When considering financial security, one question often arises: Do you really need life insurance? Life insurance policies are designed to provide financial protection for dependents after a policyholder’s death, but not everyone may require it. This article explores the importance of life insurance, helping you understand its role through practical examples, real cases, data, and expert analysis.

Life Insurance: Understanding Its Purpose and Value

Life insurance is a contract between an individual and an insurance company, where the insurer promises to pay a specified sum of money to beneficiaries upon the death of the insured person. This payment can be crucial to cover debts, ongoing expenses, or future financial goals. However, life insurance isn’t mandatory for everyone; its necessity depends on personal circumstances such as age, dependents, debts, and financial goals.

For example, a young single person with no dependents or significant debts might not find the benefits of life insurance compelling. Conversely, a parent with young children relying on their income would likely find life insurance essential for ensuring family security. According to LIMRA, about 54% of Americans have life insurance, yet roughly 40% of insured individuals are underinsured, indicating a disconnect between coverage and actual need.

When Life Insurance Is Essential: Key Scenarios

There are several life stages and situations where life insurance is particularly valuable. A common scenario involves families with dependents. If a primary earner passes away unexpectedly, life insurance can replace the lost income, allowing the family to maintain their standard of living while adjusting to the new situation. This helps cover mortgage payments, childcare, education costs, and daily expenses.

Consider the case of John and Sarah, a couple in their mid-30s with two young children. John is the primary earner. After John’s sudden death, Sarah uses the life insurance payout to cover mortgage payments and education expenses over several years. Without the policy, Sarah would have had to make difficult financial sacrifices, possibly selling their home or depleting savings. This example highlights how life insurance can be a critical safety net in such family dynamics.

In contrast, life insurance may also be necessary for individuals with significant debts, such as mortgages or business loans. When an individual dies without proper coverage, surviving family members or business partners could be burdened with these liabilities. For instance, a business owner with a partner could utilize a buy-sell agreement funded by a life insurance policy to ensure the business continues smoothly after their death.

Types of Life Insurance: Which One Suits Your Needs?

Life insurance mainly comes in two forms: term life insurance and permanent life insurance. Understanding these will help you decide which, if any, fits your financial goals.

Term Life Insurance: This type offers coverage for a specific period—typically 10, 20, or 30 years. It is generally less expensive and straightforward, making it popular for young families or individuals seeking affordable protection during peak earning or debt repayment years. For example, a 30-year-old parent might purchase a 20-year term policy to cover the years until their children are financially independent.

Permanent Life Insurance: This includes whole life and universal life insurance, which provide lifelong coverage and a savings or investment component. Premiums tend to be higher, but these policies can build cash value over time. They might appeal to wealthier individuals looking for estate planning benefits or lifelong financial security.

The table below compares the key features of term and permanent life insurance:

| Feature | Term Life Insurance | Permanent Life Insurance |

|---|---|---|

| Coverage Duration | Fixed period (10, 20, 30 years) | Lifelong coverage |

| Cost | Lower, affordable | Higher premiums |

| Cash Value Component | None | Yes, builds cash value |

| Ideal For | Temporary protection during working years | Long-term financial planning and estate |

| Flexibility | Less flexible | More flexible with premiums and benefits |

Understanding which policy type works best requires analyzing your current and projected financial needs.

