Student loans have become a common financial tool for millions seeking higher education, yet navigating repayment choices can often feel overwhelming. With the total student loan debt in the United States surpassing $1.75 trillion as of 2023 (Federal Reserve), understanding repayment options is critical for borrowers to manage their financial obligations effectively. This article dives into the various student loan repayment plans available, their features, and how to select the best one depending on individual circumstances.

Understanding the Basics of Student Loan Repayment

When federal student loans come due, borrowers typically face several repayment alternatives designed to ease their financial burden. The standard repayment plans usually spread over 10 years, but many other options exist for those needing longer terms or income-based flexibility.

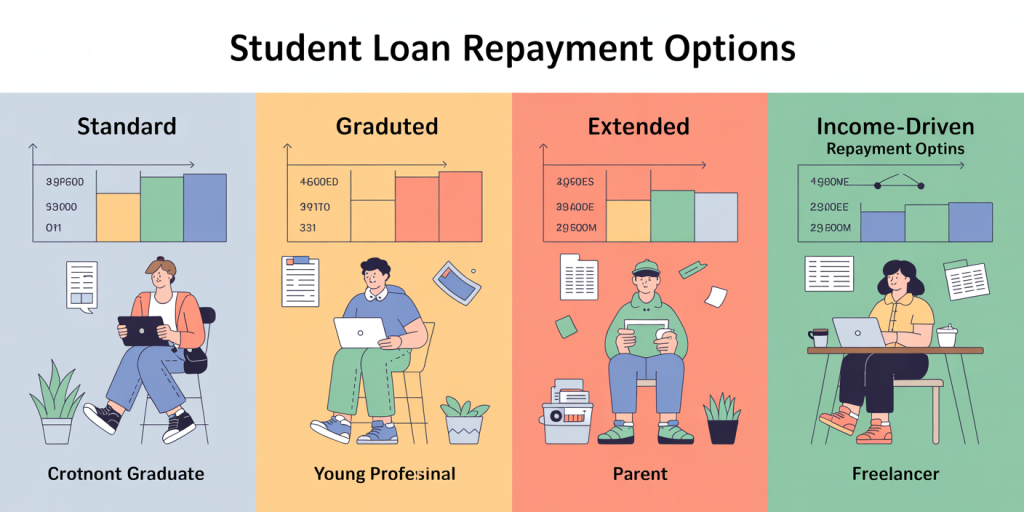

Repayment options are primarily categorized into standard, graduated, extended, and income-driven plans. Each option caters to different financial situations, and borrowers can switch between plans under certain conditions. It’s important to note that private student loans usually do not offer the same flexibility as federal loans.

For example, Jane, a recent college graduate with $30,000 in federal loans, opted for the Standard Repayment Plan, paying $318 monthly for 10 years. Her colleague, Mark, faced a lower starting salary and chose an Income-Driven Repayment (IDR) plan to pay less initially but extend his payments up to 20 or 25 years.

Standard and Graduated Repayment Plans: Simple and Predictable

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal loans, requiring fixed monthly payments over 10 years. This plan typically results in the least amount of interest paid overall because it pays off the principal faster.

Borrowers with the ability to make consistent payments often find this plan preferable. For instance, a borrower with $50,000 in loans would have monthly payments of approximately $530 under this plan (Federal Student Aid Calculator).

Graduated Repayment Plan

The Graduated Repayment Plan allows borrowers to start with lower payments, which gradually increase every two years. This design assumes that the borrower’s income will rise over time, aligning payments with earnings.

Consider Sarah, who just started working part-time while looking for full-time employment. Beginning with lower payments of $200 monthly and increasing payments every two years reduces financial pressure initially but increases overall interest paid compared to the standard plan.

| Plan Type | Term Length | Initial Monthly Payment | Payment Adjustment | Total Interest Cost |

|---|---|---|---|---|

| Standard Repayment | 10 years | Fixed (e.g., $530 on $50k loan) | Fixed throughout the term | Lowest |

| Graduated Repayment | 10 years | Lower (e.g., $200 initially) | Increases every 2 years | Higher |

Extended Repayment: More Time, Lower Monthly Payments

Borrowers with high loan balances who struggle to meet standard payments may benefit from the Extended Repayment Plan. This plan extends the repayment period up to 25 years, significantly lowering monthly payments but increasing the total interest paid.

For example, Mark, with $80,000 in student loans, chose the Extended Plan and reduced his monthly payments from $900 to about $450. However, he ended up paying nearly $30,000 more in interest over the entire repayment span.

Extended Plans are available only to borrowers with at least $30,000 in outstanding Direct Loans or Federal Family Education Loan (FFEL) Program loans.

