Real estate investing presents an exciting opportunity for beginners to build wealth and generate passive income. With property values generally appreciating over time and rental markets offering steady cash flow, entering this market can be a strategic financial move. However, for those new to real estate, understanding how to navigate the complexities of property investment is essential to minimize risks and maximize returns.

In recent years, real estate investing has attracted increased attention due to favorable mortgage rates and shifting demographic trends. According to the National Association of Realtors (NAR), existing-home sales increased by 8.5% in 2023, reflecting strong buyer interest and investor activity. For beginners, grasping the fundamental principles of real estate investment is the stepping stone toward financial success.

Understanding Different Types of Real Estate Investments

Real estate investment is not a monolith; it comprises various asset classes, each with distinct characteristics, risks, and rewards. The primary categories include residential properties, commercial real estate, and real estate investment trusts (REITs).

Residential properties are perhaps the most accessible option for beginners. These include single-family homes, condominiums, duplexes, and triplexes. Investors typically generate income through rental payments or capital appreciation. For example, renting out a three-bedroom house in a growing metropolitan area can provide steady monthly income while the property appreciates over time.

Commercial real estate involves office buildings, retail spaces, warehouses, and industrial properties. These properties generally require higher capital investment but offer longer lease terms and potentially higher returns. For instance, an office building leased to a reputable company can guarantee rental income for several years, reducing vacancy risks.

Finally, REITs offer an alternative for investors seeking exposure to real estate markets without direct property ownership. REITs are companies that own, operate, or finance income-producing real estate. Investors can buy shares of REITs through the stock market, allowing for liquidity and diversification similar to stocks or bonds.

Comparison Table: Types of Real Estate Investment

| Investment Type | Minimum Capital Required | Liquidity | Risk Level | Expected Returns | Management Responsibility |

|---|---|---|---|---|---|

| Residential Property | Low to Moderate | Low (illiquid) | Moderate | 6-12% annually | High |

| Commercial Property | High | Low | Moderate to High | 8-15% annually | Moderate |

| REITs | Low | High (tradable) | Low to Moderate | 4-10% annually | None |

Understanding these differences helps beginners select investments aligned with their financial goals, risk tolerance, and time commitment.

Assessing Your Financial Situation and Goals

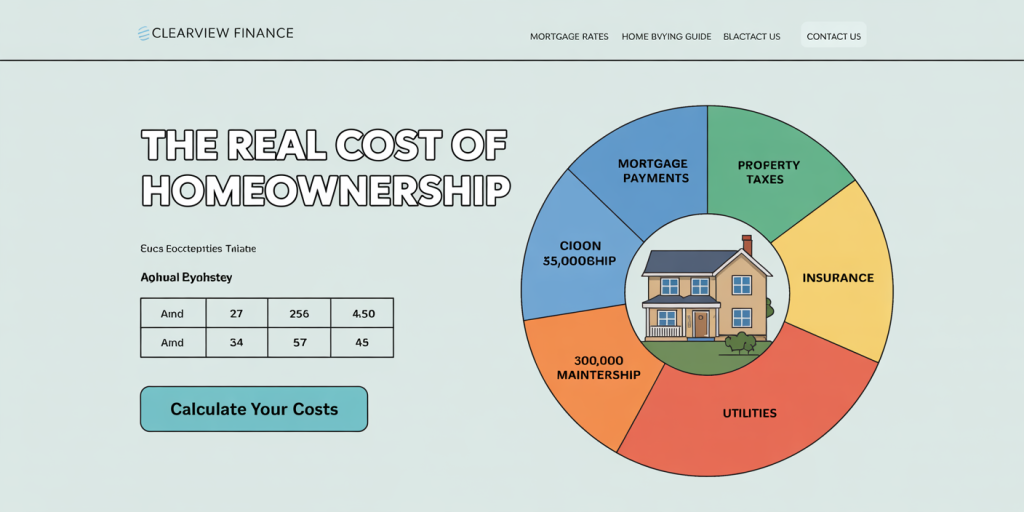

Before diving into real estate, beginners must assess their current financial health and define clear investment objectives. This preparation reduces the chances of overextending financially and ensures alignment between investments and personal aspirations.

Start by reviewing your income, expenses, debts, and available savings. A good rule of thumb in real estate investment is to avoid putting all your liquid assets into a single property. Maintain an emergency fund that covers at least six months of living expenses to buffer unexpected financial events.

Beyond finances, clarify your investment goals. Are you looking for steady monthly cash flow, long-term capital appreciation, or tax benefits? For example, if you plan to retire in 10 years, investing in rental properties with positive cash flow might be more suitable than flipping houses, which involves more active management.

Using tools like a personal financial statement or a budget planner can provide clarity. Additionally, meeting with a financial advisor experienced in real estate can help beginners understand tax implications, expected returns, and financing options.

