Tracking and growing your net worth is a fundamental aspect of personal finance that empowers you to make informed decisions and achieve long-term financial goals. Whether you are saving for retirement, buying a home, or simply aiming for financial independence, monitoring your net worth provides a clear snapshot of your financial health. This article explores practical strategies to accurately track your net worth and effective methods to grow it steadily over time.

Understanding Net Worth: The Financial Dashboard

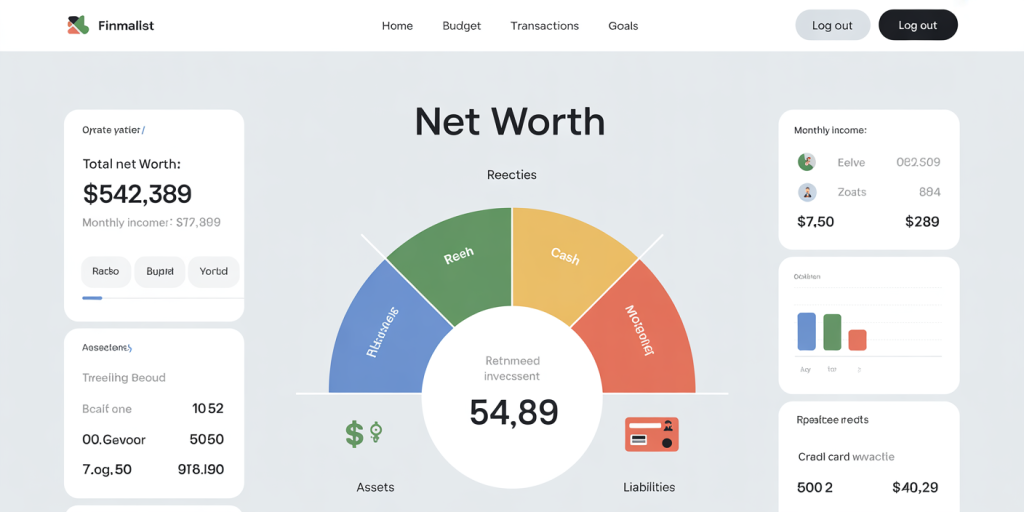

Net worth is the difference between your total assets and total liabilities. Assets include cash, investments, real estate, and other valuable possessions, while liabilities consist of debts such as mortgages, credit cards, and loans. Your net worth serves as a financial dashboard, offering insights into your overall wealth and financial progress.

For example, if Jane owns a home worth $300,000, has $50,000 in savings, and $20,000 in a retirement account, her total assets would be $370,000. If she owes $200,000 on her mortgage and has $10,000 in credit card debt, her liabilities are $210,000. Jane’s net worth is therefore $160,000 ($370,000 – $210,000). Regularly calculating this figure allows her to track upward or downward trends in her financial standing.

Research from the Federal Reserve’s 2022 Survey of Consumer Finances shows the median net worth of U.S. families is approximately $121,700, with the top 10% holding over $1.5 million. Understanding your net worth in relation to these benchmarks can motivate strategic financial planning.

How to Effectively Track Your Net Worth

Tracking net worth requires consistent effort and organized record-keeping. Begin by compiling a comprehensive list of assets and liabilities, ensuring all categories are represented accurately. Use reliable valuation methods to estimate the current values of properties, investment accounts, and other assets.

There are several tools available to simplify this process, from spreadsheet templates to personal finance apps like Personal Capital, Mint, and YNAB (You Need A Budget). These tools automatically update balances by syncing bank accounts and investment portfolios, making it easier to see changes in real time.

Another practical approach is setting a monthly or quarterly schedule for net worth assessment. For instance, Mark, a 35-year-old professional, reviews his net worth every quarter. He updates the market values of his stocks and adjusts his outstanding loan balances. This routine helps him detect any adverse financial patterns early and capitalize on growth opportunities.

| Tracking Method | Pros | Cons |

|---|---|---|

| Manual Spreadsheet | Customizable, no subscription cost | Time-consuming, prone to error |

| Personal Finance Apps | Automatic updates, user-friendly | Possible security concerns, fees |

| Financial Advisor | Professional guidance, tailored advice | Costly, less frequent updates |

Strategies to Accelerate Net Worth Growth

Increasing your net worth requires a combination of reducing liabilities and growing assets. Among the most effective tactics is paying off high-interest debt, which erodes wealth over time. Credit card debt, personal loans, and payday loans typically carry high interest rates, so prioritizing payments here boosts your net worth quickly.

Simultaneously, building assets involves saving consistently and investing prudently. Diversified investment portfolios that include stocks, bonds, real estate, and retirement accounts can generate returns that compound over years. According to a 2023 report by J.P. Morgan Asset Management, the average annual return for a diversified portfolio was approximately 7%, after inflation, over the last 30 years.

