The financial landscape for Millennials and Gen Z is evolving rapidly, shaped by global economic shifts, technological advancements, and changing societal values. These generations face unique challenges, including student debt burdens, fluctuating housing markets, and economic uncertainties exacerbated by the COVID-19 pandemic and inflationary pressures. However, the extended investment horizon available to these younger cohorts provides a strategic advantage in building and sustaining long-term wealth. Understanding actionable wealth-building strategies tailored for modern realities is essential to securing financial freedom and resilience.

Millennials (born between 1981 and 1996) and Gen Z (born between 1997 and 2012) differ in their financial knowledge, risk tolerance, and exposure to traditional investment vehicles. Research from Bank of America (2023) shows that while Millennials prioritize home ownership as a wealth marker, Gen Z is more interested in digital assets and socially responsible investing. Nonetheless, both groups benefit from a diversified approach to wealth accumulation, balancing legacy investments with innovative opportunities. Below we explore comprehensive strategies with data-backed insights, practical examples, and future-oriented perspectives.

Leveraging Compound Interest and Early Investing

One of the most powerful tools for building wealth over time is compound interest, often called the “eighth wonder of the world” by Albert Einstein. Starting to invest early can drastically increase net worth due to the exponential growth effect. For example, a 25-year-old investing $5,000 annually in an index fund with an average annual return of 7% will accumulate approximately $1.07 million by age 65. In contrast, a 35-year-old investing the same amount annually would only reach around $540,000 by retirement, nearly half the sum.

Practical application: Sarah, a 27-year-old Millennial from Texas, began contributing $300 monthly to a diversified portfolio consisting of ETFs and blue-chip stocks at age 25. Ten years later, despite market fluctuations and a few economic downturns, her portfolio grew by an average of 8% annually, totaling nearly $50,000. This early discipline coupled with regular contributions demonstrates the weight of time in wealth-building.

| Age Started Investing | Annual Contribution | Years Invested | Approximate Value at 65 |

|---|---|---|---|

| 25 | $5,000 | 40 | $1,070,000 |

| 30 | $5,000 | 35 | $810,000 |

| 35 | $5,000 | 30 | $540,000 |

(Source: Vanguard Retirement Calculator, 2024)

