When it comes to retirement savings, understanding how different accounts work can significantly impact your financial future. Among various tax-advantaged accounts, Roth Individual Retirement Arrangements (Roth IRAs) stand out as a popular choice, primarily for their unique tax benefits. This article delves into how Roth IRAs can help you save on taxes, enhancing your retirement strategy and optimizing your long-term wealth.

The Basics of Roth IRAs: Tax-Free Growth and Withdrawals

Unlike traditional IRAs, contributions to Roth IRAs are made with after-tax dollars, meaning you do not get an immediate tax deduction when you contribute. However, the key tax advantage is that your investments grow tax-free, and qualified withdrawals during retirement are also tax-free. This feature allows you to potentially save thousands in taxes over the long term.

For example, if you contribute $6,000 annually to a Roth IRA for 30 years and earn an average annual return of 7%, your account could grow to about $600,000. When you withdraw this money in retirement, none of it is taxable—a stark contrast to a traditional IRA, where withdrawals are taxed as ordinary income.

According to IRS data, individuals in higher tax brackets benefit most from Roth IRAs since they effectively lock in a lower tax rate today. If you expect to be in a higher tax bracket during retirement or anticipate taxes rising across the board, paying taxes now on Roth contributions can save you significant money later.

How Roth IRAs Differ from Traditional IRAs in Tax Treatment

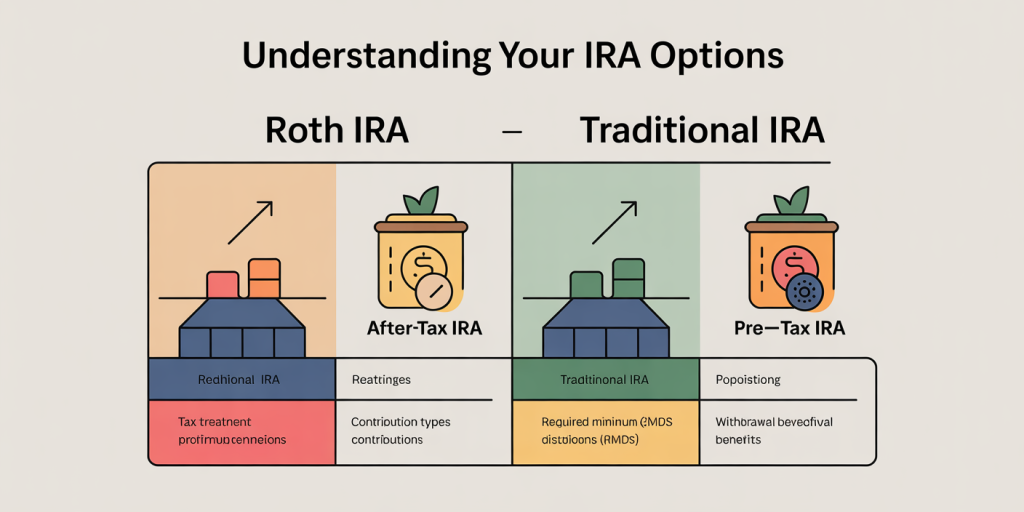

Understanding the tax differences between Roth and traditional IRAs is essential to shaping your retirement tax strategy. Contributions to traditional IRAs are often tax-deductible, lowering your taxable income immediately, but withdrawals during retirement are taxed as ordinary income. In contrast, Roth IRA contributions do not lower your current taxable income, but qualified withdrawals are tax-free.

The table below compares key tax attributes of Roth and traditional IRAs:

| Feature | Roth IRA | Traditional IRA |

|---|---|---|

| Contribution Type | After-tax dollars | Pre-tax dollars (tax-deductible) |

| Tax Treatment of Contributions | No immediate tax benefit | Tax-deductible in contribution year |

| Tax Treatment of Earnings | Tax-free growth | Tax-deferred growth |

| Tax Treatment of Distributions | Tax-free if qualified | Taxable as ordinary income |

| Required Minimum Distributions | No RMDs during the account owner’s life | RMDs begin at age 73 (as of 2024) |

| Income Limits for Contributions | Yes (phases out at higher incomes) | None for contributions; deduction may be limited based on income |

A practical example highlights the importance of this difference: Sarah, a 35-year-old in the 22% federal tax bracket, anticipates her retirement tax rate to be 28%. By contributing to a Roth IRA now, she pays tax on her contributions at 22%, but enjoys tax-free withdrawals later when her tax rate is potentially 28%. This strategy helps her save money compared to traditional IRA contributions, where she would defer tax now but pay 28% tax on larger withdrawals in retirement.

