In the early stages of adulthood, navigating financial responsibilities can be both exciting and overwhelming. For young adults, safeguarding assets and future stability is crucial, yet many underestimate the importance of having the right insurance coverage. With changing lifestyles, emerging financial goals, and evolving risks, insurance serves as a critical safety net to protect against unexpected events and expenses. Selecting appropriate insurance policies helps young adults avoid potential financial setbacks and build a secure foundation for their future.

Recent studies reveal that over 40% of young adults aged 18-34 face unexpected medical bills that could have been mitigated through proper insurance coverage (KFF, 2023). Additionally, with increasing costs related to health care, property, and even digital security, securing the right types of insurance becomes an essential part of responsible financial planning. This article explores the best insurance options tailored for young adults, supported with practical examples, comparative analysis, and forward-looking insights.

Health Insurance: Protecting Against Medical Expenses

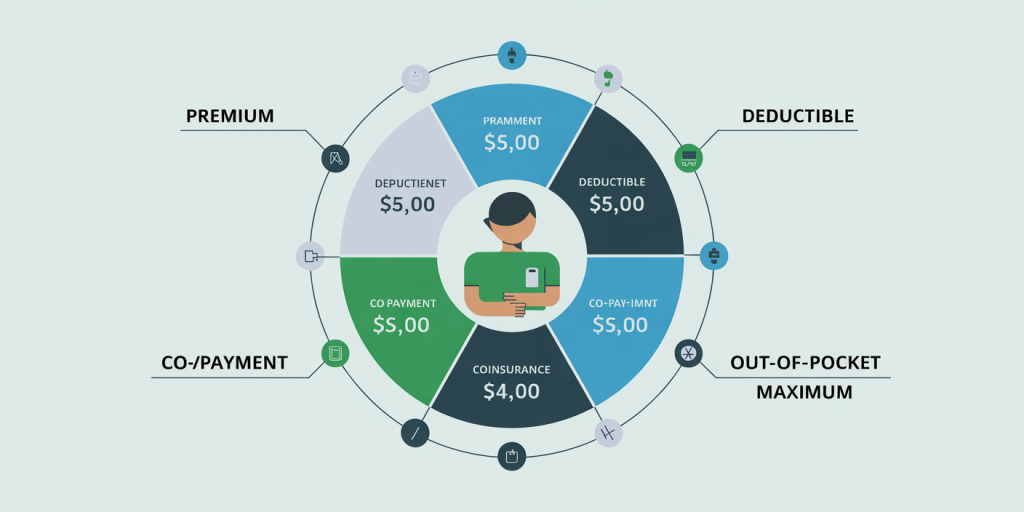

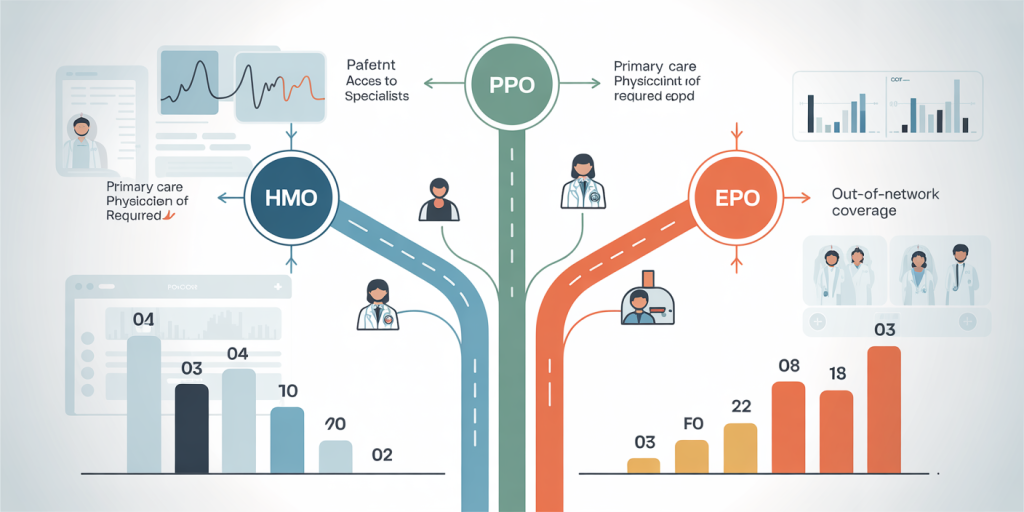

Health insurance is arguably the most vital type of coverage for young adults. Medical emergencies, chronic health issues, or routine checkups can result in significant out-of-pocket costs if uninsured. The Affordable Care Act (ACA) provisions allow young adults to remain on their parents’ plan until age 26, providing some relief. However, after this period, finding individual or employer-based plans becomes imperative.

