In today’s volatile financial landscape, investors face continuous challenges in balancing growth opportunities with potential losses. At the heart of successful investing lies a clear understanding of risk tolerance and strategic asset allocation. These two concepts are intimately intertwined and form the foundation upon which diversified investment portfolios are built. This article explores the intricacies of risk tolerance, the nuances behind asset allocation, and how understanding these factors can significantly influence investment outcomes.

The Nature of Risk Tolerance in Investing

Risk tolerance refers to the degree of variability in investment returns an individual is willing to withstand. It reflects an investor’s emotional and financial capacity to absorb losses without deviating from their long-term investment plan. Understanding one’s risk tolerance is essential because it influences investment decisions, portfolio construction, and responses to market fluctuations.

An investor with a high-risk tolerance may be willing to accept significant volatility for the potential of higher returns, typically favoring stocks or alternative assets. Conversely, a conservative investor may prioritize capital preservation, opting for bonds or cash equivalents. For example, during the 2008 financial crisis, many aggressive investors who tolerated high volatility endured substantial losses but recovered over time, whereas conservative investors had fewer losses but missed out on subsequent rebounds.

Risk tolerance is not static; it evolves based on several factors including age, financial goals, income stability, investment horizon, and personal experiences. Younger investors generally have a higher capacity to bear risk due to a longer time horizon, allowing recovery from potential setbacks. In contrast, retirees usually adopt a lower risk tolerance, focusing on steady income and capital protection.

Key Factors Influencing Risk Tolerance

Numerous variables impact an individual’s risk tolerance, making it a personalized trait rather than a one-size-fits-all measure. One primary factor is financial situation. Investors with substantial disposable income and emergency savings are often more comfortable assuming risk because losses can be absorbed without severely impacting their lifestyle. For instance, a professional with dual income streams and no debt may feel more secure investing aggressively compared to someone living paycheck to paycheck.

Psychological elements play a significant role as well. Behavioral finance studies reveal that individual attitudes toward risk are affected by cognitive biases, past investment experiences, and emotional responses. A notable case is the “loss aversion” bias, where investors disproportionately fear losses compared to gains, leading to overly conservative investment behavior that may hamper wealth accumulation.

Demographic characteristics such as age, education, and cultural background also influence risk preferences. According to a 2022 survey by Vanguard, millennials tend to have higher risk tolerance than baby boomers, partially due to different economic experiences and longer investment horizons. Meanwhile, traditional cultures emphasizing financial prudence often exhibit lower risk tolerance, preferring tangible assets and conservative investment vehicles.

| Factor | Influence on Risk Tolerance | Example Scenario |

|---|---|---|

| Age | Younger investors tolerate higher volatility | A 25-year-old invests 80% in equities |

| Financial Stability | Secure finances increase risk-taking ability | Dual-income household favors stocks |

| Psychological Biases | Loss aversion reduces risk tolerance | Investor sells stocks after minor dips |

| Cultural Background | Conservative cultures prefer lower risk | Preference for real estate over stocks |

Asset Allocation: The Bridge Between Risk and Return

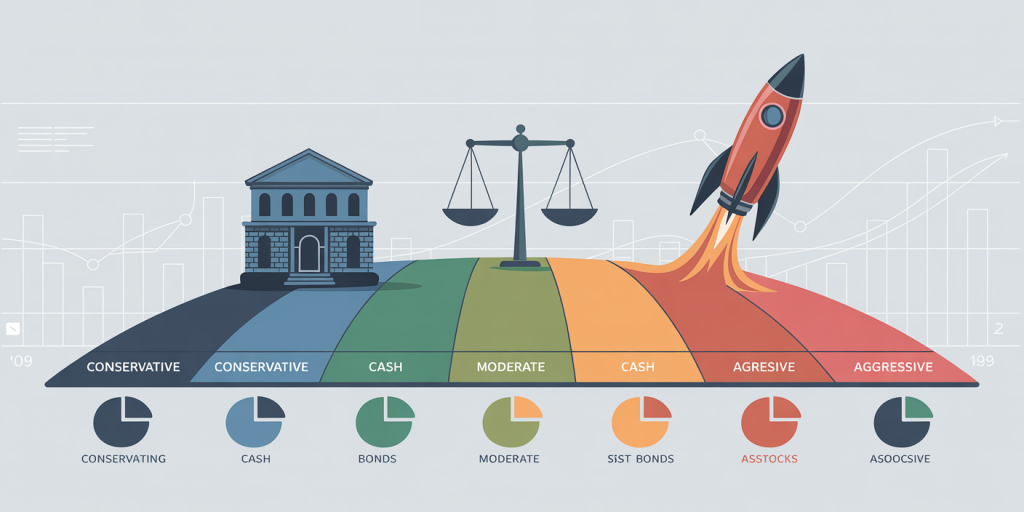

Asset allocation is the process of dividing investments across different asset classes—typically stocks, bonds, cash, and real assets—in a manner consistent with an investor’s risk tolerance and financial goals. Effective asset allocation is crucial because it shapes the portfolio’s risk-return profile and impacts overall investment performance.

The logic underpinning asset allocation is diversification. By investing in assets that behave differently under various market conditions, investors can reduce the volatility of their portfolio without necessarily sacrificing returns. For example, while stocks might decline during economic recessions, bonds often provide stability due to their fixed income nature, helping to balance overall portfolio risk.

A practical case is the approach taken by the Yale Endowment Fund, which popularized alternative asset allocations involving private equity, real estate, and hedge funds. This diversified strategy allowed Yale’s portfolio to achieve an average return of approximately 11.3% annually over a 20-year period (2002–2022), outperforming many traditional portfolios while managing volatility.

