Managing debt can be a daunting challenge for many individuals and families today. According to recent data from the Federal Reserve, total household debt in the United States hit $16.6 trillion in 2023, illustrating the widespread nature of this financial hurdle. While various repayment strategies exist, the snowball method stands out for its psychological and practical benefits, helping people regain control over their finances effectively. This article explores how the snowball method works, practical steps to implement it, real-life examples, comparative analyses with other strategies, and prospects for future financial stability.

Understanding the Snowball Method: Fundamentals and Benefits

The snowball method involves prioritizing the repayment of debts in order of smallest to largest balance, regardless of interest rates. By concentrating on eliminating the smallest debt first, individuals gain a sense of accomplishment that motivates them to continue their repayment journey. This behavioral finance principle leverages small wins to build momentum, which can make a significant difference in long-term financial health.

For example, Sarah, a college graduate with three debts—$500 on a credit card, $1,500 in a personal loan, and $6,000 on student loans—found the snowball method transformative. By paying minimum amounts on all debts except the $500 credit card, she aggressively paid it off quickly. This win gave her the motivation to tackle larger debts methodically, reducing her overall repayment time by almost a year.

In addition to motivation, the snowball method encourages disciplined budgeting. It requires setting up a payment plan where you allocate all extra cash flow to the smallest debt once the minimum payments are covered. The approach contrasts with strategies that prioritize interest rates, such as the avalanche method, which may offer more savings in interest but lack the immediate psychological reward.

Steps to Implement the Snowball Method Effectively

Implementing the snowball method involves a structured approach. The first step is to list all outstanding debts from the smallest balance to the largest, excluding mortgage debt if preferred. This ordering establishes the sequence of repayment targets.

Next, establish minimum monthly payments for all debts except the one with the smallest balance. Redirect any additional funds toward that smallest debt until it is fully paid off. After clearing the smallest debt, roll over the combined payments (previous minimum plus extra) to the next smallest debt, and repeat this process.

For practical illustration, imagine John owes $300, $900, and $2,000 on three different credit cards. Each month, he pays the minimum on all cards—say, $15, $30, and $60 respectively—but applies an extra $100 to the $300 card. Once that card is paid off in about two months, John combines $15 minimum with the $100 extra and applies $115 toward the $900 card, speeding up its repayment.

To maintain momentum, it is crucial to automate payments and track progress regularly. Digital tools and budgeting apps like Mint or YNAB (You Need A Budget) support this process by setting reminders and visualizing debt reduction trends. Automation ensures that no funds are missed in repayment, reinforcing the habit necessary to stay on course.

Comparing the Snowball Method to the Avalanche Method

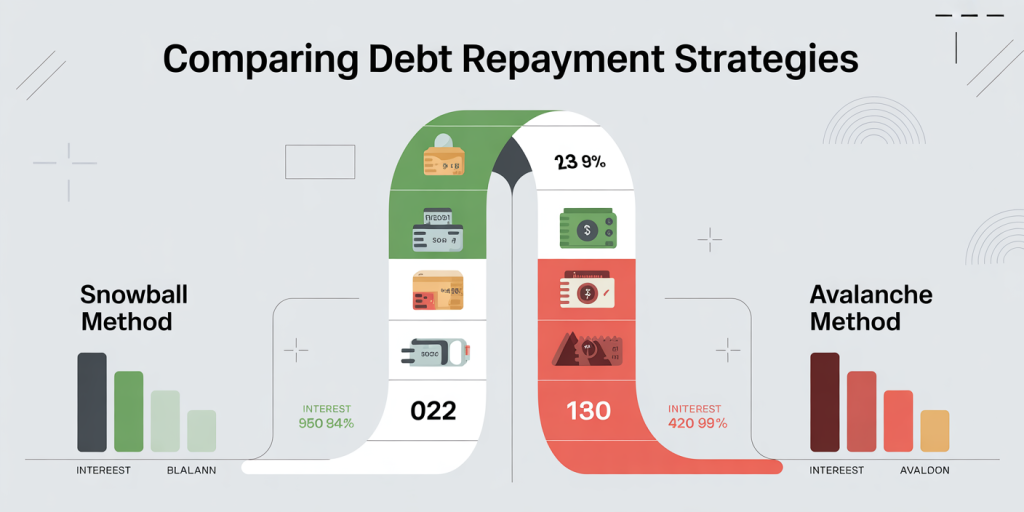

While the snowball method emphasizes quick wins by focusing on small balances first, the avalanche method targets debts by interest rates, aiming to minimize the total interest paid across the repayment period. Understanding their differences can help individuals choose an approach aligned with their priorities.