A practical example involves Emma, a 24-year-old freelance graphic designer, who initially delayed getting health insurance due to cost concerns. After an unexpected appendicitis surgery, she faced medical bills exceeding $15,000. This scenario underscores the essential nature of health insurance coverage, which could have reduced her financial burden to manageable copayments and deductibles.

It’s important to compare various health insurance plans based on coverage, premiums, deductibles, and network of providers. Employer-sponsored health insurance is often the most cost-effective due to shared premiums. However, if unavailable, marketplaces like Healthcare.gov provide subsidies to eligible individuals, reducing premium costs.

| Insurance Feature | Employer-Sponsored Plan | ACA Marketplace Plan | Catastrophic Health Plan |

|---|---|---|---|

| Average Monthly Premium | $150-$400 | $200-$450 (post-subsidy) | $100-$200 |

| Deductible | $500-$1,500 | $1,400-$3,000 | $8,000+ |

| Out-of-pocket Maximum | $3,000-$6,000 | $4,000-$7,000 | High |

| Suitable for | Full coverage with regular visits | Moderate coverage with subsidies | Young healthy adults seeking emergency coverage |

By evaluating these features carefully, young adults can find a plan matching their budget and health needs, thus avoiding financial distress resulting from medical emergencies.

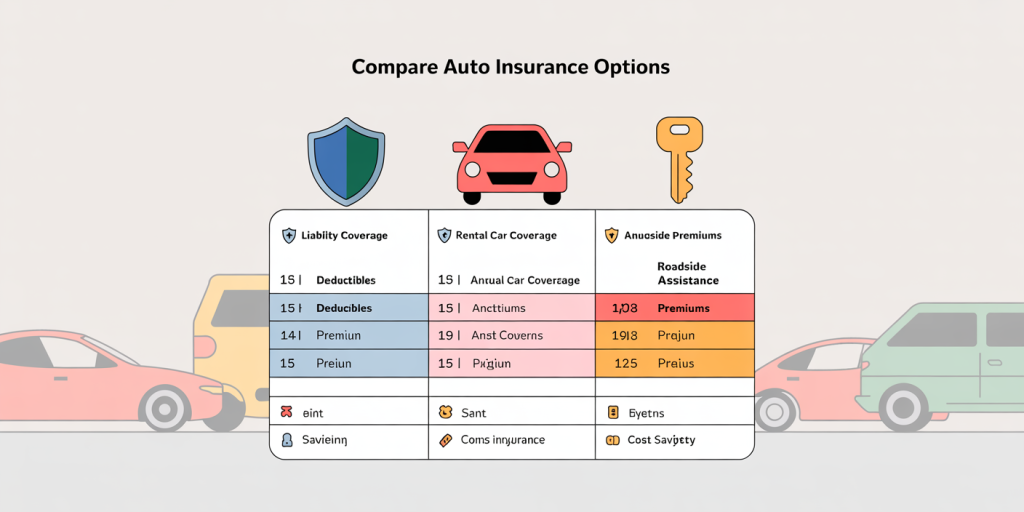

Auto Insurance: Minimizing Risk on the Road

Car ownership remains prevalent among young adults transitioning to independence, making auto insurance an indispensable policy. According to the Insurance Information Institute (2023), drivers aged 18-24 account for 13% of all auto accidents, despite representing only about 8% of licensed drivers. This statistic exemplifies the elevated risk for young drivers and the necessity for comprehensive auto insurance.

Auto insurance helps cover damages from collisions, theft, or liability arising from accidents caused by the insured party. Take Michael, a 22-year-old college student who recently purchased a used car. By opting for state-minimum coverage, he saved on premiums but faced out-of-pocket expenses exceeding $7,000 after a minor collision with another vehicle. Subsequently, Michael upgraded his policy to include collision and comprehensive coverage, ensuring better protection against unpredictable incidents.