Asset allocation strategies are often categorized into three primary types: strategic, tactical, and dynamic allocation. Strategic allocation involves setting fixed proportions aligned with long-term objectives. Tactical allocation allows short-term adjustments to exploit perceived market opportunities. Dynamic allocation continuously adapts based on changing risk tolerance or market outlooks.

Aligning Asset Allocation With Risk Tolerance

Creating an asset allocation framework tailored to one’s risk tolerance requires a systematic evaluation of investment objectives and comfort with potential losses. Financial advisors often use questionnaires and risk profiling tools to assess an investor’s tolerance and translate it into a recommended asset mix.

For example, consider three hypothetical investors: Conservative Clara, Moderate Mark, and Aggressive Alex. Clara prioritizes capital preservation and steady income, with low tolerance for loss. Her portfolio might consist of 20% equities, 70% bonds, and 10% cash. Mark seeks balanced growth while mitigating risk, resulting in a portfolio split roughly 50% equities, 40% bonds, and 10% alternatives. Alex pursues high growth and accepts volatility, favoring 80% equities, 10% bonds, and 10% alternatives.

The following table illustrates a simplified model of how risk tolerance correlates with asset allocation:

| Investor Profile | Equities (%) | Bonds (%) | Cash & Alternatives (%) | Expected Annual Return* (%) | Estimated Volatility* (%) |

|---|---|---|---|---|---|

| Conservative Clara | 20 | 70 | 10 | 4-5 | 5-7 |

| Moderate Mark | 50 | 40 | 10 | 6-7 | 10-12 |

| Aggressive Alex | 80 | 10 | 10 | 8-10 | 15-18 |

*Expected returns and volatilities are illustrative based on historical averages.

These allocations must be regularly reviewed as life circumstances and market conditions change. For example, Alex may gradually shift towards a more conservative portfolio in their 50s as retirement approaches, reflecting a declining risk tolerance and shorter time horizon.

Practical Case Studies: Lessons in Risk and Allocation

Examining real-world scenarios provides valuable insights into how risk tolerance and asset allocation impact portfolio outcomes. Consider the case of an investor heavily concentrated in technology stocks during the dot-com bubble of 1999–2000. This portfolio exhibited high risk tolerance with minimal diversification. When the bubble burst, investors faced losses exceeding 70% in some cases, followed by years of recovery. This experience underscores the peril of disregarding asset allocation in favor of risky bets.

Conversely, during the COVID-19 pandemic crash in March 2020, portfolios with balanced asset allocations fared differently. Data from Morningstar indicates that moderate portfolios with roughly 60% equities and 40% bonds recovered faster and with less drawdown compared to all-stock portfolios which plunged more than 30%. Investors with lower risk tolerance who maintained diversified strategies demonstrated resilience amidst market chaos.

Financial advisors often stress that risk tolerance should reflect emotional capacity, not just quantitative metrics. For instance, an investor with theoretical tolerance for equities may panic during market downturns and prematurely liquidate holdings, crystallizing losses. Through guided asset allocation and risk assessment, clients learn to align their portfolios realistically with both goals and temperament.

Tools and Metrics to Assess Risk Tolerance and Allocation

Modern investment platforms and financial advisors offer a range of tools to quantify risk tolerance and optimize asset allocation. Commonly used questionnaires gauge responses to hypothetical market scenarios, estimating an investor’s risk threshold. These assessments factor in preferences about loss aversion, investment horizon, and liquidity needs.

Quantitative measures such as standard deviation (volatility), beta (market risk), and Value at Risk (VaR) provide data-driven insights. VaR estimates potential losses over a specific period at a given confidence level, helping investors visualize downside risk. For example, a portfolio with a one-month VaR of $10,000 at 95% confidence suggests a 5% chance of losing more than $10,000 in a month.

Robo-advisors have popularized algorithm-driven asset allocation models tailored to risk scores and goals. These platforms automatically adjust portfolios with minimal investor input, promoting disciplined investing. However, human judgment remains valuable, especially in volatile or complex environments.

| Assessment Tool | Purpose | Example Output |

|---|---|---|

| Risk Tolerance Questionnaire | Evaluates emotional and financial comfort with loss | Profile: Moderate Risk |

| Standard Deviation | Measures volatility of returns | 12% annual volatility |

| Beta | Measures sensitivity to market movements | Beta of 1.2 (higher than market) |

| Value at Risk (VaR) | Estimates potential maximum loss | 5% chance to lose $5,000 in a month |

Future Perspectives on Risk Tolerance and Asset Allocation

As the investment landscape evolves due to technological advances, demographic shifts, and global economic changes, the concepts of risk tolerance and asset allocation will continue to adapt. The rise of ESG (Environmental, Social, and Governance) investing, for example, has introduced new dimensions of risk assessment, where non-financial factors influence portfolio construction.

Artificial intelligence and machine learning are becoming central to refining risk tolerance evaluations and dynamically adjusting asset allocation. Predictive analytics may soon enable portfolios to respond in real-time to market signals and personal circumstances, providing investors with more customized and timely investment solutions.

Moreover, changing retirement patterns and increasing life expectancies necessitate longevity risk considerations, encouraging more nuanced approaches to risk tolerance. Multi-phase investing—balancing growth, preservation, and income phases—will become mainstream, requiring sophisticated asset allocation strategies that evolve throughout an investor’s life cycle.

In conclusion, understanding risk tolerance and asset allocation is more critical than ever to navigate the complexities of modern investing. By aligning investment choices with personal risk profiles and employing robust asset allocation methods, investors position themselves to achieve sustainable growth while weathering market uncertainties. The future promises even greater integration of data and technology to tailor these principles uniquely to each individual’s journey toward financial security.