Real estate often appreciates and can yield rental income. Digital assets, such as royalties from intellectual property, also serve as modern examples of income-producing assets.

Consider the case of Warren Buffett, one of the world’s wealthiest individuals, whose wealth primarily stems from strategic ownership of high-performing stocks and businesses that generate dividends and earnings, exemplifying how financial assets contribute to building wealth.

Another practical example is retirees using dividend-paying stocks and rental properties as income streams, allowing them to fund their lifestyles without depleting their principal investments.

Table 1: Common Types of Assets and Their Wealth-Building Potential

| Asset Type | Income Generation | Appreciation Potential | Liquidity | Example |

|---|---|---|---|---|

| Stocks | Dividends | High | High | Shares in Apple, Microsoft |

| Bonds | Interest | Moderate | Moderate | Government, Corporate Bonds |

| Real Estate | Rent | Moderate to High | Low to Moderate | Rental properties, commercial real estate |

| Savings Accounts | Interest | Low | High | Bank savings account |

| Collectibles | Rarely | Variable | Low | Art, classic cars |

Liabilities: The Hidden Wealth Drainers

Liabilities are financial obligations or debts that require periodic payments or reduce your net worth. Common examples include mortgages, car loans, credit card debts, and even recurring expenses associated with certain possessions. Unlike assets, liabilities drain resources by requiring outflows of money over time without generating income.

For a real-world illustration, consider a mortgage on a personal home. While a home’s value may appreciate, a primary residence is traditionally considered a liability unless it produces rental income, because it includes ongoing costs: mortgage payments, property taxes, maintenance, and utilities.

Credit card debts often accumulate high interest, significantly reducing disposable income and hindering the ability to save or invest. According to a 2023 report by the Federal Reserve, American consumers held over $930 billion in revolving credit card debt, impacting their financial flexibility.

An example from everyday life is luxury vehicles purchased for status rather than utility. Often, such vehicles depreciate quickly and require costly maintenance, making them financial liabilities rather than wealth-building assets.

Table 2: Common Liabilities and Their Financial Impact

| Liability Type | Monthly Cost | Interest/Depreciation Rate | Impact on Wealth | Example |

|---|---|---|---|---|

| Mortgage (Primary Residence) | High | Moderate – Low | Depends if leveraged profitably | Family home |

| Auto Loans | Moderate | High (depreciation) | Negative | Personal car |

| Credit Card Debt | Variable | Very High (15-25% APR) | Highly Negative | Unpaid credit card balances |

| Personal Loans | Moderate | Moderate | Negative | Consumer loans |

The Role of Financial Literacy and Mindset in Managing Assets and Liabilities

Understanding what qualifies as an asset or liability goes beyond definitions — it requires financial discipline and a mindset oriented towards wealth creation. Many individuals mistakenly believe that all possessions they own are assets, but failure to distinguish these can lead to financial strain.

Financial literacy encourages tracking net worth frequently, understanding cash flow’s importance, and promoting the habit of investing surplus income into assets instead of liabilities. For instance, instead of buying an expensive car outright, finance experts often suggest directing funds toward investments in stocks or real estate that generate returns.

A notable case is Chris Reining, who achieved financial independence in his 30s by focusing on investing in high-yield assets and avoiding unnecessary debt. His story exemplifies how proper financial habits and knowledge can transform one’s net worth trajectory.

Data backs this behavioral shift: a 2022 FINRA study found that financially literate Americans are 3 times more likely to invest in assets and maintain positive net worth compared to those with limited financial education.

Comparing Assets and Liabilities: Impact on Cash Flow

At a practical level, the critical question is how assets and liabilities affect your monthly cash flow, which directly impacts your ability to build wealth. Cash flow is the net amount of money moving in and out during a specific period.

Assets positively influence cash flow by generating passive income, such as rental income or dividends, that enhance disposable income. Conversely, liabilities reduce cash flow because they require recurring payments.

Case Study Example:

Imagine two individuals each earning $5,000 monthly: Person A owns rental properties generating $1,200 in monthly income but pays $500 in mortgage and maintenance expenses. Net positive cash flow: $700. Person B owns a car loan costing $400 monthly with no associated income. Net negative cash flow: -$400.

Person A effectively boosts savings or investment potential by $700 every month, whereas Person B has less cash to save or invest due to liability costs.

Table 3: Illustration of Cash Flow Impact

| Scenario | Income from Assets | Expense from Liabilities | Net Cash Flow Impact |

|---|---|---|---|

| Person A (Asset Focus) | +$1,200 | -$500 | +$700 |

| Person B (Liability Focus) | $0 | -$400 | -$400 |

Over time, this difference compounds, where positive net cash flow supports further asset acquisition, accelerating wealth growth.

Future Perspectives: Shifting Trends in Asset and Liability Management

Looking ahead, emerging trends in technology, markets, and regulations are reshaping how individuals acquire assets and manage liabilities. The rise of digital assets like cryptocurrencies and NFTs introduces new opportunities and risks within the asset category. While these digital investments can yield extraordinary returns, their volatility requires careful risk management.

Moreover, the increasing availability of fractional real estate investing and robo-advisors is democratizing access to traditionally high-barrier assets, enabling more people to build diversified portfolios with smaller capital.

On liability management, personalized financial tools powered by artificial intelligence are improving debt repayment strategies, helping consumers prioritize liabilities that harm their credit and cash flow the most.

Environmental considerations are also influencing asset choices. Sustainable investments (ESG funds) are gaining popularity, aligning wealth-building with ethical and future-proof criteria.

Institutions like the OECD predict that financial literacy will remain integral to wealth equality, urging global policies to promote access to asset-building education and responsible borrowing.

In summary, understanding the evolving landscape and integrating modern asset classes while limiting harmful liabilities is paramount for wealth preservation and growth.

By distinguishing clearly between assets and liabilities and focusing efforts on growing income-producing assets, individuals can effectively increase their net worth and achieve long-term financial security. Real-world examples, data-backed insights, and actionable perspectives underscore the importance of financial literacy and the strategic management of cash flow. Awareness of future market trends further empowers individuals to adapt and prosper in their wealth-building journey.

Deixe um comentário