Key coverage types for young adult drivers include liability, collision, comprehensive, uninsured motorist, and medical payments coverage. The cost varies greatly depending on driving history, vehicle type, location, and coverage limits.

| Coverage Type | What It Covers | Cost Impact | Recommended for |

|---|---|---|---|

| Liability | Damages to others’ property/body | Lower premiums | Mandatory, essential |

| Collision | Repairs to own car after collision | Moderate increase | Valuable for newer vehicles |

| Comprehensive | Theft, vandalism, natural disasters | Moderate increase | Protects against non-collision risks |

| Uninsured Motorist | Damages by uninsured drivers | Minor increase | Important for high-risk areas |

| Medical Payments | Medical expenses post-accident | Minor increase | Covers immediate medical costs |

Young adults should carefully balance coverage needs vs. premium costs, considering factors like vehicle value and individual driving tendencies.

Renters Insurance: Securing Personal Belongings

For young adults renting apartments or shared housing, renters insurance is often overlooked yet highly beneficial. According to the National Association of Insurance Commissioners (NAIC), only 41% of renters carry renters insurance, despite an average claim payout of $2,200 for property damage or theft. This gap leaves many vulnerable to cost-intensive losses.

Sarah, a 27-year-old marketing professional, learned the value of renters insurance after a fire damaged her apartment. Without insurance, replacing her laptop, furniture, and clothing would have severely impacted her financial stability. With renters insurance in place, she received a settlement that covered most losses and temporary living expenses.

Renters insurance covers personal property loss, liability protection (for injuries occurring in a rental property), and sometimes additional living expenses if the rental becomes uninhabitable. Premiums are generally affordable, averaging $15 to $30 monthly, depending on location and coverage limits.

| Insurance Aspect | Standard Renters Insurance | Without Insurance |

|---|---|---|

| Property Damage | Covered up to policy limits | Out-of-pocket expenses |

| Liability Protection | Coverage for accidents in home | Personal liability risk |

| Additional Living Expenses | Covered for displacement costs | Paid personally |

| Cost | $180 – $360 per year | $0 upfront, high risk |

For young adults accumulating possessions like electronics, furniture, and personal items, renters insurance is a low-cost safeguard against significant financial loss.

