In today’s financial landscape, managing multiple debts can quickly become overwhelming. From credit card balances to personal loans and medical bills, the burden of juggling various payments often leads consumers to seek solutions that simplify repayment and reduce financial stress. One popular strategy is debt consolidation, which combines several debts into a single loan or payment. While this approach might seem like a quick fix, it is essential to understand its advantages and potential pitfalls before making crucial financial decisions.

Debt consolidation has gained prominence in recent years due to rising consumer debt levels. According to the Federal Reserve’s report in 2023, Americans collectively hold over $16 trillion in debt, with credit card balances alone surpassing $1 trillion. Any measure that helps individuals regain control over their finances deserves thoughtful consideration. This article explores the pros and cons of debt consolidation with practical examples, data-driven insights, and clear comparisons to help you make informed choices.

What is Debt Consolidation?

Debt consolidation refers to the process of combining multiple debts into one single loan or payment plan. This is usually done through debt consolidation loans, balance transfer credit cards, or debt management programs. The goal is to reduce interest rates, simplify monthly bills, and potentially shorten the repayment timeline.

For instance, someone with three credit card debts, each with different interest rates ranging from 15% to 25%, may take out a consolidation loan with a fixed interest rate of 10%. By doing so, the debtor pays a single monthly installment rather than multiple payments, streamlining budgeting and reducing stress.

Debt consolidation can be either secured or unsecured. Secured loans require collateral such as a home or car, while unsecured loans rely solely on creditworthiness. Each option has specific implications for risk and cost, which borrowers must evaluate carefully before proceeding.

Advantages of Debt Consolidation

Lower Interest Rates and Save Money

The primary advantage of debt consolidation is the opportunity to obtain lower interest rates, potentially reducing the total amount paid over the life of the debt. High-interest credit cards and payday loans can sometimes exceed 20% APR, which makes debt repayment expensive and sluggish. Consolidation loans or balance transfers with promotional rates as low as 0-5% APR for an introductory period can significantly alleviate this burden.

For example, a 2022 study by the National Foundation for Credit Counseling found that consumers who consolidated their debt saved an average of 15% on interest payments. Lowering the interest rate accelerates debt payoff and prevents debt from snowballing out of control.

Simplified Financial Management and Improved Credit Score

Managing multiple debts often leads to missed or late payments, which damage one’s credit score. Consolidation reduces the number of payments, making it easier to stay on track. Consistent, on-time payments positively influence credit scores over time.

Consider the case of Amanda, a consumer with four credit cards with varying due dates and minimum payments. After consolidating her balances into one installment loan, she streamlined her payment process and improved her credit score from 630 to 700 in 12 months, enabling her to qualify for better loan terms.

Potential Access to Additional Credit or Financial Flexibility

Consolidation can free up credit limits on previous cards, offering more financial flexibility. Additionally, some consolidation loans allow for debt restructuring or extend the repayment period, which can temporarily ease cash flow challenges.

Overall, debt consolidation can be a powerful tool for financial recovery when used responsibly, fostering better money management habits and reducing the psychological burden of multiple debts.

Drawbacks of Debt Consolidation

Possibility of Higher Total Costs

While debt consolidation can lower monthly payments, extending loan terms may increase the total interest paid over time. For example, consolidating $10,000 of credit card debt at 20% APR into a five-year loan at 12% APR will reduce monthly payments but may result in paying more interest overall depending on the repayment speed.

A real-life scenario from a 2023 consumer finance survey showed 28% of consolidation borrowers regretted the decision because the longer terms undermined the anticipated savings. Therefore, borrowers need to evaluate not just monthly affordability but total cost.

Risk of Secured Loan and Asset Loss

Using collateral for a consolidation loan introduces risk. If payments are missed, personal assets such as homes or cars could be repossessed. Many consumers fail to distinguish between unsecured consolidation loans and home equity loans, the latter being secured debt with higher stakes.

For example, John, a small business owner, consolidated his credit card debt using a home equity line of credit (HELOC). After an unexpected business downturn, he struggled to keep up with payments and faced foreclosure threats. This example underlines the importance of understanding loan terms and risks involved with secured consolidation.

