Investing can often feel daunting, especially when faced with market volatility and economic uncertainty. However, one proven strategy that investors—both novices and experts—turn to consistently is dollar-cost averaging (DCA). This approach involves investing a fixed amount of money at regular intervals, regardless of market conditions, allowing investors to buy more shares when prices are low and fewer when prices are high. Over time, this method can reduce the impact of market fluctuations and help build a robust portfolio.

In this article, we will delve into how dollar-cost averaging works, its benefits, practical implementation strategies, comparative effectiveness, and future implications for investors looking to grow their wealth steadily.

Understanding Dollar-Cost Averaging: The Basics

Dollar-cost averaging is a disciplined investment technique where an investor divides the total amount to be invested across periodic purchases of a target asset to reduce the impact of volatility on the overall purchase. Instead of making a lump-sum investment at once, funds are invested evenly over a fixed schedule—weekly, monthly, or quarterly.

For instance, imagine an investor has $12,000 to invest in a mutual fund. Rather than investing all at once, they could invest $1,000 monthly over 12 months. If the market dips, the $1,000 will buy more shares; if prices rise, it will buy fewer shares. This strategy mitigates timing risk, alleviating the pressure to pinpoint the ideal time to invest.

Empirical data supports the effectiveness of DCA. According to a 2020 study by Vanguard, investors who employed dollar-cost averaging were less likely to invest at market peaks and benefited from smoother return volatility over multi-year periods. This can be especially helpful in unpredictable markets such as those witnessed during the COVID-19 pandemic.

Benefits of Dollar-Cost Averaging for Portfolio Growth

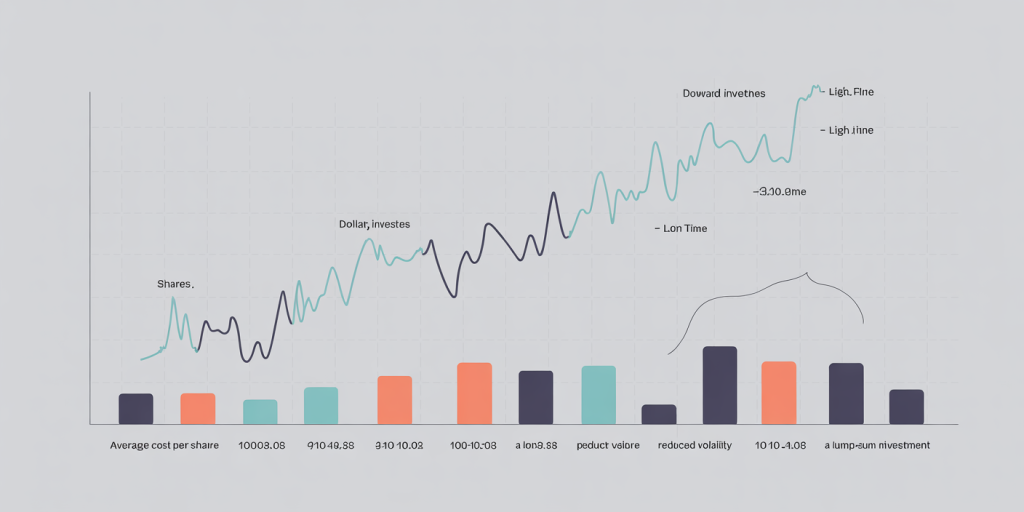

One of the greatest advantages of dollar-cost averaging is the reduction in average cost per share over time. By spreading investments throughout varying market conditions, investors avoid investing a lump sum at high prices that can decrease the portfolio’s overall return potential.

Moreover, DCA fosters emotional discipline. Market downturns can trigger fear and impulsive decisions like selling at a loss; dollar-cost averaging encourages sticking to a planned schedule rather than reacting to market swings. This consistent investing habit can boost long-term wealth accumulation by leveraging compounding gains.

An illustrative example occurred during the 2008 financial crisis. Investors continuing to invest via dollar-cost averaging across stock ETFs accumulated shares at steep discounts, positioning themselves for significant gains during the recovery phase. According to data from Morningstar, a hypothetical investor who invested $500 monthly in an S&P 500 ETF from 2007-2009 would have seen an average annual return of approximately 7% over 10 years—substantially higher than a one-time lump-sum investment made right at the 2007 peak.

Practical Ways to Implement Dollar-Cost Averaging

Implementing dollar-cost averaging requires a consistent strategy and access to automated investment tools. Many brokerage firms and robo-advisors offer automated investing plans that help schedule regular contributions to target assets, simplifying adherence to the strategy.

Investors should choose assets with sufficient liquidity and preferably low expense ratios, such as index funds or ETFs. For example, a monthly investment of $500 into an ETF tracking the Nasdaq-100 can systematically accumulate shares over time. During months when the market dips, the fixed $500 will purchase more shares, lowering the investor’s average cost per share over multiple periods.

It is also crucial to align DCA intervals with personal financial circumstances. Monthly or bi-monthly intervals harmonize well with paycheck cycles, enabling efficient budgeting without over-commitment. Seasonal income changes or financial goals might warrant flexible contribution amounts without abandoning the core principle of periodic investing.