The following table summarizes the key differences between these two popular debt repayment strategies:

| Aspect | Snowball Method | Avalanche Method |

|---|---|---|

| Payment Order | Smallest balance first | Highest interest rate first |

| Psychological Impact | High motivation due to frequent wins | Less immediate gratification |

| Interest Savings | Moderate | Maximizes interest savings |

| Recommended For | People needing psychological boosts | People focused on minimizing cost |

| Typical Duration | Slightly longer repayment periods | Potentially shortest repayment time |

Studies suggest that while the avalanche method often saves more money in interest (up to 10-25% over the life of the debts), the snowball method’s motivation boost reduces the risk of abandonment. For example, a 2019 survey by the National Foundation for Credit Counseling found that 68% of people who used the snowball method reported feeling more in control of their finances, whereas 55% of avalanche users appreciated the interest savings but felt less engaged.

Choosing between these methods depends largely on your financial psychology and discipline. If you struggle to stay motivated, the snowball method may be preferable, whereas the avalanche method suits individuals with strong commitment to minimizing costs.

Real-Life Success Stories Demonstrating the Snowball Method

Several real-world cases underscore the effectiveness of the snowball method in accelerating debt repayment. Take the case of Carlos and Maria, a couple with a combined debt of $18,000 spread across five credit cards and a car loan. Initially overwhelmed, they applied the snowball method, paying off their smallest $400 credit card first. This success spurred them to tackle an $800 loan next, and so forth.

Within 18 months, through consistent payments averaging $700 a month and strategic budgeting, they eliminated all unsecured debts, significantly boosting their credit score from 620 to 750. Their case exemplifies how the method not only swiftens repayment but also improves overall financial health, including saving on insurance premiums and loan interest by raising creditworthiness.

Another example involves Amanda, a freelancer who managed $7,500 in medical bills and credit card balances. By prioritizing her $500 medical bill, she freed up $75 monthly, then redirected it toward her credit cards. Within a year, she was debt-free and had saved over $1,200 in interest payments.

These stories illustrate that regardless of income level or debt size, the snowball method provides an accessible framework for consistent debt reduction.

Practical Tips to Maximize Snowball Method Success

While the snowball method is straightforward, combining it with additional strategies boosts its effectiveness. First, create and maintain a strict budget that frees up extra cash for debt payments. Tools like Excel budget templates, or apps such as EveryDollar, help categorize expenses and identify areas to cut back.

Second, avoid accumulating new debt during this process. Suspend usage of credit cards once their balances are paid off to prevent undermining progress. It is also beneficial to negotiate with creditors for lower interest rates or hardship programs. According to a 2022 study by Credit Karma, successful negotiations can reduce interest rates by up to 3%, accelerating repayment.

Third, consider boosting income through side gigs or freelance work to add funds to debt payments. For instance, a 2023 report from Upwork revealed that 36% of freelancers increase debt payments with their additional income, accelerating their financial freedom.

Finally, celebrate each payoff milestone. Rewarding yourself within budget can reinforce motivation and help maintain discipline. For example, treating yourself to a modest dinner or a movie night after paying off a debt balance keeps you emotionally engaged without derailing financial goals.

Future Perspectives: The Snowball Method in a Changing Financial Landscape

Debt management methods like the snowball approach will continue to be relevant as household debt remains a global concern. Innovations in financial technology fostering personalized debt coaching and automated payment systems promise to further simplify strategy implementation.

Looking forward, artificial intelligence (AI)-driven financial apps may customize snowball repayment plans integrating real-time income data, expense tracking, and predictive analytics to optimize debt payoff speed. Banks may increasingly offer tailored incentives, such as reduced interest rates or rewards, for customers using effective debt management techniques.

Moreover, evolving economic conditions, including inflation and interest rate changes, will influence debt repayment dynamics. The adaptable nature of the snowball method positions it well to accommodate fluctuating cash flows, allowing borrowers to adjust payment sizes flexibly while maintaining repayment momentum.

Education and financial literacy efforts will shape adoption rates as well. With statistics showing that 60% of Americans lack a basic budget plan (source: FINRA Investor Education Foundation, 2022), promoting simple yet psychologically effective systems like the snowball method can make a significant impact on reducing national debt burdens.

In summary, the snowball method enhances not only debt repayment efficiency but also financial behavior and confidence, making it a valuable tool in navigating both current debts and future financial goals. Its combination of simplicity, motivation, and adaptability ensures that it will remain a cornerstone strategy for individuals striving for financial freedom amid evolving challenges.

Deixe um comentário