Potential for Renewed Debt Problems

One key risk is that consolidation does not inherently solve underlying spending or budgeting issues. Some consumers pay off credit cards through consolidation, only to resume accumulating new debt. This cycle worsens financial instability rather than alleviating it.

According to a 2023 credit bureau report, nearly 40% of debt consolidation customers fell back into delinquency or new debt within two years, indicating that consolidation is not a cure-all but a tool that must be combined with disciplined financial behavior.

Possible Impact on Credit Score

Applying for a new consolidation loan often results in a hard credit inquiry that may temporarily lower credit scores. Additionally, if consolidation involves closing old credit card accounts, the credit utilization ratio could worsen, impacting creditworthiness.

A comparative analysis between consolidation and other debt relief methods, like debt settlement or bankruptcy, shows that while consolidation generally has a moderate credit impact, the effects on credit need to be accounted for especially by those already on the cusp of low credit scores.

Different Methods of Debt Consolidation Compared

Choosing the right consolidation method depends on individual financial situations and goals. Below is a comparative table summarizing the main options.

| Debt Consolidation Method | Interest Rate Range | Secured/Unsecured | Typical Loan Term | Credit Impact | Ideal For |

|---|---|---|---|---|---|

| Personal Debt Consolidation Loan | 5% – 15%+ | Usually Unsecured | 2 – 7 years | Moderate | Good credit scores, no collateral risk |

| Balance Transfer Credit Card | 0% – 5% (introductory) | Unsecured | Usually up to 18 months | Moderate | Small to medium credit card debt |

| Home Equity Loan / HELOC | 4% – 8% | Secured | 5 – 30 years | Moderate to High | Homeowners with substantial equity |

| Debt Management Plan (DMP) | Varies (usually lower) | N/A | 3 – 5 years | Low to Moderate | Those struggling with budgeting, debt counseling |

| Debt Settlement | Varies (may reduce debt) | N/A | 1 – 3 years | High | Severely delinquent debt cannot pay fully |

Each method carries distinct advantages and drawbacks. For example, balance transfer credit cards offer low rates but require disciplined repayment within the promotional period. Home equity loans have lower interest but must be chosen cautiously to avoid foreclosure risks.