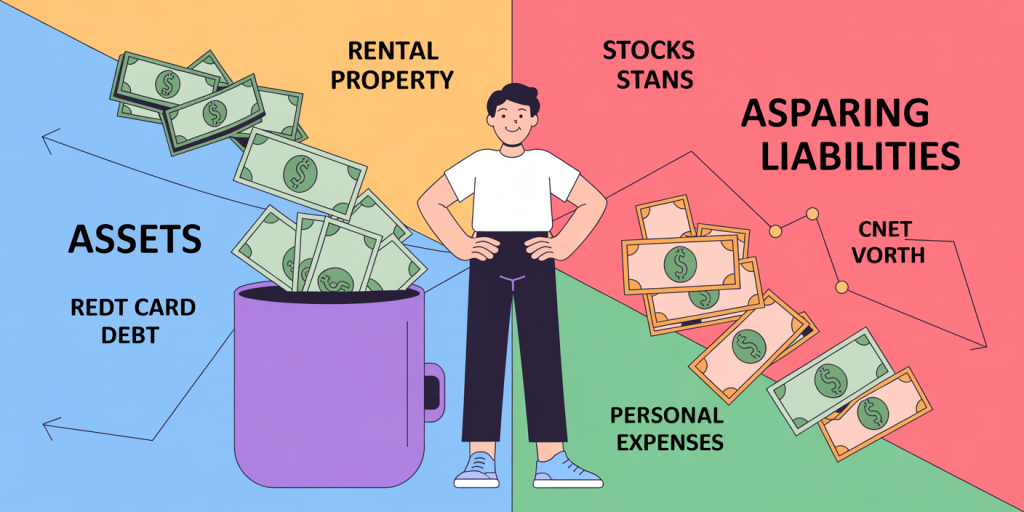

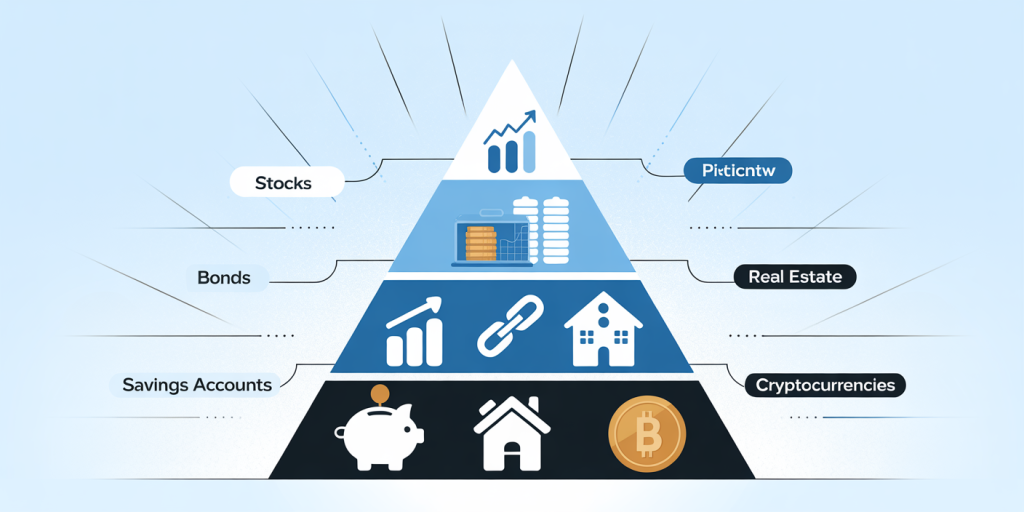

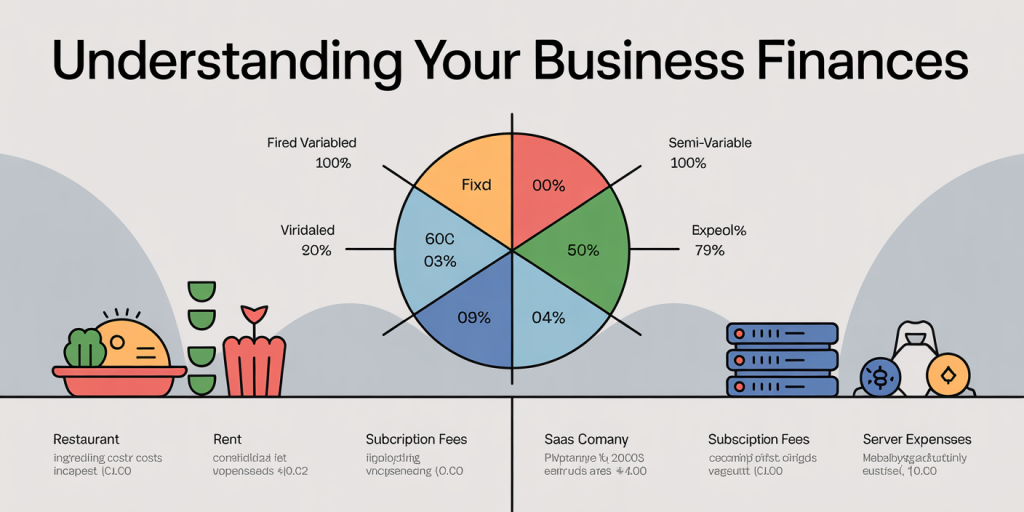

Diversification Across Asset Classes

Diversification helps mitigate risk by spreading investments across different asset classes such as equities, bonds, real estate, and alternative investments like cryptocurrencies or commodities. Millennials and Gen Z should prioritize a well-rounded portfolio to balance growth potential with risk exposure.

In the post-pandemic era, many young investors have gravitated towards digital assets and thematic ETFs focused on sectors like clean energy, biotech, and technology. However, traditional assets remain foundational. For instance, bonds provide stability during equity market volatility, while real estate often preserves capital and provides rental income.

An illustrative case is David, a 30-year-old Gen Z investor from California who balances his portfolio with 60% stocks, 20% bonds, 10% real estate investment trusts (REITs), and 10% cryptocurrency. Despite market corrections in 2022, his portfolio yielded an annualized return of 9% since inception, showcasing the benefits of diversification.

| Asset Class | Expected Annual Return | Risk Level | Suitability for Millennials & Gen Z |

|---|---|---|---|

| Stocks (Equities) | 7-10% | High | Growth-focused investors with high risk tolerance |

| Bonds | 3-5% | Low | Risk-averse investors seeking stability |

| Real Estate (REITs) | 5-8% | Moderate | Income and capital preservation |

| Cryptocurrencies | Highly volatile (varies) | Very High | Speculative component suited for small allocations |

(Source: Morningstar, 2024)

