Managing self-employed income can often feel like navigating a labyrinth, especially when juggling multiple clients, projects, and fluctuating earnings. With the rise of the gig economy and freelance workforce, app-based financial tools have become indispensable for simplifying income tracking, tax preparation, and overall financial management. This article explores the best apps designed explicitly for tracking self-employed income, helping freelancers, consultants, and entrepreneurs streamline their finances with precision and confidence. By leveraging technology, self-employed individuals can not only maintain accurate records but also optimize their financial health and compliance.

According to the U.S. Bureau of Labor Statistics, over 16% of Americans are self-employed, highlighting the significance of reliable financial tools tailored for this growing segment. With such a large population depending on accurate income tracking to manage taxes and cash flow, choosing the right app can markedly affect financial stability and business growth. This comprehensive guide evaluates top income tracking apps, compares their key features, and projects future trends in financial technology for the self-employed sector.

Essential Features of Self-Employed Income Tracking Apps

When selecting an income tracking app, several core features must be considered for maximum effectiveness. First, automatic income and expense categorization is critical. This helps self-employed workers avoid manual entry errors and saves valuable time. For example, QuickBooks Self-Employed uses machine learning to match transactions to common categories like mileage, office supplies, and client payments. This automated categorization ensures that tax deductions are accurately captured without additional effort.

Another vital feature is integration with tax tools. Given that freelancers often rely on quarterly estimated tax payments, apps that offer seamless integration with tax software or provide tax estimations are highly advantageous. FreshBooks, for instance, combines income tracking with invoicing and offers real-time tax insights. With over 24 million users worldwide (source: FreshBooks official website, 2023), such integration helps avoid costly tax surprises and simplifies year-end filing.

Beyond these, mobile accessibility, real-time notifications, customizable reports, and multi-currency support are also key functionalities that make income tracking apps invaluable for self-employed professionals working globally. Having an all-in-one platform to manage payments, expenses, tax deductions, and invoices can enhance productivity and reduce financial anxiety.

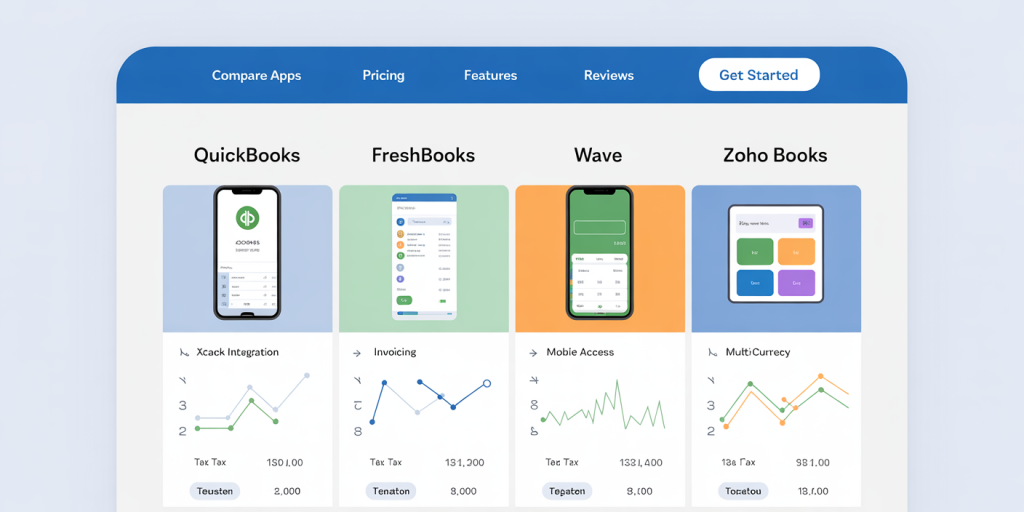

Top Apps for Tracking Self-Employed Income

1. QuickBooks Self-Employed

QuickBooks Self-Employed is a leader in the market, specifically designed for freelancers and independent contractors. It automatically tracks income and expenses by connecting to bank accounts and credit cards. The app also calculates quarterly estimated taxes, which is a crucial benefit for self-employed workers facing complex tax obligations.

One practical example is a freelance graphic designer who uses QuickBooks Self-Employed to log payments from multiple clients, track expenses like software subscriptions, and monitor mileage for client visits. By the end of the year, the app generates detailed reports, simplifying tax filing and maximizing deductible expenses.

Moreover, QuickBooks integrates with TurboTax, enabling users to export data directly for tax preparation. This synergy saves hours of manual entry during tax season and ensures higher accuracy.

2. FreshBooks

FreshBooks is an excellent choice for those who prioritize invoicing alongside income tracking. Its cloud-based platform provides easy invoice creation, payment tracking, and expense monitoring. FreshBooks’s automatic payment reminders reduce delays in receiving income, a common issue for self-employed professionals with multiple clients.