Tax Advantages of Roth IRAs Beyond Retirement Withdrawals

Tax advantages associated with Roth IRAs extend beyond tax-free withdrawals post-retirement age. One distinctive feature is the lack of required minimum distributions (RMDs). While traditional IRAs require you to withdraw a minimum amount starting at age 73, Roth IRAs allow your money to grow tax-free for as long as you want. This makes Roth IRAs an excellent vehicle for estate planning and wealth transfer, as it helps keep funds in the tax-free growth environment longer.

Further, Roth IRAs provide flexibility in accessing contributions without penalties or taxes. Since contributions are made after-tax, you can withdraw the amount you put in at any time without incurring taxes or early withdrawal penalties. However, earnings withdrawn before age 59½ may be subject to taxes and a 10% penalty unless certain exceptions apply.

Consider John, who contributed $30,000 to his Roth IRA over the years. At age 50, he loses his job and needs $10,000 to cover expenses. John can withdraw $10,000 from his contribution balance without taxes or penalties, providing financial flexibility during unexpected situations—something not typically available with pre-tax retirement accounts.

Who Benefits Most from Roth IRAs: Income and Tax Strategy Considerations

Roth IRAs are especially suited for individuals who expect their income—and consequently, their tax rates—to rise in the future. Millennials and young professionals, who are often early in their careers and in lower tax brackets, may find Roth IRAs particularly advantageous by paying tax at a low rate today.

A study by Fidelity Investments found that investors who start contributing to Roth IRAs early in their careers accumulate more tax-advantaged wealth due to the compound growth of tax-free earnings. Moreover, those in moderate income brackets, especially those facing income limits, should carefully plan their contributions. The IRS income limits for Roth IRA contributions in 2024 phase out at $138,000 to $153,000 for single filers and $218,000 to $228,000 for married filing jointly.

For high-income earners who exceed contribution limits, a “backdoor Roth IRA” strategy is an alternative to access Roth benefits. This involves making non-deductible contributions to a traditional IRA and then converting the funds to a Roth IRA. However, this process has tax implications and requires careful planning to avoid unexpected tax liabilities.

Comparative Tax Savings: Roth IRAs vs. Other Retirement Accounts

To appreciate the tax benefits of Roth IRAs fully, it is crucial to compare them against other common retirement saving options like 401(k) plans and traditional IRAs.

| Retirement Account | Contribution Tax Treatment | Growth Taxation | Withdrawal Taxation | RMDs |

|---|---|---|---|---|

| Roth IRA | After-tax | Tax-free | Tax-free (if qualified) | None |

| Traditional IRA | Pre-tax (deductible) | Tax-deferred | Taxed as ordinary income | Yes, at age 73 |

| 401(k) | Pre-tax (deductible) | Tax-deferred | Taxed as ordinary income | Yes, at age 73 |

| Roth 401(k) | After-tax | Tax-free | Tax-free (if qualified) | Yes, at age 73 |

A key differentiator for Roth IRAs is the absence of RMDs, unlike Roth 401(k)s, which require RMDs after age 73. This means Roth IRAs provide greater control over your taxable income in retirement by allowing you to decide if and when to tap into your savings.

Moreover, Roth IRA contributions come with more flexibility: you can withdraw your principal at any time penalty-free. On the other hand, early withdrawals from 401(k)s or traditional IRAs often incur penalties and taxes unless specific criteria are met.

Real-world tax savings underscore the importance of these differences. A 2022 analysis from the Employee Benefit Research Institute (EBRI) showed that retirees with Roth accounts significantly reduced their tax bills in retirement by managing withdrawals to avoid jumping into higher tax brackets.

Future Perspectives: Roth IRAs and Tax Policy Trends

Looking ahead, Roth IRAs are likely to remain a cornerstone in tax-efficient retirement planning. However, evolving tax policies could influence how these accounts are used and regulated.

One trend is potential changes in tax rates. With federal deficits rising and debates around tax reforms ongoing, many experts predict higher tax rates in the future. This makes locking in lower tax rates now through Roth IRA contributions more appealing.

Additionally, recent legislation such as the SECURE Act 2.0 has extended RMD age to 73 and introduced strategies to encourage Roth conversions. These changes signal a growing emphasis on Roth accounts as tools for tax diversification and estate planning.

Some analysts recommend a balanced approach: combining traditional and Roth accounts to hedge against future tax uncertainties. For example, during market downturns, it might be advantageous to perform Roth conversions at lower valuations to maximize the tax-free growth potential.

In conclusion, Roth IRAs offer a compelling way to save on taxes, especially for those expecting higher earnings in retirement or anticipating tax rate increases. Their flexibility, combined with tax-free growth and withdrawals, provides both immediate and long-term tax-saving opportunities that should be an integral part of a well-rounded retirement strategy.

Deixe um comentário