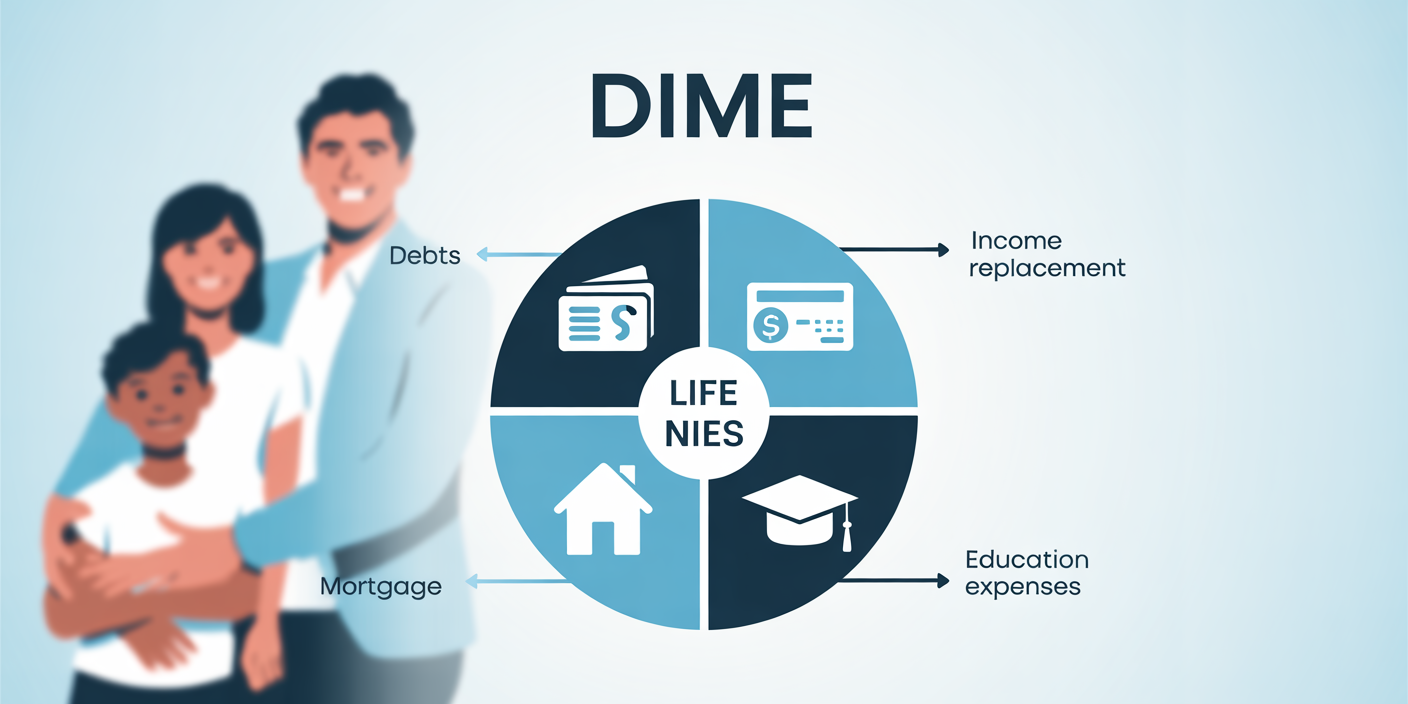

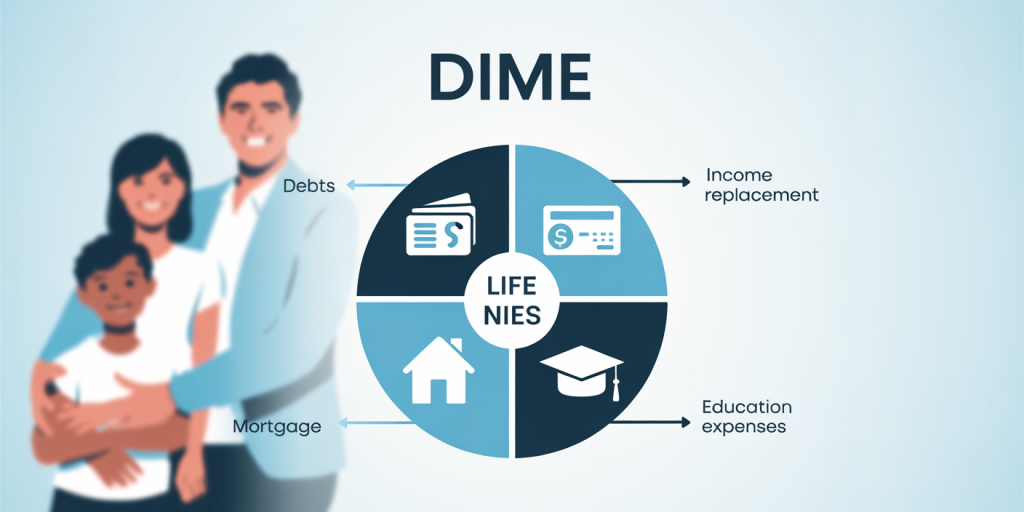

Life Insurance: Building Long-Term Financial Security

Though often associated with older adults, life insurance can be an important consideration for young adults, especially those with dependents, debts, or long-term financial goals. The younger and healthier an individual is, the lower the premiums tend to be, making it an opportune time to purchase coverage.

