Planning for retirement is one of the most crucial financial decisions you will make in life. Determining how much to save can feel overwhelming due to the variety of factors involved: lifestyle expectations, inflation, healthcare costs, life expectancy, and potential income sources during retirement. This comprehensive guide explores these elements in depth, providing actionable advice and illustrative examples to help you understand how much to save for a secure and comfortable retirement.

Understanding the Retirement Savings Landscape

The amount you need to save for retirement depends heavily on your current expenses, desired lifestyle, and the anticipated length of retirement. According to the Employee Benefit Research Institute (EBRI), the median savings for people aged 55–64 is around $107,000, a figure often seen as insufficient when compared to average retirement expenses. This underscores the importance of a proactive savings strategy.

Retirement typically lasts 20 to 30 years or more, which means you must ensure that your savings will generate enough income to cover your basic and discretionary costs through a prolonged post-work life. Factors such as Social Security, pensions, and investment income all contribute, but personal savings generally form the core financial buffer.

Setting Realistic Retirement Savings Goals

A commonly cited rule of thumb is to aim for retiring with savings equal to 10 to 12 times your annual income by retirement age. For example, if you currently earn $60,000 a year, your retirement savings target would be between $600,000 and $720,000. However, this general guideline can be misleading if not adjusted for your particular situation.

To illustrate, Jessica, a 45-year-old marketing manager, earns $80,000 annually and aims to retire at 65. By this guideline, she should target between $800,000 and $960,000. But Jessica plans to downsize her home and reduce her living costs by 25% upon retirement. Adjusting for lifestyle changes, Jessica recalculates her target to approximately $600,000, reflecting her expected lower expenses.

Another approach utilizes the “25x rule,” which states you should aim to save 25 times your estimated annual retirement expenses. If you anticipate needing $40,000 per year in retirement, your target savings would be $1 million. This method focuses more on projected expenses rather than income replacement percentage.

How to Calculate Your Retirement Needs

Calculating an accurate retirement savings target involves multiple factors: your current spending, inflation, healthcare costs, and expected returns on investments. Starting with a baseline of current expenses, adjust for inflation and lifestyle shifts expected after retirement.

For example, consider Mark, whose current annual expenses total $50,000. Assuming inflation of 3% over the next 20 years until Mark reaches retirement, his expenses will rise to approximately $90,305 per year (calculated using compound interest formula). If Mark wants to maintain this lifestyle for 25 years in retirement, the total retirement funding required would be around $2.25 million without accounting for investment returns.

However, factoring in an average annual return of 5% on his investments during retirement, Mark’s actual savings requirement can significantly decrease since his funds will continue growing. Calculators or financial planners usually employ methods like the “4% safe withdrawal rule,” which suggests withdrawing no more than 4% of your retirement portfolio each year to minimize the risk of depletion.

Comparative Table: Sample Retirement Savings Estimates Based on Income and Target Replacement Ratio

| Annual Pre-Retirement Income | 70% Target Replacement | 80% Target Replacement | 90% Target Replacement |

|---|---|---|---|

| $40,000 | $700,000 | $800,000 | $900,000 |

| $60,000 | $1,050,000 | $1,200,000 | $1,350,000 |

| $80,000 | $1,400,000 | $1,600,000 | $1,800,000 |

| $100,000 | $1,750,000 | $2,000,000 | $2,250,000 |

*Assuming 25 years of retirement and a 4% withdrawal rate.*

This table provides a simplified benchmark for retirement savings based on income levels and the percentage of income one aims to replace during retirement. The “replacement ratio” is the fraction of pre-retirement income needed annually during retirement to cover expenses.

The Impact of Healthcare Costs on Retirement Savings

One often underestimated factor in retirement planning is healthcare expenses. According to Fidelity Investments, a typical retired couple aged 65 in 2023 would need approximately $315,000 to cover healthcare costs in retirement, including premiums, out-of-pocket expenses, and long-term care.

Healthcare costs tend to grow faster than general inflation. Medicare may cover some medical expenses, but many retirees face significant gaps in coverage, including dental, vision, and long-term care, which Medicare does not comprehensively cover.

Taking healthcare into account, retirees like Anna and Tom, who are projecting annual expenses of $50,000 excluding healthcare, should consider saving an additional 10–15% more to cover healthcare-related costs. For them, this translates into increasing their savings target from $1.25 million (based on the 25x rule) to closer to $1.5 million to mitigate unforeseen medical expenses.