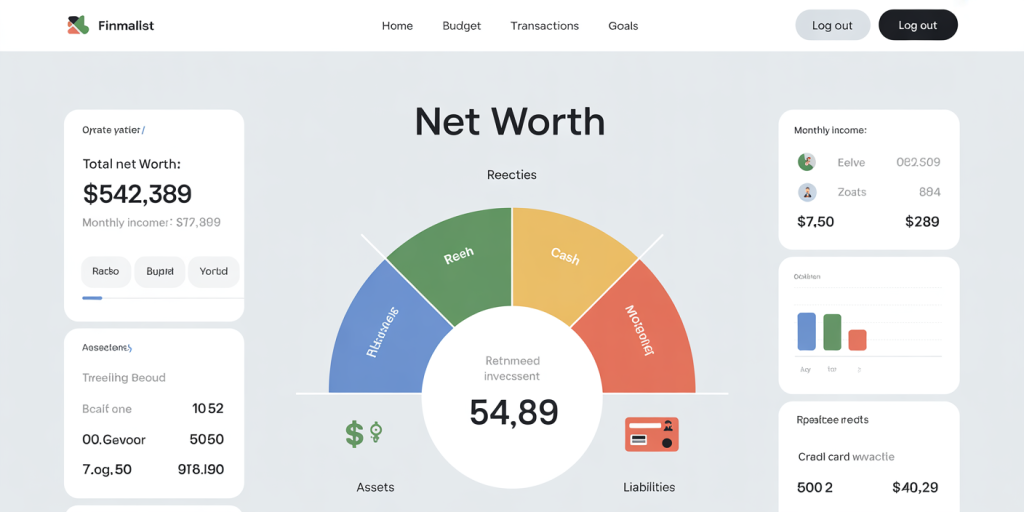

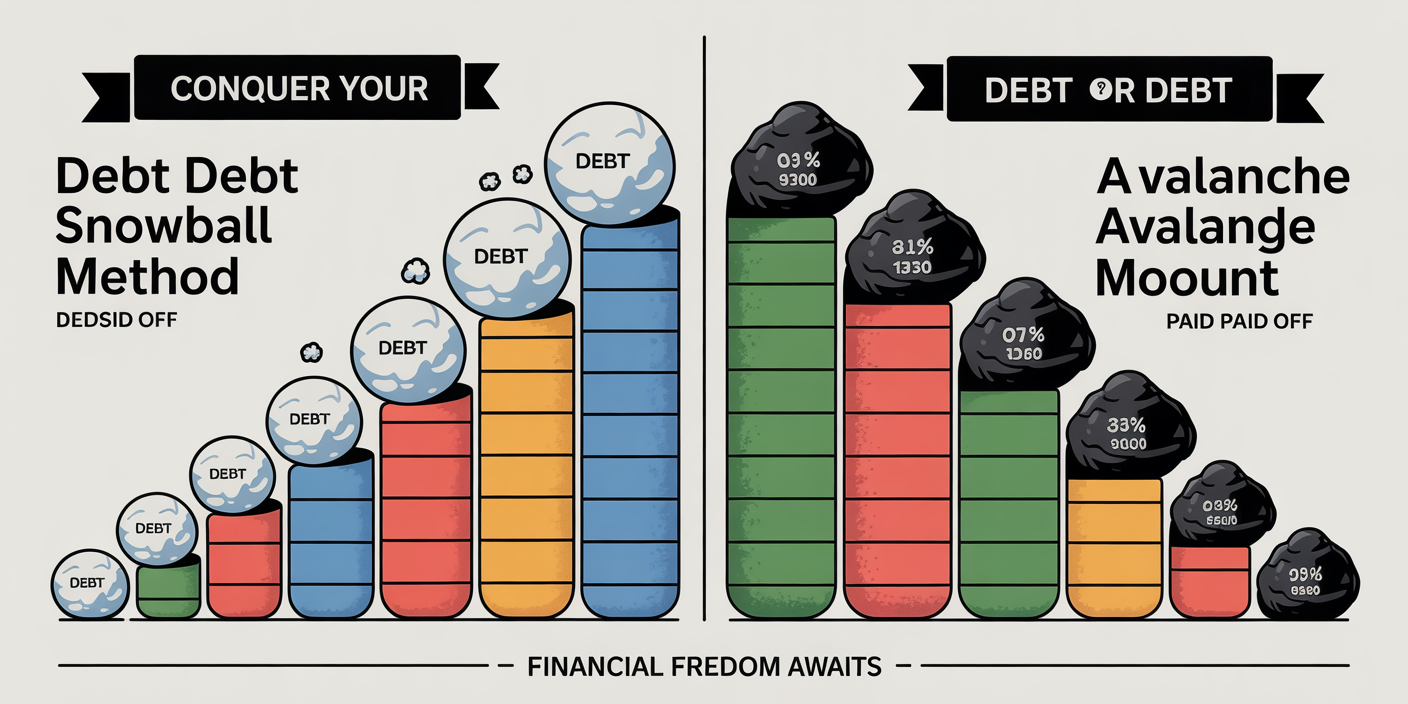

Mastering Debt Management and Cash Flow Strategies

Millennials and Gen Z often face substantial student loan debt. According to the Federal Reserve (2023), 43 million Americans hold student debt, with an average balance of $32,731. Managing and prioritizing debt repayment is a critical step in the journey toward wealth accumulation, as high-interest debt can erode savings potential.

Developing disciplined cash flow management practices, such as budgeting, automating savings, and prioritizing high-interest debt, allows more funds to flow into investments. For example, Anna, a 