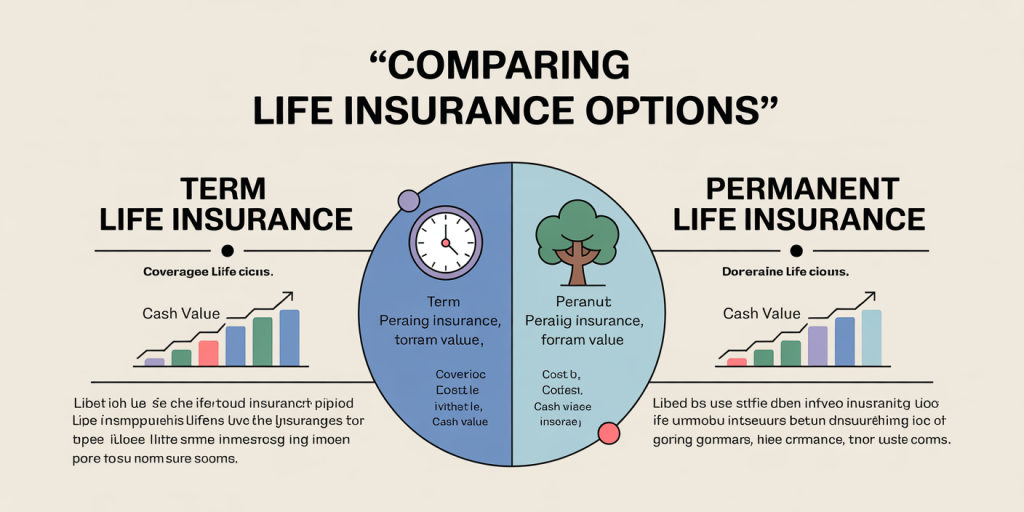

Consider James, a 29-year-old who recently got married and took out a mortgage. He bought a term life insurance policy to protect his spouse and future children from potential financial hardship in case of his untimely death. Term life insurance provides coverage for a fixed period (e.g., 10, 20, or 30 years) and is more affordable than whole life policies.

Statistics from LIMRA’s 2023 Life Insurance Consumer Survey indicate that only 54% of millennials own life insurance, even though many have financial responsibilities warranting coverage. For young adults, term life insurance costing as little as $15 to $30 monthly can protect loved ones and provide peace of mind.

| Life Insurance Type | Description | Monthly Cost (Estimated) | Best For |

|---|---|---|---|

| Term Life | Fixed-term, affordable coverage | $15 – $50 | Young adults with dependents or debts |

| Whole Life | Permanent coverage + cash value | $100+ | Those wanting lifelong coverage and savings component |

| Universal Life | Flexible premiums and death benefits | $75+ | Individuals seeking customizable policies |

Young adults should evaluate their financial obligations and future plans to determine if life insurance is a necessary investment at their stage, often prioritizing term life for cost-effectiveness.

Disability Insurance: Protecting Income Against Unexpected Health Changes

Disability insurance often flies under the radar for many young adults, but it is critical to protect income if illness or injury prevents working. The Social Security Administration reports that about one in four people aged 20-64 will experience a disability lasting at least 90 days during their working years.

Jessica, a 25-year-old software engineer, was diagnosed with a chronic condition that temporarily halted her work. Fortunately, her employer-provided disability insurance replaced 60% of her salary during this period, allowing her to cover living expenses without exhausting savings or incurring debt.

Disability insurance comes in short-term and long-term forms. Short-term disability typically covers 3-6 months of income replacement, while long-term disability can last several years or until retirement age, depending on policy terms.

| Disability Insurance Type | Coverage Duration | Benefit Amount | Suitable For |

|---|---|---|---|

| Short-term Disability | Up to 6 months | Usually 50-70% salary | Temporary injury or illness |

| Long-term Disability | Several years or until retirement | 40-60% salary | Severe or permanent disability |

For young adults, especially those with high student loan burdens or living expenses, disability insurance is a vital safeguard against lost income and resulting financial instability.

Future Perspectives: Adapting Insurance Choices to the Changing Landscape

The insurance needs of young adults will inevitably evolve with societal shifts, technology advancements, and changing work patterns. The rise of gig economy jobs, remote work, and digital asset ownership, for instance, will necessitate new types of insurance products and customized policies.

In the coming years, insurance providers are expected to integrate more technology-driven solutions such as usage-based auto insurance (via telematics) and cyber insurance tailored for individual digital risks. Moreover, increasing awareness about mental health might lead to more comprehensive health insurance policies addressing psychological well-being, an area historically underinsured.

Young adults should stay informed about emerging coverage options and proactively adjust their insurance portfolios accordingly. For example, digital nomads may require international health and travel insurance, while professionals working in the gig economy should explore hybrid disability and liability policies.

Additionally, climate change is prompting a rise in natural disaster claims, making renters and property insurance more crucial for young adults living in susceptible regions. Proactive risk mitigation and reassessment of coverage limits will be necessary to ensure adequate protection.

By approaching insurance as a dynamic component of their personal finance strategy, young adults can ensure resilience against current and future uncertainties, supporting their long-term financial well-being.

In summary, selecting the best types of insurance for young adults involves a comprehensive understanding of their unique risks and financial circumstances. Health, auto, renters, life, and disability insurance stand out as essential policies that provide a balanced safety net against medical expenses, property loss, income disruptions, and unexpected liabilities. Matched with thoughtful planning and regular policy reviews, these insurance solutions help young adults confidently navigate their financial journeys while preparing for the challenges and opportunities ahead.