Building wealth is more than just an ambition; it’s a carefully structured process that requires discipline, informed decision-making, and a clear strategy. Across the globe, millions strive for financial independence, yet few truly understand the systematic approach needed to accumulate lasting wealth. By breaking down this journey into actionable steps, anyone can begin to take control of their financial future.

In this article, we will walk through the essential stages of wealth building. Each section will provide practical guidance supported by real-world examples, data, and comparisons to help you implement these strategies effectively.

Understanding Your Financial Baseline: Assessing Where You Stand

Before embarking on a wealth-building journey, it’s crucial to assess your current financial status. This step includes understanding your income streams, expenses, debts, and net worth. Without a clear financial snapshot, setting realistic goals becomes challenging.

Start by calculating your net worth — the difference between your assets (savings, investments, property) and liabilities (loans, credit card debts, mortgages). According to a 2023 report by the Federal Reserve, the average net worth of U.S. households was approximately $746,821. However, wealth distribution varies widely; the median net worth was $137,300, indicating many fall far below the average due to wealth concentration among the top 1%.

Understanding your debts is equally critical. For instance, individuals with high-interest debt, such as credit card balances averaging 16% APR, need to prioritize repayment before aggressively investing. This initial clarity guides your next steps and prevents financial decision-making based on assumptions.

Real Case: Jane, a 29-year-old marketing specialist, tracked her finances using a budgeting app and discovered her discretionary spending consumed 40% of her income. This insight motivated her to reduce eating-out expenses and channel those savings into a retirement account.

Creating a Budget and Emergency Fund: The Foundation of Financial Stability

A budget is the cornerstone of effective money management and wealth accumulation. Crafting a budget requires listing all income sources and fixed and variable expenses. Tools like YNAB (You Need A Budget) or Mint help users automate tracking and monitor spending categories.

Why is budgeting indispensable? It prevents lifestyle inflation—the tendency to increase spending as income rises—which can stall wealth-building efforts. According to a 2022 survey by The Balance, 60% of Americans reported they have no formal budget, which correlates with higher levels of debt and lower savings rates.

Beyond budgeting, establishing an emergency fund is a priority. Financial experts recommend saving three to six months’ worth of living expenses to cover unforeseen circumstances like medical emergencies or job loss. For example, if your monthly expenses total $3,000, your goal should be a minimum of $9,000 saved in a liquid, low-risk account.

Practical Example: Mike, an entrepreneur, allocated 15% of his monthly income to build a six-month emergency fund over 18 months. Once achieved, he redirected these funds into diversified investments, knowing his cash reserve provided a safety net.

Eliminating High-Interest Debt: Unlocking More Capital for Investment

Paying off high-interest debt serves as one of the fastest wealth-building moves. Credit card debt, payday loans, and certain personal loans often exceed interest rates of 15%, which typically outpace average investment returns.

