Entrepreneurs and side hustlers often face the challenge of turning their ideas into viable businesses. Whether you’re launching a tech startup, selling handmade crafts, or offering consulting services, a solid financial plan is crucial for success. Financial planning not only provides clarity about your business’s financial future but also helps you make informed decisions, allocate resources efficiently, and secure funding when needed. According to a 2022 report by the U.S. Small Business Administration, businesses with detailed financial planning are 30% more likely to survive beyond their first three years.

This article guides you through creating a comprehensive financial plan tailored for your side hustle or startup, covering the key components from budgeting and forecasting to funding options and financial risk management. Real-world examples and practical tips will enhance your understanding and prepare you for the financial challenges ahead.

Understanding the Role of Financial Planning in Business Success

Financial planning is more than balancing income and expenses; it’s a strategic process that aligns your business goals with financial reality. Many aspiring entrepreneurs underestimate the importance of a formal financial strategy. For instance, a survey by SCORE revealed that 82% of small business owners felt that financial mismanagement was the primary reason their businesses failed.

A well-crafted financial plan lays the foundation for your business’s growth by establishing clear benchmarks and financial discipline. The plan typically includes revenue projections, expense estimates, cash flow analysis, and funding strategies. By defining these elements upfront, you can avoid cash shortages, make necessary adjustments early, and demonstrate to investors that your business is financially viable.

For businesses starting as side hustles, it is imperative to manage the financial transition strategically—gradually scaling expenses and investing profits wisely can prevent burnout and financial ruin. Consider the example of Ella, who started a custom jewelry business part-time. By drafting a simple cash flow forecast and setting monthly sales targets, she structured her operations to reinvest profits into marketing and inventory growth. Her plan eventually helped in securing a small loan from a local bank to expand her product line.

Crafting a Realistic Budget: The Starting Point of Financial Planning

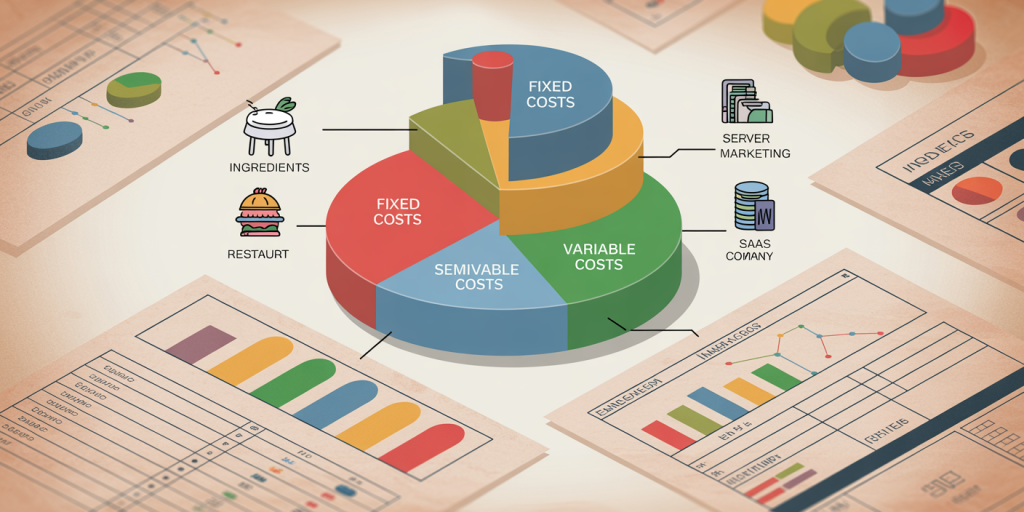

Budgeting is the backbone of any financial plan, especially for startups and side hustles operating with constrained resources. A practical budget outlines your anticipated income streams and balances them against fixed and variable expenses to avoid overspending. For example, the National Federation of Independent Business (NFIB) states that small businesses spend on average 20-30% of their revenue on operational expenses, making cost management critical.

Start by identifying all income sources and categorizing expenses into fixed (rent, subscriptions) and variable (raw materials, shipping). This separation aids in tracking where costs can be reduced during lean periods. For a tech startup, fixed costs might include software licenses and office rent, while variable costs include marketing campaigns and freelance developer fees.

A comparative example:

| Expense Type | Fixed Costs (Monthly) | Variable Costs (Estimated Monthly) |

|---|---|---|

| Rent | $1,200 | $0 |

| Software Licenses | $300 | $0 |

| Marketing | $0 | $500 |

| Raw Materials | $0 | $1,200 |

In this case, the monthly minimum expenses are $1,500 (fixed) plus $1,700 (variable), totaling $3,200. Understanding this helps the business owner set sales targets or funding goals to cover these costs plus desired profits.

Revenue Forecasting: Predicting Income Based on Market Realities

Revenue forecasting helps you set realistic sales goals and anticipate the cash inflows that sustain your business. This forecasting should be grounded in market research, competitor analysis, and realistic assumptions about customer acquisition.

Use the SMART framework to set sales objectives that are Specific, Measurable, Achievable, Relevant, and Time-bound. For example, if you run an online tutoring side hustle, you might forecast acquiring 10 new students per month paying $50 each for five sessions.

Using Ella’s jewelry business, she used market data indicating an average customer expenditure of $75 and projected a 10% monthly growth in sales volume. This forecasting enabled her to predict revenues increasing from $1,500 to over $3,000 within six months.