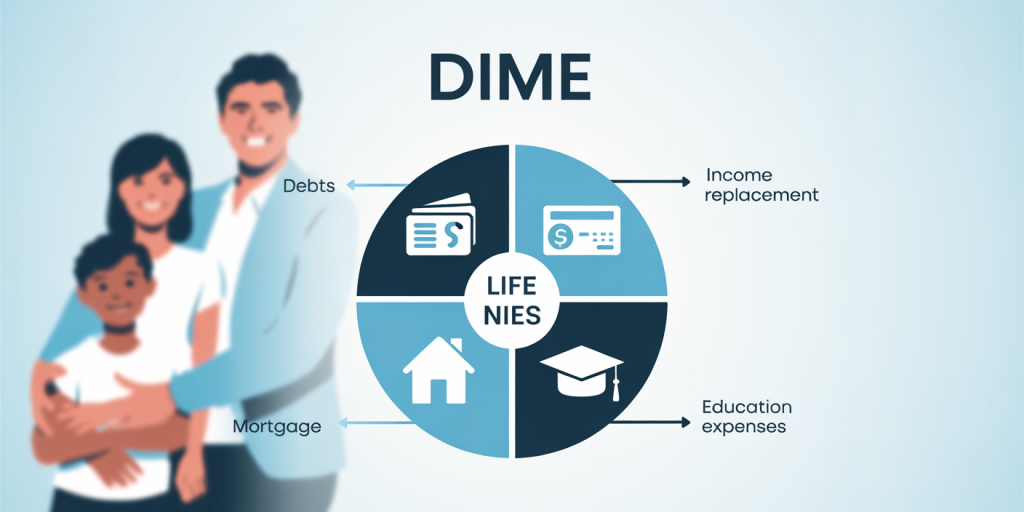

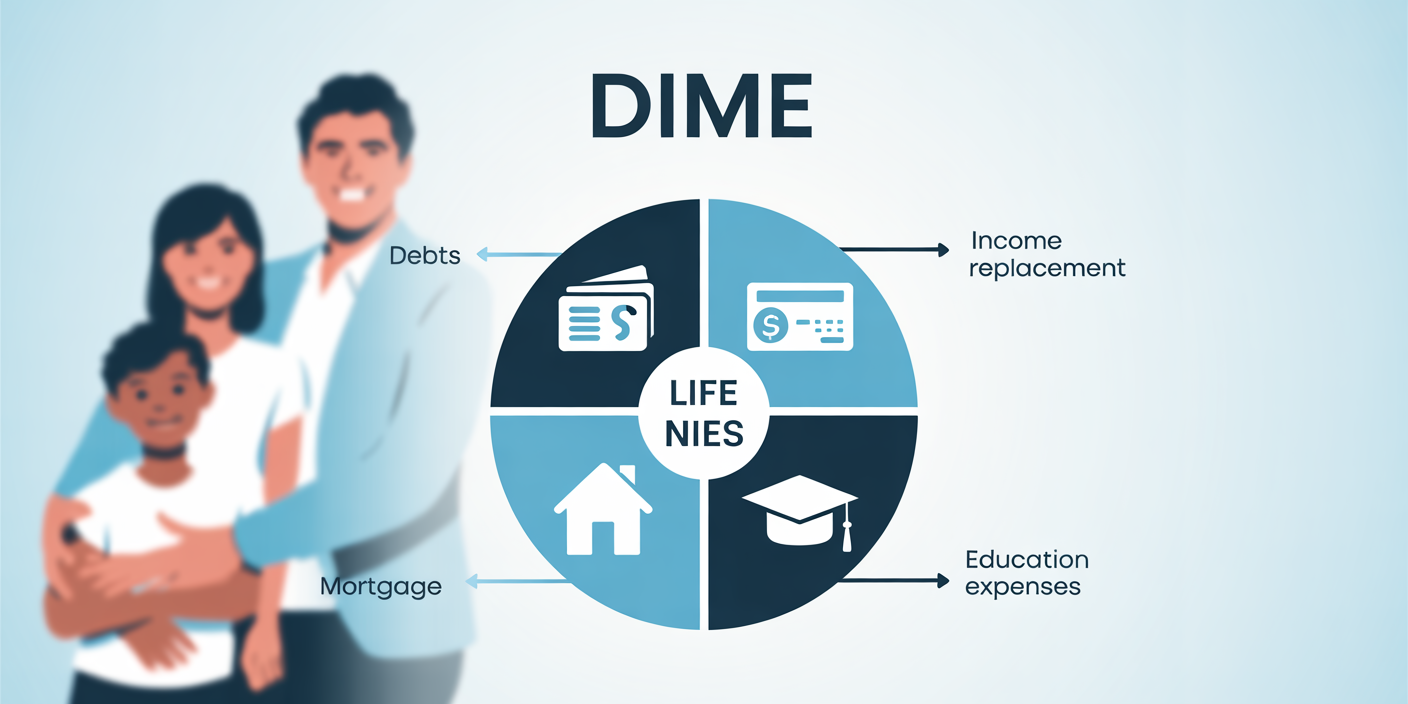

Calculating Your Life Insurance Needs: Practical Approaches

Determining the right amount of life insurance coverage is critical. Being underinsured or overinsured can both hamper financial stability. A common rule of thumb is to have coverage worth 5 to 10 times your annual income, but this is a simplistic approach. More precise methods consider debts, future expenses, income replacement, and existing savings.