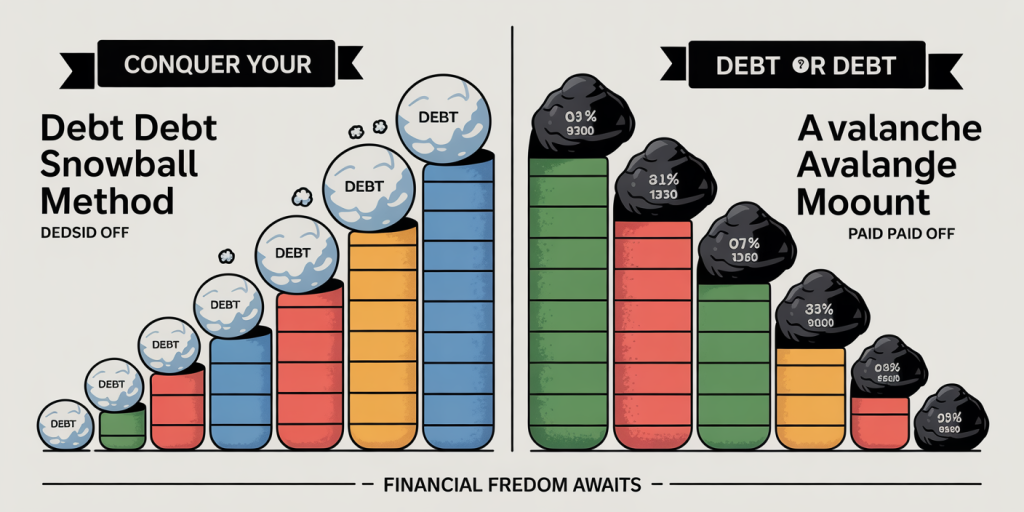

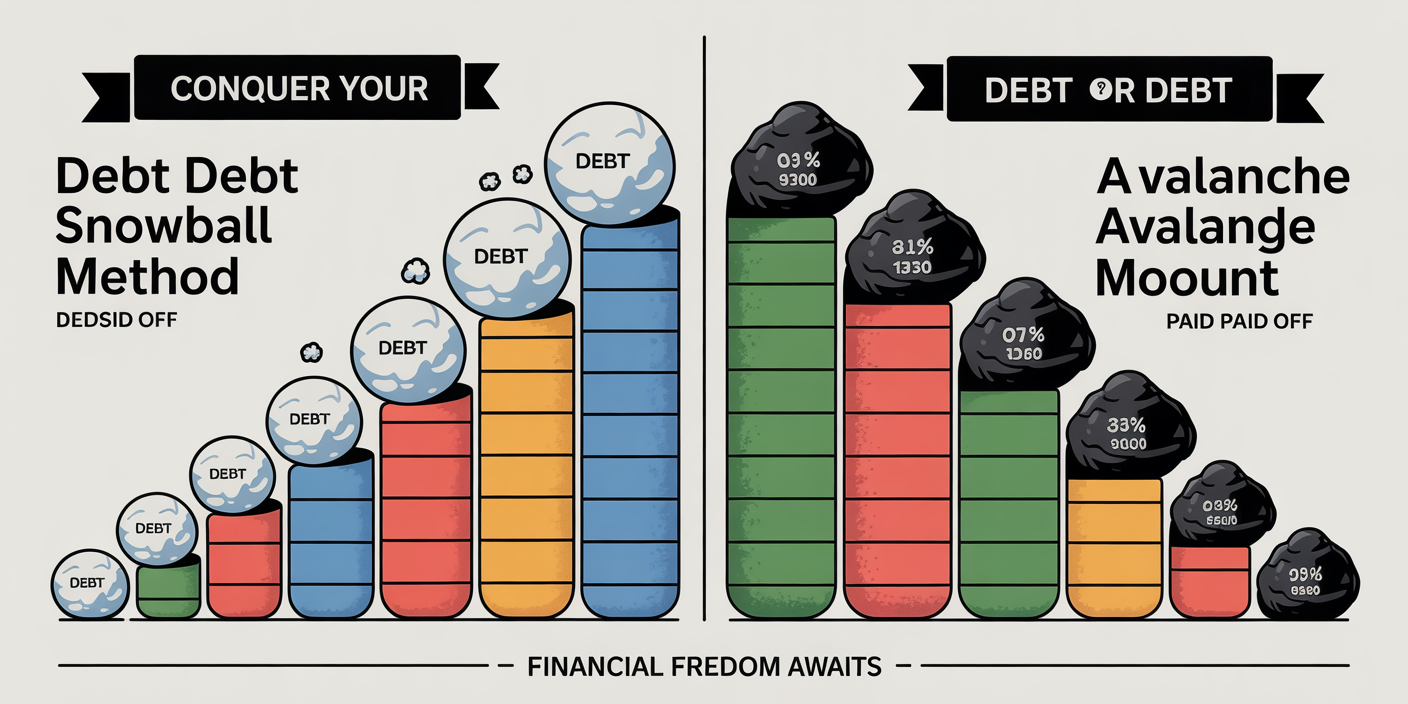

Two common strategies exist for tackling debt: the Debt Snowball and Debt Avalanche methods. The Debt Snowball focuses on paying off debts from smallest to largest balance to gain psychological momentum, while the Debt Avalanche targets debts with the highest interest rates first for maximum cost savings.

| Strategy | Focus | Pros | Cons |

|---|---|---|---|

| Debt Snowball | Smallest balance first | Boosts motivation early | May cost more in interest |

| Debt Avalanche | Highest interest first | Saves more money in interest | Requires greater persistence |

According to a study by the National Foundation for Credit Counseling, the Debt Avalanche method saves an average of $1,400 in interest over the life of typical debt compared to the Debt Snowball method.

Case Study: Sarah had $12,000 in credit card debt distributed among three cards, with APRs of 22%, 19%, and 15%. By prioritizing the 22% card first through the Avalanche method, she cut her repayment time by eight months and saved approximately $1,200 compared to spreading payments across all cards evenly.

Investing Wisely: Growing Wealth Through Compounding and Diversification

Once debt is under control and an emergency fund is in place, investing becomes the primary vehicle for wealth expansion. The power of compounding returns—earning returns on both principal and accumulated interest—magnifies wealth over time.

Consider this comparison:

| Investment Option | Average Annual Return | 20-Year Growth of $10,000 |

|---|---|---|

| Savings Account | 1.5% | $13,490 |

| S&P 500 Index Fund | 10% | $67,275 |

| Real Estate | 8% (net) | $46,610 |

*Source: Historical asset returns based on Morningstar data (1999-2019)*

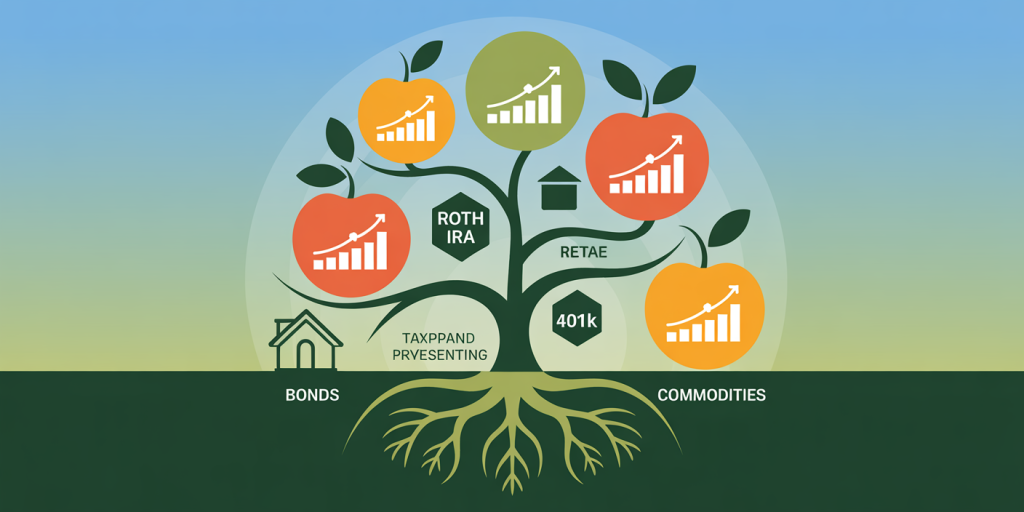

Diversification across asset classes (stocks, bonds, real estate, commodities) reduces risk and balances volatility. For instance, during the 2008 financial crisis, well-diversified portfolios experienced smaller drawdowns compared to portfolios heavily invested in equities alone.

Real-world investors like Warren Buffett exemplify patient, value-focused investing. Buffett’s Berkshire Hathaway achieved an average annual return of 20%+ over decades, largely by investing in undervalued companies with strong fundamentals.

Practical Tip: Use tax-advantaged accounts such as 401(k)s or IRAs to maximize investment growth. Employer matching contributions are essentially free money, instantly boosting your investment returns.

Leveraging Income Growth and Multiple Revenue Streams

Building wealth is not solely about saving and investing; increasing income is an essential component. Many individuals plateau in wealth accumulation because they depend on a single source of income.

Studies show that millionaires, on average, have seven streams of income (source: Thomas J. Stanley, “The Millionaire Next Door”). These can include salaries, dividends, rental income, side businesses, royalties, and freelance work.

Take the example of Robert, who began freelancing as a graphic designer while working full-time. Within five years, his side income accounted for 30% of his total earnings, enabling additional investments and faster debt repayment.

Additionally, investing in personal development and skills can yield higher income potential. The U.S. Bureau of Labor Statistics reports median weekly earnings increase approximately 20% when an individual holds a bachelor’s degree compared to just a high school diploma.

Comparison of Income Growth Strategies:

| Strategy | Potential Impact | Required Investment | Timeframe |

|---|---|---|---|

| Upskilling (formal education) | +20-35% income | Tuition, time | 1-4 years |

| Side Business | Variable, scalable | Startup costs, effort | 6 months – years |

| Real Estate Rental Income | 5-10% annual return | Capital for down payment | Ongoing |

Planning for the Future: The Role of Retirement and Estate Planning

As wealth grows, planning for retirement and beyond is paramount. Retirement planning ensures that accumulated wealth supports your desired lifestyle without depleting resources prematurely.

For example, the Vanguard 2023 Retirement Nest Egg study found that a 4% withdrawal rate on a diversified portfolio generally sustains retirement funds for 30 years, depending on market conditions. Using retirement calculators helps tailor saving targets based on your expected lifestyle and inflation.

Estate planning focuses on managing the transfer of wealth to heirs efficiently, minimizing taxes, and ensuring your wishes are honored. Establishing wills, trusts, and powers of attorney is essential regardless of wealth size.

Data Insight: According to Caring.com, only 32% of Americans had a will as of 2023, exposing assets to probate delays and unnecessary taxation.

Looking Ahead: The Future of Wealth Building

The landscape of wealth building continues to evolve with technological advancements and changing economic conditions. Digital assets such as cryptocurrencies have emerged as alternative investment opportunities, albeit with higher volatility and regulatory uncertainty.

Furthermore, automation and artificial intelligence tools increasingly provide personalized financial advice at minimal cost. Robo-advisors, for example, managed approximately $1.2 trillion in assets in 2023, democratizing investment management.

Sustainability is also reshaping investor priorities. Environmental, Social, and Governance (ESG) investing is growing rapidly, with global ESG assets expected to reach $53 trillion by 2025 (source: Bloomberg Intelligence).

On a societal level, financial literacy initiatives and increased access to financial education may empower more individuals to build and preserve wealth systematically.

In this dynamic environment, staying informed and adaptable is crucial. Continual education, reassessing investment portfolios, and embracing innovation can accelerate your financial journey toward independence and security.

By following this step-by-step path—understanding your finances, budgeting, eliminating debt, investing wisely, increasing income, and planning ahead—you can construct a robust framework for building long-term wealth. Remember, wealth building is not a race but a disciplined journey requiring persistence, knowledge, and strategic action.

Deixe um comentário