28-year-old Millennial in New York City, structured her budget to pay off her credit card debt aggressively while contributing 15% of her income to a retirement fund. Within two years, she eliminated $12,000 in credit card balances, freeing up money to increase her monthly investment contributions.

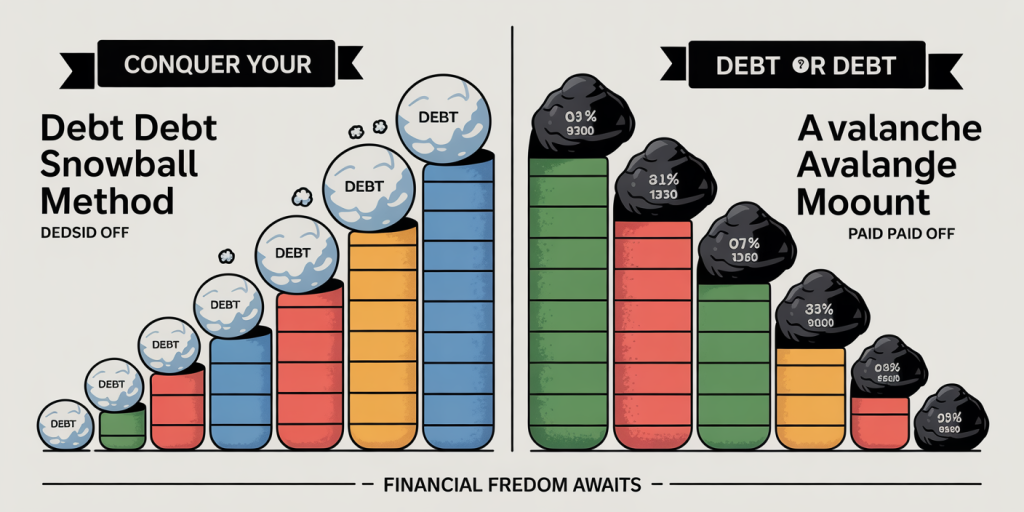

Employing a debt-repayment strategy like the “debt avalanche” or “debt snowball” method helps reduce liabilities effectively. The debt avalanche targets the highest-interest debts first, minimizing payment duration and cost, while the debt snowball focuses on tackling smaller debts to gain psychological momentum.