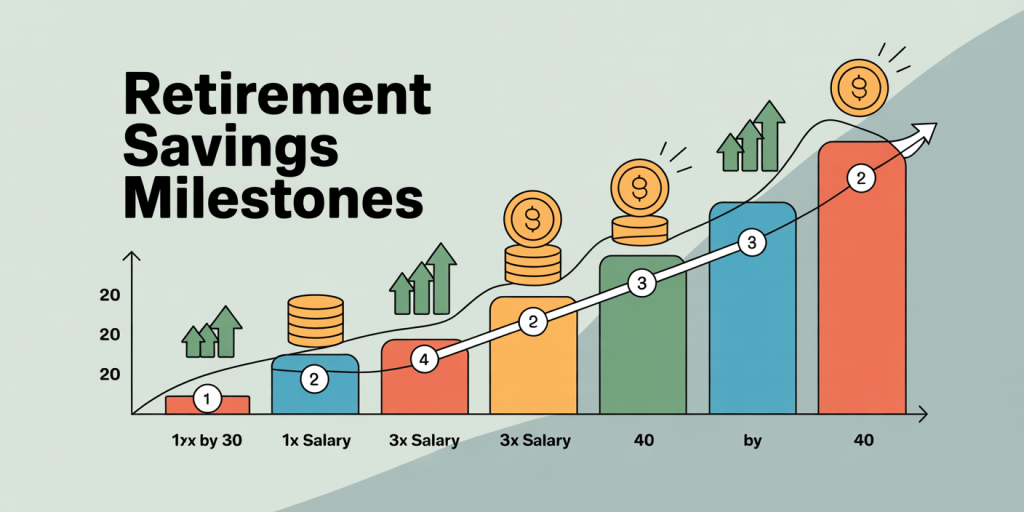

How Much Should You Save at Different Ages?

Retirement savings are most efficiently managed when started early. Below is a guide on savings benchmarks at key ages to stay on track for a comfortable retirement: By Age 30: Save an amount equal to 1x your annual salary. By Age 40: Save 3x your annual salary. By Age 50: Save 6x your annual salary. By Age 60: Save 8x your annual salary. By Age 67: Save 10x your annual salary.

For example, Carlos, age 40, earns $70,000 annually and should aim to have $210,000 saved. Falling short may require higher savings rates or delaying retirement.

If you are behind schedule, increasing your savings rate—even by a few percentage points—can have a significant impact due to compound interest. A 2019 report from the Center for Retirement Research highlights that individuals saving 15% of their income, starting in their 30s, are significantly better positioned than those who begin at 50, regardless of the amount saved.

Factors to Consider Beyond Savings Amounts

While setting savings targets is fundamental, there are additional elements to consider for a comprehensive retirement plan:

1. Investment Strategy: Allocating assets wisely between stocks, bonds, and safer instruments can affect growth and risk. A typical strategy is to reduce stock exposure gradually as you approach retirement.

2. Inflation and Market Volatility: Even a modest 3% annual inflation can erode purchasing power. Buffering your portfolio against downturns is critical.

3. Social Security and Pensions: These income sources reduce the amount you need to draw from savings. The Social Security Administration reports an average monthly benefit of $1,827 as of 2024.

4. Longevity and Lifestyle Changes: Increased life expectancy means savings may need to last 30 years or longer. Also, lifestyle changes — such as downsizing your home, relocating, or working part-time — can decrease your retirement expenses and savings needs.

Looking Ahead: The Future of Retirement Savings

The landscape of retirement savings is evolving due to demographic, economic, and technological changes. Rising life expectancies and changes to Social Security threaten to increase reliance on personal savings. According to the U.S. Census Bureau, by 2030 the number of Americans aged 65 and older will nearly double from 52 million in 2018 to 95 million, intensifying demands on retirement resources.

Financial tools and products are also advancing. Robo-advisors and AI-driven financial planning platforms provide more personalized saving and investment strategies to adapt to changing market conditions. Moreover, ESG (Environmental, Social, and Governance) investments are gaining popularity, allowing retirees to align investments with their values.

For younger generations, the gig economy creates a need for more self-directed retirement savings, due to less employer-sponsored plans. Solutions such as portable retirement accounts and incentives for consistent contributions might become prominent.

Ultimately, the key takeaway remains: the amount you save today will determine your financial independence tomorrow. Regularly reviewing and adjusting your retirement plan in response to changing circumstances can ensure you stay on track.

In summary, deciding how much to save for retirement requires a personalized and continually updated approach. Consider your expected lifestyle, inflation, healthcare costs, and available income sources. Use practical benchmarks and savings milestones to track your progress. By combining prudent financial planning with disciplined saving habits, you can create a robust safety net and enjoy your retirement years with confidence.

Deixe um comentário