Purchasing a home is one of the most significant financial decisions many individuals and families will ever make. However, determining how much house you can truly afford goes well beyond simply looking at the listing price or what your lender pre-approves. This process involves a comprehensive understanding of your income, expenses, debt obligations, and lifestyle needs. In this article, we’ll break down the practical realities of home affordability, supported by data, practical examples, and key considerations to help you make a well-informed decision.

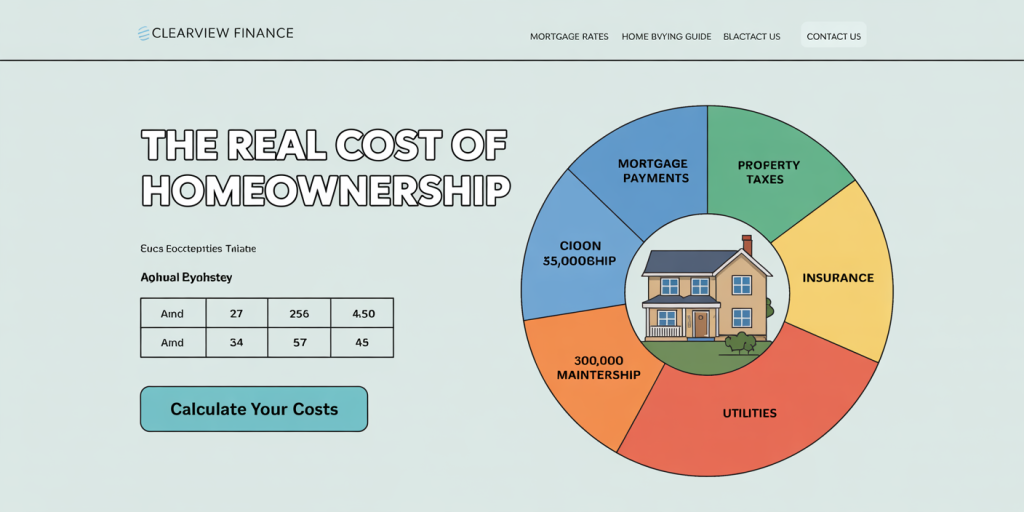

Understanding the True Cost of Homeownership

When most potential buyers ask, “How much house can I afford?” they often focus primarily on the mortgage payment. While this is a critical component, it’s just the tip of the iceberg. Owning a home includes additional expenses such as property taxes, homeowners insurance, maintenance costs, homeowners association (HOA) fees, and utilities.

For example, a homebuyer purchasing a $300,000 house with a 20% down payment ($60,000) might have a mortgage of $240,000. Assuming a 30-year fixed mortgage at a 6.5% interest rate, the monthly principal and interest payment would be approximately $1,518. But property taxes could add up to $300-$400 monthly, insurance another $100, and maintenance costs might average 1% of the home price annually (about $250 per month).

This means the actual housing cost could be around $2,200 per month, a 45% increase from the mortgage figure alone.

Many financial experts recommend that total monthly housing costs should not exceed 28-30% of your gross monthly income. This guideline helps ensure that homeowners can comfortably manage payments without sacrificing other financial priorities.

Evaluating Your Income and Debt-to-Income Ratio (DTI)

One of the primary metrics lenders use to evaluate home affordability is the debt-to-income ratio or DTI. Your DTI calculates the percentage of your monthly gross income that goes towards debt payments. A lower DTI generally means you have more capacity to take on a mortgage, although most lenders set maximum limits to ensure borrower financial health.

The two common types of DTI ratios are: Front-end ratio: Percentage of income devoted to housing costs Back-end ratio: Percentage of income spent on all debt, including housing, credit cards, loans, etc.

For instance, with a monthly gross income of $6,000, adhering to the 28% front-end ratio means your housing expenses should not exceed $1,680. If your existing debts consume $1,200 monthly, and the lender’s maximum back-end limit is 43%, your total allowable debt payments would be $2,580. Subtracting your current debts leaves $1,380 for housing, which is lower than the front-end suggestion, possibly lowering the house price you can afford.

Case Study: Jane’s Home Purchase Plan

Jane earns $5,500 a month before taxes and pays $500 in student loans and $400 in car payments. Using the 43% back-end guideline, her total monthly debt payments can be about $2,365. After subtracting $900 in current debts, she has $1,465 left for a mortgage, property tax, and insurance. This means Jane might need to look at homes where monthly costs stay within this figure, ensuring she doesn’t overextend.