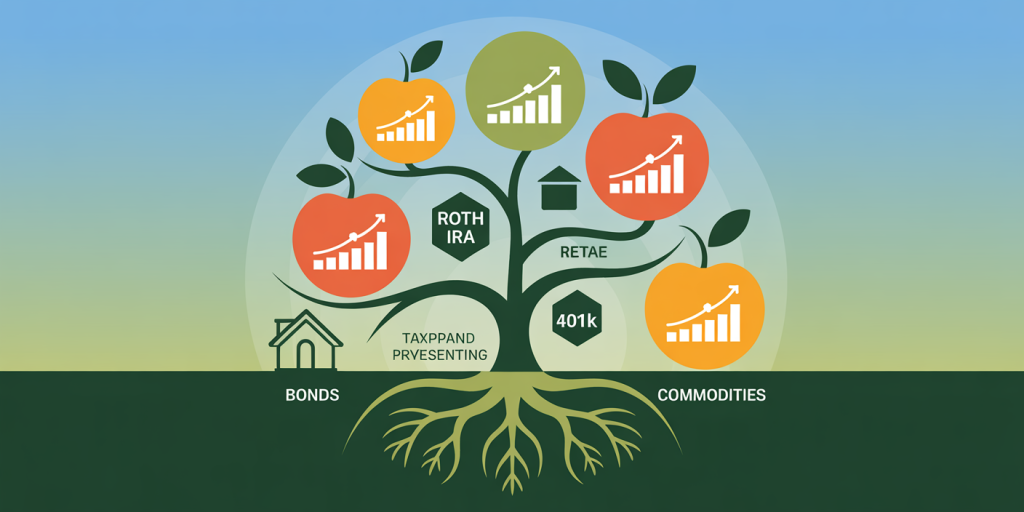

Utilizing Retirement Accounts and Tax-Advantaged Opportunities

Maximizing contributions to tax-advantaged accounts like 401(k)s, IRAs (Individual Retirement Accounts), and Roth IRAs is essential for long-term wealth growth. Such accounts defer taxes on earnings or provide tax-free growth, dramatically increasing the efficiency of investments over decades.

Millennials and Gen Z should ideally start contributions early to benefit from compound growth and employer matching. A study by Fidelity (2023) indicates that Millennials contributing consistently to their 401(k)s experience an average balance increase of 12% year-over-year, outperforming sporadic savers by 40%. Additionally, Roth IRAs allow for tax-free withdrawals in retirement, advantageous for younger investors expecting to be in higher tax brackets later.

For example, John, a 33-year-old Gen Zer, contributes the maximum allowed to his Roth IRA each year. By investing in a diversified index fund, he expects to accumulate over $1.2 million tax-free by retirement age, assuming a 7% annual growth rate.

| Account Type | Tax Treatment | Contribution Limits (2024) | Ideal Use for Millennials & Gen Z |

|---|---|---|---|

| 401(k) | Tax-deferred | $23,000 ($30,500 if age 50+) | Employer matching; consistent retirement savings |

| Traditional IRA | Tax-deferred | $6,500 ($7,500 if age 50+) | Tax deduction now, taxes paid on withdrawal |

| Roth IRA | Tax-free growth | $6,500 ($7,500 if age 50+) | Tax-free growth and withdrawals ideal for younger investors |

(Source: IRS, 2024)

Building Wealth Through Real Estate and Side Hustles

Real estate remains a reliable long-term wealth builder, offering both capital appreciation and passive income generation via rentals. While high property prices in urban areas may deter initial investment, Millennials and Gen Z can capitalize on suburban or emerging markets that show growth potential.

Case in point: Lisa, a 29-year-old Millennial, purchased a fixer-upper in a fast-growing suburb of Dallas. After renovation and renting out the property, she has created a steady income stream. Additionally, the property’s appreciation increased her net worth by 15% annually over five years. Many young investors partner with real estate crowdfunding platforms, like Fundrise or RealtyMogul, to access real estate investments with lower capital requirements.

Supplementing income through side hustles or freelance work can accelerate wealth accumulation. Platforms like Upwork or Etsy provide flexible opportunities for Gen Z to monetize skills or hobbies, which can be reinvested into savings or entrepreneurial ventures.

Future Perspectives: Navigating Emerging Trends and Technologies

Looking ahead, the wealth-building landscape for Millennials and Gen Z will be shaped profoundly by technological advancements, climate change, and shifting regulatory environments. Innovations in fintech, such as robo-advisors and blockchain technology, democratize access to sophisticated investment tools and reduce fees.

Socially responsible investing (SRI) and environmental, social, and governance (ESG) criteria are gaining traction, driven by these generations’ desire for purpose-driven wealth. According to Morgan Stanley (2024), 85% of Gen Z investors factor ESG considerations into their decisions, signaling a redefinition of traditional investment paradigms.

Moreover, the notion of financial independence is evolving through decentralized finance (DeFi), fractional ownership, and digital currencies. While these areas hold great promise, they also come with higher volatility and regulatory uncertainty, emphasizing the continued importance of education and cautious risk management.

Millennials and Gen Z face a unique financial environment filled with challenges and opportunities. By embracing early investment, strategic diversification, prudent debt and cash flow management, and leveraging tax advantages, these generations can craft resilient and prosperous financial futures. Incorporating real estate and side incomes further accelerates wealth building, while awareness of emerging trends ensures adaptability in a rapidly changing world. The key is a balanced, informed approach tailored to individual goals and values, setting the foundation for generational wealth and financial independence.