Real-World Examples of Successful and Problematic Debt Consolidations

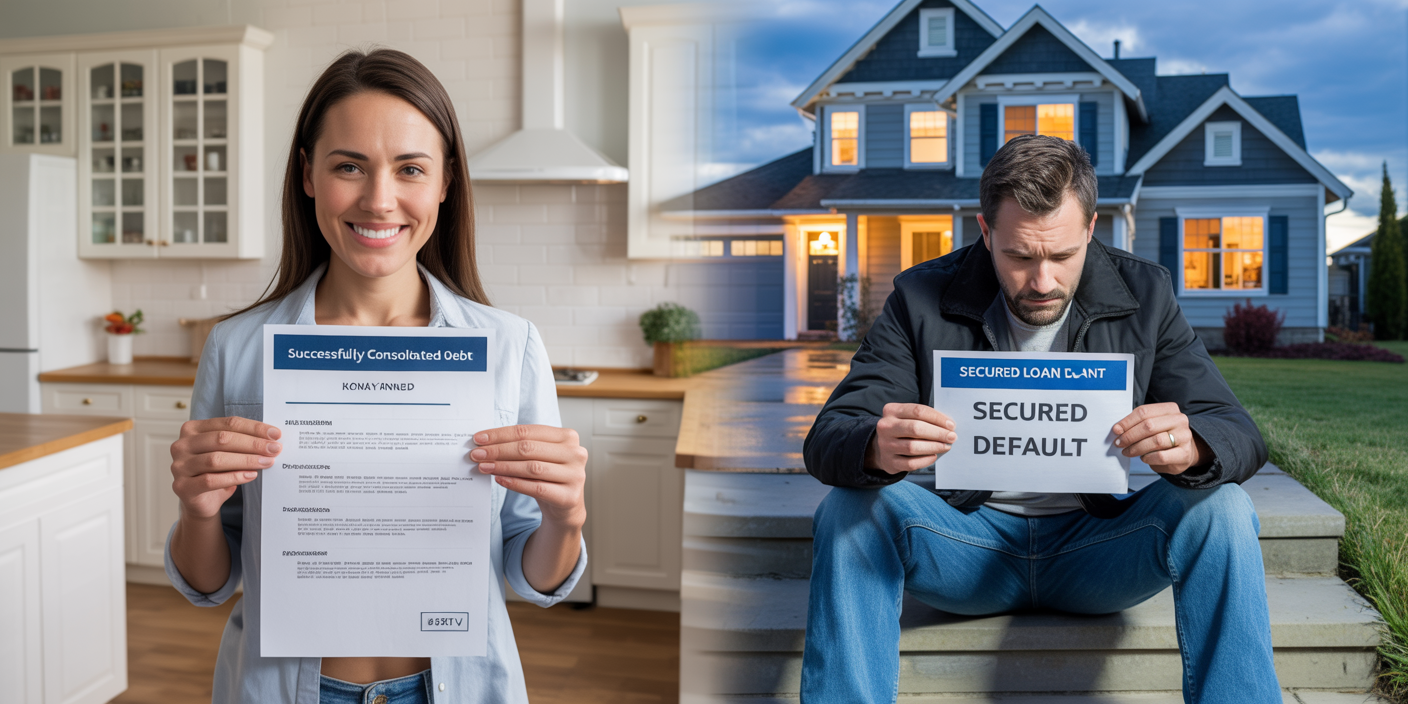

Consider Emma, a 34-year-old graphic designer who carried $15,000 in credit card debt at 22% APR. She took out a personal consolidation loan at 11% APR with a 5-year term. By focusing on timely payments and controlling new spending, she reduced her debt by over 60% within three years and raised her credit score significantly. Emma’s story illustrates how debt consolidation, when paired with responsible financial behavior, can lead to lasting improvement.

On the other hand, Michael, a 45-year-old contractor, consolidated $20,000 in credit card debt through a home equity loan. An unexpected medical emergency disrupted his payments, and he struggled to pay the secured loan on time. His house was put at risk, demonstrating the dangers of using collateral without a contingency plan.

Such examples highlight that the outcomes of debt consolidation largely depend on personal discipline, financial planning, and selecting the appropriate strategies for one’s circumstances.

Future Perspectives on Debt Consolidation

The debt consolidation market continues to evolve with technological innovations and changing consumer behavior. Online lending platforms offer faster approvals and better personalized terms, potentially lowering costs and increasing accessibility for more borrowers. According to a 2024 LendingTree report, digital loan originations for debt consolidation increased by 18% year over year, signaling rising demand for streamlined, tech-enabled financial services.

Furthermore, artificial intelligence and machine learning algorithms are being deployed to assess credit risk more accurately, offering borrowers customized consolidation offers and identifying optimal repayment plans based on individual spending patterns.

However, regulators are also paying closer attention to the debt consolidation industry, seeking to protect consumers from predatory lending practices and hidden fees. Transparency and education remain critical as consolidation becomes an increasingly common financial tool.

In the future, debt consolidation may be integrated with broader financial wellness programs, combining debt repayment with budgeting advice, savings incentives, and credit counseling. This holistic approach could improve long-term outcomes for consumers struggling with debt.

Innovative payment models, such as income-driven repayment plans or subscription-based debt management apps, might also redefine how consolidation is structured, focusing on affordability and sustainability.

Preparing for Debt Consolidation Success

To benefit optimally from debt consolidation, consumers should: Assess all outstanding debts’ terms, interest rates, and balances. Calculate total expected payments for consolidation loans, including fees. Confirm ability to make consistent payments under the new plan. Avoid new debt accumulation during and after consolidation. Seek professional credit counseling when needed.

Debt consolidation is neither a universal remedy nor a guaranteed path to financial freedom. It requires thoughtful evaluation, clear goals, and disciplined follow-through.

In summary, consolidating debt offers clear advantages such as simplified payments, reduced interest costs, and potential credit score improvements but also carries risks including extended repayment periods, secured loan dangers, and potential recurrence of debt problems. By understanding these dynamics, evaluating personal financial status, and selecting appropriate consolidation methods, consumers can use debt consolidation to regain control and lay foundations for financial stability in the years ahead.

Deixe um comentário