Financing Your First Property: Options and Strategies

Securing proper financing is often the biggest hurdle for beginners. Several funding methods are available, each with benefits and drawbacks. Understanding these can empower investors to optimize their capital structure.

The traditional mortgage loan is the most common financing option. It requires a bank to approve your creditworthiness, income, and down payment ability. For residential investment properties, lenders often require a 20-25% down payment, which can be challenging for new investors. Interest rates vary based on credit scores and market conditions. For instance, the average mortgage rate for investment properties in 2024 hovers around 6.5%.

Alternatively, some investors use hard money loans — short-term, high-interest loans typically provided by private lenders. While easier to qualify for, these loans carry higher costs and are usually repaid quickly, commonly through property resale or refinancing.

Partnering with other investors is another strategy, allowing resource pooling. For example, a group of friends or family members might collectively purchase a rental property, sharing costs and profits proportionally.

Government-backed loan programs, such as FHA loans, can offer lower down payments but generally require the investor to live in the property as a primary residence for at least one year, limiting their use for rental investment.

Navigating Property Management and Tenant Relations

One of the key challenges in real estate investing involves managing properties and tenants effectively. For beginners, deciding whether to self-manage or hire a property management company is crucial.

Self-management allows investors to save on expenses and maintain full control but demands time and skills in marketing, repairs, and conflict resolution. For instance, a first-time landlord might spend hours screening tenants, handling maintenance calls, and ensuring legal compliance.

Hiring a property management company typically costs 8-12% of monthly rent but provides professional services such as tenant vetting, rent collection, property maintenance, and legal enforcement. This is especially beneficial for investors who own multiple properties or live far from their rental units.

Proper tenant screening reduces vacancy and eviction risks. Background checks, credit reports, and rental histories can help identify reliable renters. In recent cases, landlords who implemented rigorous screening, such as requiring proof of income at 3x the rent, reported 30% fewer late payments.

Landlords must also understand landlord-tenant laws in their jurisdiction regarding security deposits, eviction procedures, and habitability standards to avoid costly legal issues.

Evaluating Market Trends and Timing Your Investment

Market analysis is vital for successful real estate investing. Ignoring market cycles and relying solely on intuition can lead to suboptimal investments. Beginners should learn to read economic indicators, local market data, and demographic trends to make informed decisions.

Areas with robust job growth, population increases, and infrastructure development typically experience higher housing demand, pushing prices and rents upward. For example, tech hubs like Austin, Texas, have seen property values grow over 15% annually in recent years, driven by a surge in job creation.

Conversely, investing in markets with declining populations or economic stagnation may result in prolonged vacancies and depreciated values. Using online platforms like Zillow, Realtor.com, and local government statistics can help assess neighborhood trends.

Timing also matters. The 2008 housing market crash serves as a cautionary tale. Investors who bought properties at market peaks faced significant losses, whereas those who entered during downturns enjoyed substantial appreciation afterward. Monitoring mortgage interest rate trends, housing supply, and buyer demand can help pinpoint favorable entry points.

Example: Case Study of Market Timing

In 2011, John, a beginner investor in Detroit, purchased multiple single-family homes at distressed prices averaging $20,000 each. Despite the city’s financial troubles at the time, John anticipated future revitalization. Over 10 years, Detroit’s housing market improved, and John’s properties appreciated to approximately $70,000 each. This example demonstrates the power of patience and comprehensive market research.

Future Perspectives: Emerging Trends in Real Estate Investing

The landscape of real estate investing is continually evolving. For beginners, being aware of future trends can offer a competitive edge and identify novel opportunities.

Technology integration is reshaping how properties are bought, managed, and sold. Platforms employing artificial intelligence analyze market data to predict property values and rental demand. Furthermore, blockchain technology promises secure and transparent property transactions, potentially reducing costs and fraud.

Sustainability is another critical trend. Demand for green buildings and energy-efficient homes is increasing as environmental concerns grow. Investors who focus on eco-friendly properties may qualify for tax incentives and attract premium tenants.

Additionally, the rise of remote work is shifting housing demand from urban centers to suburban and rural areas, altering traditional market dynamics. For example, cities like Boise, Idaho have seen real estate appreciation due to increased remote worker migration.

Finally, fractional ownership and crowdfunding platforms allow investors with limited capital to participate in large-scale real estate projects, democratizing access to lucrative investments.

According to a 2024 report by Deloitte, the global real estate market is projected to grow at a CAGR of 6% over the next five years, driven by innovation and evolving consumer preferences. Beginners who stay informed and adaptable can capitalize on these shifts.

Real estate investing offers lucrative potential but requires a solid foundation of knowledge, careful planning, and ongoing market awareness. For beginners, understanding different property types, financing options, management strategies, and market trends is essential to making smart, informed decisions that build enduring wealth. As the market evolves, embracing technology and sustainability can further enhance investment success and resilience.