A forecasting table example might look like this:

| Month | Projected Sales Volume | Average Price per Sale | Projected Revenue |

|---|---|---|---|

| 1 | 20 | $75 | $1,500 |

| 2 | 22 | $75 | $1,650 |

| 3 | 24 | $75 | $1,800 |

| 4 | 26 | $75 | $1,950 |

| 5 | 28 | $75 | $2,100 |

| 6 | 30 | $75 | $2,250 |

Realistic revenue forecasts prevent overestimations that can lead to overspending and cash flow problems.

Funding Options: Balancing Borrowing, Equity, and Personal Investment

Securing adequate financing is often a major hurdle for startups and side hustles. According to a 2023 report by the Kauffman Foundation, nearly 40% of startups cite lack of capital as their main growth limitation. Understanding the pros and cons of various funding sources allows entrepreneurs to select the right mix for their needs.

Personal Investment: Many side hustles begin with founders investing their savings, which allows full control but limits growth potential. For example, an individual who starts freelance graphic design might only need a computer and software subscription, expenses easily covered personally.

Debt Financing: Loans from banks or credit unions can provide substantial capital. The downside is the obligation to repay regardless of profits and often requiring collateral. A real case is Mike who launched a food truck business with a $20,000 loan, balancing loan repayments with his cash flow carefully to avoid default.

Equity Financing: Seeking investment from angel investors or venture capitalists comes with trade-offs — the influx of funds can accelerate growth but results in dilution of ownership. Startups with high growth potential, like a SaaS company, often pursue this path.

| Funding Type | Advantages | Disadvantages | Suitable For |

|---|---|---|---|

| Personal Investment | Full control, simple | Limited funds, personal risk | Small side hustles |

| Debt Financing | Keeps ownership, large capital | Repayment pressure, collateral needed | Expanding startups |

| Equity Financing | Significant capital, strategic input | Dilution, potential loss of control | High-growth startups |

Choosing a funding strategy aligned with your business model and risk tolerance is critical.

Managing Cash Flow: Ensuring Liquidity in Every Business Stage

Cash flow management is often called the lifeblood of any business and requires constant attention. It ensures that you have enough cash on hand to meet day-to-day operational needs such as paying suppliers, staff, and rent.

A common mistake is focusing solely on profitability while ignoring cash flow. For example, a startup might have strong sales on paper but if customers delay payments, the business could face liquidity issues.

A practical approach involves creating a cash flow statement that tracks inflows and outflows monthly. Leveraging technology such as QuickBooks or Xero can automate this and flag potential shortfalls.

Case study: Sarah, who runs a digital marketing side hustle, allowed clients 60 days to pay. Without careful cash flow forecasting, she risked not paying her contractors on time. By introducing partial upfront payments and discounts for early settlement, she improved her monthly liquidity by 20%.

| Month | Cash Inflow | Cash Outflow | Net Cash Flow | Cumulative Cash Balance |

|---|---|---|---|---|

| 1 | $5,000 | $4,200 | $800 | $800 |

| 2 | $6,000 | $5,500 | $500 | $1,300 |

| 3 | $4,500 | $5,800 | -$1,300 | $0 |

Maintaining positive cash flow requires proactive measures such as managing payment terms, optimizing inventory, and controlling expenses.

Planning for Financial Risks and Uncertainties

Financial planning must include strategies to cope with risks such as unexpected expenses, market downturns, or supply chain disruptions. Startups that fail to plan for contingencies frequently face severe setbacks.

Building an emergency fund is a prudent step. Generally, setting aside three to six months’ worth of operating expenses can provide a buffer during tough times. For side hustles, this might mean saving $3,000 to $5,000 depending on monthly costs.

Insurance is another safeguard. Business liability, property, or professional indemnity insurance can mitigate risks that otherwise could lead to crippling losses.

A noteworthy example is how the COVID-19 pandemic impacted various startups. According to a McKinsey study, businesses with robust financial plans and emergency reserves were more adept at pivoting their models and surviving the crisis.

Future Perspectives: Adapting Your Financial Plan for Growth and Change

A financial plan is not a static document; it should evolve alongside your business. As your side hustle or startup grows, revisit and adjust your budget, forecasts, and funding strategies to reflect new realities.

Emerging technologies, shifting consumer preferences, and economic changes necessitate agility. For example, incorporating tools like automated financial dashboards can provide real-time insights, helping you make data-driven decisions and reduce manual errors.

Moreover, as businesses scale, they often require more sophisticated financial management, including tax planning, payroll systems, and investment in financial advisory services. Planning for scalability ensures that growth is sustainable.

Forecasting beyond one year, investors and banks typically expect a three- to five-year financial outlook, including profitability milestones and expansion plans. Preparing these projections strengthens your negotiating position and business credibility.

In the near future, integrating ESG (Environmental, Social, and Governance) factors into financial planning will become increasingly important as investors and customers prioritize sustainable business practices. Therefore, aligning your financial plan with long-term sustainability goals can open doors to new funding opportunities and markets.

Creating a robust financial plan for your side hustle or startup empowers you to navigate uncertainties, optimize resource allocation, and attract funding. By budgeting realistically, forecasting revenues accurately, managing cash flow diligently, and preparing for risks, your business stands a stronger chance to thrive. Keeping your financial plan dynamic and responsive to change will ensure your venture remains resilient and positioned for growth.