Consider the case of a freelance writer managing various projects with different payment schedules. FreshBooks helps keep invoices organized, tracks payment status in real time, and automatically logs income when payments are received. This holistic approach fosters better cash flow management.

Additionally, FreshBooks offers integration with several payment gateways such as PayPal and Stripe, allowing users to process payments effortlessly within the app. This comprehensive ecosystem appeals to entrepreneurs who want to maintain a professional appearance and efficient financial workflow.

3. Wave Accounting

Wave is a free financial app that combines income tracking, invoicing, and receipt scanning, making it highly attractive for new freelancers and small business owners. Despite its zero cost, Wave offers robust features such as automatic bank transaction imports and customizable financial reports.

A real-world example includes a self-employed consultant who uses Wave to track client payments and business expenses without investing in costly software. The app’s functionality to scan receipts directly into the system eliminates paperwork and manual data entry.

Though Wave does not provide tax filing capabilities directly, it integrates well with third-party tax tools, making it suitable for users looking for a budget-friendly solution without compromising functionality.

4. Zoho Books

Zoho Books stands out for its comprehensive accounting features tailored to small businesses and the self-employed. Beyond income tracking, it offers detailed project management, automated bank feeds, and solid reporting capabilities. The app supports multi-currency income tracking, ideal for freelancers operating in international markets.

For example, an independent consultant working with both domestic and foreign clients benefits from Zoho Books’ ability to handle currency conversions and create income reports by client or project. This granularity aids in precise financial analysis.

Zoho Books also includes tax compliance tools for various jurisdictions, simplifying the management of complex tax environments. The platform’s affordability and rich features make it a popular choice among tech-savvy freelancers seeking depth beyond basic income tracking.

Comparative Overview of Income Tracking Apps

To assist in identifying the optimal app, the following table summarizes key attributes across the discussed platforms:

| Feature | QuickBooks Self-Employed | FreshBooks | Wave | Zoho Books |

|---|---|---|---|---|

| Automatic Income Tracking | Yes | Yes | Yes | Yes |

| Expense Categorization | Yes | Yes | Yes | Yes |

| Invoicing Capabilities | Basic | Advanced | Basic | Advanced |

| Tax Estimation/Preparation | Yes | No | No | Yes |

| Mobile Accessibility | Yes | Yes | Yes | Yes |

| Free Version Available | No | No | Yes | Trial Available |

| Multi-Currency Support | Limited | Limited | Limited | Yes |

| Payment Gateway Integration | Limited | Extensive | Limited | Moderate |

This comparison highlights that while QuickBooks and Zoho Books offer more robust tax tools, FreshBooks excels in invoicing and payment tracking, and Wave remains the most budget-friendly option without sacrificing core capabilities.

How Income Tracking Impacts Self-Employed Financial Health

Accurate income tracking directly influences a self-employed individual’s financial health by enabling better budgeting, tax compliance, and strategic planning. According to a 2022 survey by QuickBooks, 57% of freelancers reported feeling stressed about managing finances, underscoring the importance of streamlined tracking solutions.

For example, timely and precise income tracking allows a freelance marketer to identify peak earning periods and allocate funds for tax payments and savings accordingly. Additionally, organized records can reduce audit risks by substantiating income and expenses to tax authorities.

Financially, these apps help users identify profitable clients and projects by generating income reports segmented by source, helping self-employed workers make informed decisions on where to focus efforts or cut losses. This ability to analyze income patterns supports sustainable business growth and improves cash flow management.

Emerging Trends and the Future of Income Tracking Apps

Looking forward, the landscape of income tracking apps for the self-employed is set to evolve with several technological advancements. One significant trend is the integration of artificial intelligence (AI) for enhanced automation and predictive analytics. AI-driven apps will not only categorize income and expenses but also forecast income trends based on historical data, helping freelancers plan ahead more effectively.

Blockchain technology is also gaining attention for its potential to increase financial transparency and security in income tracking and payments. By leveraging decentralized ledgers, future apps could guarantee tamper-proof records, benefiting freelancers who require proof of transactions for legal or contractual purposes.

Moreover, we can expect greater personalization in financial apps, where machine learning tailors recommendations on expense reductions, tax deductions, and investment opportunities based on the user’s unique financial patterns. API integrations with emerging fintech platforms will further embed income tracking into a comprehensive digital financial ecosystem.

The growing shift toward remote and freelance work also means income tracking apps will increasingly support global currencies, international tax regulations, and cross-border payment solutions. This trend positions apps such as Zoho Books favorably due to their international readiness.

Lastly, growing regulatory emphasis on gig economy tax compliance worldwide will compel app developers to build features facilitating adherence to complex reporting requirements, ensuring users remain compliant with less manual intervention.

By carefully selecting an income tracking app suited to their unique needs, self-employed individuals can harness technology to reduce administrative burdens, enhance financial clarity, and build resilient businesses. As these tools continue evolving with emerging technologies, the future promises even greater support for the dynamic financial world of the self-employed.

Deixe um comentário