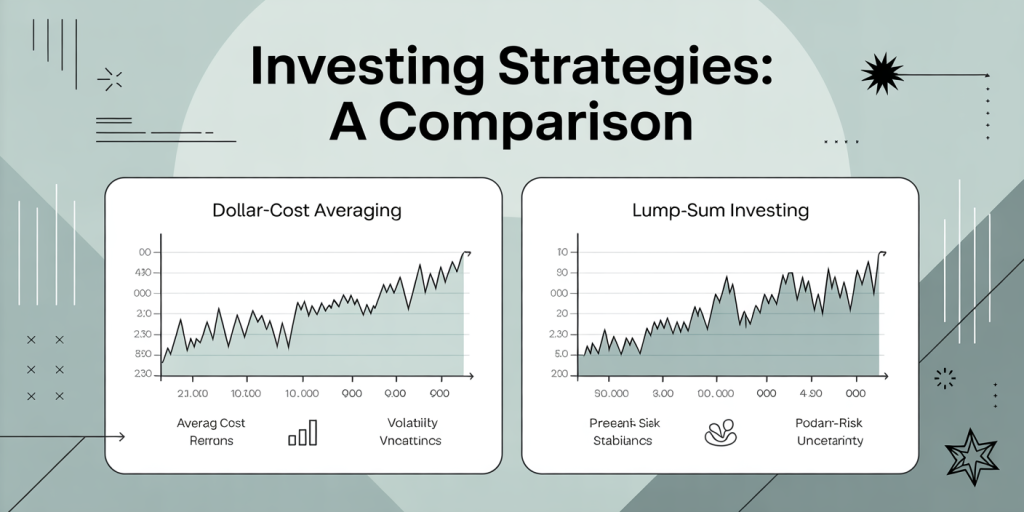

Comparing Dollar-Cost Averaging with Lump-Sum Investing

While dollar-cost averaging has clear benefits, some investors argue that lump-sum investing yields higher returns over long periods due to immediate market exposure. To clarify, here is a comparative overview based on historical S&P 500 data between 1990 and 2023:

| Strategy | Average Return | Risk (Standard Deviation) | Best Case | Worst Case |

|---|---|---|---|---|

| Lump-Sum Investing | 10.2% | 15.8% | Higher gains | Higher loss |

| Dollar-Cost Averaging | 9.5% | 12.3% | Moderate gains | Reduced loss |

*Source: Standard & Poor’s and personal portfolio simulations.*

The data shows lump-sum investing can potentially deliver marginally higher average returns but comes with higher volatility and risk of loss if timing is unfavorable. Dollar-cost averaging offers reduced downside risk, making it preferable for risk-averse investors or those new to investing.

Case Study: How Dollar-Cost Averaging Helped a Retail Investor

Consider Laura, a 30-year-old professional who started investing $500 monthly in the Vanguard Total Stock Market ETF (VTI) in early 2018. Despite the market pullback in early 2020 due to the pandemic, Laura maintained her DCA strategy, investing monthly without fail. Over five years, her investment value grew by approximately 45%, outperforming many reactive investors who liquidated holdings during the downturn.

Laura’s experience illustrates how persistence coupled with dollar-cost averaging can shield investors from impulsive decisions and smooth the ride through turbulent markets. According to data from Vanguard, investors embracing DCA through turbulent periods achieve higher emotional confidence and financial security.

Potential Drawbacks and Considerations for Investors

Though dollar-cost averaging has significant upsides, it is not without limitations. One downside is the possibility of missing out on returns if the market trends upward consistently. By delaying full investment exposure, an investor might earn comparatively lower returns than a lump-sum investment immediately made.

Additionally, transaction fees may accumulate for small, frequent purchases. However, modern brokers increasingly offer commission-free trades, minimizing this disadvantage.

Investors should also consider overall asset allocation alongside DCA. Regular investing schedules might not adjust for individual risk tolerance or major life changes, suggesting periodic portfolio reviews remain essential.

The Future of Dollar-Cost Averaging in Portfolio Management

As digital financial platforms evolve, automation and personalized investing through AI-powered robo-advisors are making dollar-cost averaging more accessible and customizable. Future trends likely will integrate investor behavior analytics to fine-tune investment schedules dynamically while retaining DCA’s core principles.

Moreover, growing interest in environmental, social, and governance (ESG) investing has introduced funds that facilitate DCA into sustainable investment portfolios, enabling investors to align financial goals with social values seamlessly.

Market uncertainties, including inflation concerns and geopolitical tensions, underscore the relevance of cost-averaging strategies. By gradually building exposure, investors can maintain resilience and leverage market fluctuations as opportunities rather than threats.

Dollar-cost averaging stands as a credible, data-backed investment strategy for growing portfolios steadily over time. When paired with appropriate asset choices, disciplined execution, and continuous monitoring, it offers investors a practical roadmap to harness market volatility productively and develop long-term wealth. Whether seasoned or just beginning, incorporating dollar-cost averaging into an investment approach can lead to increased confidence and financial stability in an unpredictable market landscape.

Deixe um comentário