Income-Driven Repayment Plans: Affordability Based on Earnings

Income-Driven Repayment (IDR) plans are a popular solution for borrowers whose incomes do not allow for standard payments. These plans cap monthly payments at a percentage of discretionary income and offer loan forgiveness after 20 or 25 years of consistent payments.

Types of IDR Plans

Four main IDR plans exist: Revised Pay As You Earn (REPAYE): Payments are 10% of discretionary income; all federal loans qualify. Pay As You Earn (PAYE): Also 10% of discretionary income but limited to newer borrowers. Income-Based Repayment (IBR): Payments are 10-15%; eligibility and repayment period depend on loan disbursement date. Income-Contingent Repayment (ICR): Payments are the lesser of 20% of discretionary income or a fixed amount.

Practical Example

Linda, a teacher earning $35,000 annually with $40,000 in loans, enrolled in an IBR plan. Her payments are capped at roughly $150 monthly instead of the $450 standard payment, letting her manage expenses while still steadily reducing her debt.

Benefits and Considerations

IDR plans provide financial relief, but they may increase the total amount paid due to extended terms. Moreover, forgiven amounts may be taxable as income, depending on current tax law (IRS Publication 970).

| Plan | Payment As % of Discretionary Income | Term Length for Forgiveness | Eligible Loans |

|---|---|---|---|

| REPAYE | 10% | 20-25 years | All federal loans |

| PAYE | 10% | 20 years | Newer borrowers |

| IBR | 10-15% | 20-25 years | Various criteria |

| ICR | 20% or fixed payment | 25 years | Direct Loan or consolidation loan |

Public Service Loan Forgiveness: Serving the Community Pays Off

Public Service Loan Forgiveness (PSLF) provides a path for borrowers employed in qualifying public service roles to have remaining federal loan balances forgiven after 10 years of payments.

Eligibility and Practicalities

To qualify, borrowers must: Work full-time for a government or qualifying nonprofit organization. Make 120 qualifying payments under an eligible repayment plan (including all IDR plans and Standard). Have Direct Loans only; FFEL and Perkins Loans must be consolidated.

A case highlighting PSLF success is that of Daniel, a nurse practitioner who worked for a nonprofit hospital. After 10 years of steady payments under an IDR plan, his remaining $25,000 loan balance was forgiven. This program has grown steadily; as of 2023, over 90,000 borrowers have received forgiveness through PSLF (Department of Education).

Considerations

Borrowers must keep detailed records of payments and employment certification annually. Recent reforms have expanded eligibility and improved the program’s accessibility.

Private Student Loans: Limited Options and Higher Risks

Unlike federal loans, private student loans rarely offer income-driven or forgiveness-based repayment plans. Borrowers are often bound by the terms set by private lenders, including the repayment schedule, interest rates, and consequences for default.

Options Available

Some private lenders offer: Fixed or variable interest rates. Shorter repayment terms (5-15 years). Occasional hardship deferments or forbearance options.

However, borrowers like Emily, who relied on private loans for graduate school, found their options restrictive when facing unemployment, resulting in ballooning debt and credit issues.

Best Practices for Private Loans

Borrowers should thoroughly review loan terms before borrowing, consider refinancing options, and prioritize repayment to avoid default.

Future Perspectives: Evolving Policies and Emerging Trends

Student loan repayment landscapes are continuously changing, influenced by economic conditions, legislative reforms, and public policy debates. Recent discussions at the federal level have emphasized further loan forgiveness and expanded repayment support, reflecting widespread concern over the $1.75 trillion student debt burden.

Technological Improvements

Digital platforms now provide enhanced tools for loan management, personalized repayment calculators, and streamlined application processes for income-driven and forgiveness programs. These technological advances make it easier for borrowers to stay informed and compliant.

Legislative Prospects

Prospective changes include: Expanding eligibility for forgiveness programs. Enhancing protections for borrowers in default. Simplifying repayment plans into fewer, more transparent options.

For example, a bipartisan proposal in 2024 aims to consolidate IDR plans into a single plan with predictable payments, easing navigation confusion for borrowers.

Economic Impact and Social Equity

Addressing student loan debt has wider implications for economic growth and social mobility. Easier repayment pathways can unlock home ownership, entrepreneurship, and financial security for millions, contributing positively to the economy.

Paying off student loans is a multifaceted challenge influenced by loan types, income, employment, and personal finances. By understanding the available repayment options—from standard and graduated payments to income-driven plans and forgiveness programs—borrowers can select strategies that minimize financial stress and optimize long-term outcomes. As policies evolve and tools improve, staying informed will empower borrowers to achieve financial freedom and invest confidently in their futures.

Deixe um comentário