The Importance of Down Payments and Mortgage Types

The size of your down payment dramatically affects your affordability by reducing the mortgage principal and doesn’t just impact your monthly payments but also your ability to qualify for various loan products.

Traditional mortgages typically require a 20% down payment to avoid private mortgage insurance (PMI), which adds extra cost. However, many borrowers opt for lower down payments with FHA loans (as low as 3.5%) or conventional loans with PMI.

Lower down payments can help first-time buyers enter the market sooner but will increase monthly payments and total loan costs over time. Conversely, making a larger down payment can save thousands in interest and insurance fees.

Table 1: Down Payment Impact on Mortgage Cost for a $300,000 Home

| Down Payment | Loan Amount | Estimated Monthly Payment (P&I at 6.5% APR)* | PMI Cost (if applicable) | Total Monthly Housing Cost Approx. |

|---|---|---|---|---|

| 3.5% ($10,500) | $289,500 | $1,830 | $150 | $2,200+ |

| 10% ($30,000) | $270,000 | $1,707 | $100 | $2,100+ |

| 20% ($60,000) | $240,000 | $1,518 | $0 | $1,860+ |

*Note: Estimates exclude taxes, insurance, and HOA fees.

Hidden and Recurring Expenses to Account For

Many buyers overlook the ongoing costs that come with homeownership. These expenses can include emergency repairs, appliance replacements, landscaping, and energy costs. According to the National Association of Realtors (NAR), homeowners spend on average 1-3% of their home’s value annually on maintenance.

For example, on a $300,000 house, an annual $3,000 to $9,000 allocation for upkeep should be budgeted, translating into $250 to $750 monthly set aside for repairs.

Another consideration is property tax rate fluctuations. While the average U.S. property tax rate is about 1.1% of assessed home value, rates vary widely by state. For instance, in New Jersey, rates average 2.4%, whereas in Alabama, they can be as low as 0.4%. This variation can dramatically impact affordability.

Energy costs also depend on home size and efficiency. Larger or older homes tend to require more heating, cooling, and upkeep expenses.

Lifestyle and Future Financial Goals Matter

Affordability is not just a calculation but a reflection of your personal lifestyle choices and future goals. For example, opting for a home that stretches your budget to the maximum might mean sacrificing travel, retirement savings, or emergency funds.

Consider the case of Mark and Lisa, a dual-income couple who recently purchased a $350,000 home. With a combined monthly income of $8,000, they initially targeted the “max affordability” range based on lender pre-approval. However, after assessing their monthly budget, they opted for a $280,000 home instead. This allowed them to maintain contributions to their retirement accounts and save for college tuition without financial strain.

Balancing current comfort with long-term goals is essential for sustainable homeownership.

Tools and Strategies to Assess Home Affordability

Several tools can help buyers calculate affordability accurately. Online mortgage calculators, such as those from Zillow, Bankrate, or NerdWallet, take into account income, debts, down payment, loan term, and interest rates to estimate monthly payments.

Another useful strategy is to get pre-qualified and pre-approved by lenders. A pre-qualification provides a rough estimate of borrowing capacity, while pre-approval involves submitting financial documents for a more precise loan figure.

Additionally, consulting a financial advisor or mortgage broker can yield personalized insights, especially for buyers with irregular income sources or complex financial situations.

Looking Ahead: The Future of Housing Affordability

The housing market is continually evolving, affected by interest rates, employment trends, urbanization, and government policies. Given recent Fed rate hikes, mortgage rates have increased significantly from historic lows seen during the COVID-19 pandemic — moving past 6% for a 30-year fixed loan in mid-2024. Higher interest rates reduce borrowing power, meaning buyers can afford less home for the same monthly payment.

At the same time, remote work trends are shifting demand toward suburban and rural areas, where home prices tend to be lower. This may create more affordability options for buyers willing to look outside metropolitan cores.

Moreover, first-time homebuyer programs and down payment assistance initiatives continue to emerge nationwide, improving accessibility. Examples include the FHFA’s First-Time Homebuyer Pilot and local grants aimed at closing down payment gaps.

Families aspiring to buy a home in the future should monitor market conditions, continue saving for larger down payments, and aim to reduce debts to maximize affordability.

Buying a home involves much more than sticker price numbers. Realistically assessing your financial picture, understanding all associated costs, and factoring in lifestyle needs are essential steps in determining how much house you can truly afford. Using data, practical examples, and forward-looking considerations, prospective buyers can make sound decisions that build long-term stability and satisfaction in homeownership.

Deixe um comentário