Consider Sarah, who started investing $500 per month at age 30. By maintaining this habit until age 60 with an average 7% return, she would accumulate nearly $500,000. This example illustrates how disciplined investing over time substantially grows net worth.

Adding a side income source such as freelancing or rental property income can further accelerate growth. Increasing cash flow allows for higher savings rates and quicker debt reduction. John, a software engineer, increased his net worth by 20% within two years through a combination of side gigs and disciplined budgeting.

Monitoring Asset Allocation and Portfolio Performance

Growth in net worth largely depends on the performance of your investments and asset allocation strategy. Regularly reviewing and rebalancing your portfolio ensures that you manage risk and align your investments with your goals.

For example, younger investors like Emma might allocate 80% of their portfolio to stocks and 20% to bonds, aiming for growth. In contrast, older individuals closer to retirement might prefer a more conservative mix, such as 40% stocks and 60% bonds, to protect capital.

| Age Group | Typical Asset Allocation (Stocks : Bonds) | Purpose |

|---|---|---|

| 20-40 years | 80 : 20 | Growth-oriented |

| 40-60 years | 60 : 40 | Balanced growth and safety |

| 60+ years | 40 : 60 | Capital preservation |

Periodic rebalancing is essential because market fluctuations can skew your allocation over time. For instance, during a bull market, stocks might become overrepresented, exposing you to higher risk than intended.

Tracking portfolio performance should also involve analyzing returns net of fees and taxes. Employing tax-advantaged accounts such as 401(k)s, IRAs, and Health Savings Accounts (HSAs) optimizes long-term growth by preserving more of your gains.

The Role of Real Estate and Alternative Assets in Net Worth Growth

Real estate remains one of the most popular methods for building net worth. According to the National Association of Realtors, the median price of existing homes in the United States increased by 15% year-over-year through 2023. Properties not only appreciate over time but can also generate rental income, contributing to cash flow.

However, owning real estate requires careful attention to costs, including taxes, insurance, maintenance, and mortgage interest. A practical example is the Smith family, who bought a rental property in 2015. Despite initial expenses, they have enjoyed both monthly rental income and property value appreciation, which boosted their net worth by over $100,000 within eight years.

Alternative assets such as collectibles, precious metals, cryptocurrencies, and private equity also play a role for some investors. While these may offer diversification benefits, they often carry higher volatility and require specialized knowledge. Prioritizing core assets like diversified stock portfolios and cash reserves is generally advisable before venturing into alternatives.

Establishing a Growth Mindset and Long-Term Perspective

Growing net worth is a marathon, not a sprint. Psychological factors like patience, discipline, and an adaptable mindset profoundly influence financial success. Individuals who view their net worth tracking as a learning tool rather than a judgment tend to maintain consistent habits.

For example, during market downturns, it’s common for investors to feel tempted to liquidate holdings. However, history teaches that markets recover over time—between the 2008 global financial crisis and 2023, the S&P 500 delivered an average annual return of approximately 10%, despite temporary losses.

Financial advisors often suggest setting realistic, measurable goals—such as increasing net worth by 10% annually or eliminating a specific debt within a timeframe—and celebrating milestones along the way. This approach fosters motivation and reduces the risk of burnout.

Future Perspectives: Embracing Technology and Financial Innovation

The future of net worth tracking and growth is closely tied to advances in technology and financial innovation. Artificial intelligence (AI) and machine learning are increasingly integrated into personal finance platforms, providing tailored insights, predictive analytics, and automated portfolio adjustments.

For instance, robo-advisors like Betterment and Wealthfront use algorithms to manage portfolios dynamically based on your risk tolerance and financial goals. This automation reduces human error and enhances efficiency, allowing investors to maximize returns over time.

Blockchain technology and decentralized finance (DeFi) are emerging arenas offering novel investment opportunities and more transparent financial records. As regulatory clarity improves, these options could become mainstream components of net worth growth strategies.

Additionally, financial wellness programs offered by employers, increased availability of financial education resources, and growing emphasis on sustainable and socially responsible investing (SRI) are reshaping how individuals approach net worth management.

Remaining adaptable, continuously learning, and leveraging technological tools will be crucial for individuals seeking to optimize their net worth growth in the coming decades. Embracing these trends while adhering to fundamental principles of budgeting, saving, and investing will provide a resilient foundation for wealth building.

Tracking and growing your net worth is an empowering journey that combines meticulous monitoring with strategic action. By understanding the components of net worth, using effective tracking tools, employing debt reduction and investment strategies, and adopting a long-term perspective, you can steadily enhance your financial position. As technology evolves, embracing innovation will further strengthen your ability to manage and grow your wealth sustainably, preparing you for a secure financial future.

Deixe um comentário