A popular method used by financial advisors is the “DIME” formula: Debt: Total current debts such as mortgages, loans, and credit card balances. Income: Future income replacement, typically multiplied by the number of years until dependents become financially independent. Mortgage: Remaining balance on your home mortgage. Education: Future education costs for children or dependents.

For example, if you have $200,000 in debts, want to replace $50,000 in annual income for 10 years ($500,000), have a mortgage balance of $150,000, and foresee $100,000 in education expenses, your ideal coverage might be approximately $950,000.

Studies reinforce the importance of such calculations; a 2023 report by the National Association of Insurance Commissioners (NAIC) found that more than one-third of Americans either don’t have life insurance or have inadequate coverage, often due to unclear assessment of their real needs.

When Life Insurance Might Not Be Necessary

While life insurance can prove essential for many, there are instances when you might not need it. For example, individuals who have no dependents, adequate personal savings, or assets that can cover final expenses and debts might not benefit substantially from life insurance.

Retired individuals who have paid off their mortgage, have no dependents relying on their income, and possess sufficient retirement funds and investments typically fall into this category. Likewise, single people without anyone financially dependent on them may prioritize other financial goals like investments or retirement savings.

A practical case is Emma, a single professional in her late 40s with no children or spouse, no significant debts, and substantial savings. Emma chose not to purchase life insurance, instead allocating her finances toward growth investments and retirement accounts, which better matched her financial priorities.

Life Insurance and Estate Planning: A Strategic Tool

Beyond immediate income replacement, life insurance can be a valuable component of estate planning. It can help cover estate taxes, provide liquidity to pay off debts, and ensure that heirs receive intended inheritances without forced asset sales.

For example, high-net-worth individuals often use permanent life insurance as a vehicle to pass wealth tax-efficiently. The cash value accumulation within certain policies can also serve as a source of funds during the policyholder’s lifetime.

In one notable example, the late Apple co-founder Steve Jobs reportedly had a life insurance policy that helped his family meet estate tax obligations, preserving wealth intended for beneficiaries. While complex, this level of planning is increasingly relevant for individuals with sizable assets.

Emerging Trends and Future Perspectives in Life Insurance

The life insurance industry is evolving, influenced by changes in technology, demographics, and consumer preferences. Notably, digital platforms now offer simplified application processes and immediate underwriting decisions. According to a 2024 report by McKinsey, 45% of life insurance purchases now occur online, driven by Millennials and Gen Z buyers seeking convenience.

Additionally, insurers are increasingly incorporating wellness data from wearable devices to personalize premiums and promote healthier lifestyles. This data-driven approach could make life insurance more affordable and accessible in the future.

Another rising trend is the integration of life insurance within broader financial wellness packages offered by employers and fintech firms, expanding the traditional scope of coverage and benefits. As financial planning becomes more holistic, life insurance will likely continue to adapt by offering flexible and customizable solutions.

Finally, the growing awareness of mental health’s impact on longevity and well-being may lead to more personalized underwriting criteria that consider psychological as well as physical health indicators.

Final Thoughts on Life Insurance Necessity

Determining whether you really need life insurance requires a thorough look at your personal and financial situation. Key factors include your age, financial responsibilities, dependents, debts, and future goals. In many cases, especially where dependents rely on your income, life insurance provides a crucial safety net that can protect loved ones from financial hardship.

However, not everyone benefits equally from life insurance, particularly those without dependents or significant financial obligations. Advances in technology and shifting consumer needs continue to shape the life insurance landscape, making it easier to access tailored and affordable coverage than ever before.

By carefully assessing your situation, using practical tools such as the DIME formula, and seeking professional advice if necessary, you can make an informed decision on whether life insurance is right for you—and how much coverage you need to ensure financial security for yourself and your family.

Deixe um comentário