Achieving Financial Independence, Retire Early (FIRE) has gained widespread traction among millennials and Gen Xers seeking to escape the traditional 9-to-5 grind decades before the typical retirement age. A strategic approach to investing is paramount to successfully executing a FIRE plan. Among the myriad of investment vehicles available, index funds stand out as a powerful tool for those aiming to accumulate wealth efficiently and with minimal risk. This article explores how index funds fit into a comprehensive FIRE strategy, backed by data, real-world examples, and practical insights.

Understanding the FIRE Movement and Its Investment Needs

The FIRE movement centers on extreme savings and investing to build a nest egg that can sustainably cover living expenses indefinitely. For many, FIRE means retiring in their 30s, 40s, or 50s by living below their means and investing aggressively. The core challenge lies in balancing risk, returns, and liquidity to ensure monies last long after traditional retirement funds would have been tapped out.

Typically, FIRE adherents target a 25x to 30x multiple of their annual expenses in investments, based on the 4% safe withdrawal rule endorsed by financial experts. This means, for example, if you spend $40,000 a year, you would need $1 million to $1.2 million invested to retire safely. Achieving and maintaining this capital demands steady growth, minimized fees, and diversification — criteria which index funds satisfy exceptionally well.

By offering broad market exposure, low management fees, and historical reliability, index funds align perfectly with the disciplined, long-term approach essential for FIRE success.

Why Index Funds Are Foundational to FIRE Investing

Low Costs Significantly Improve Compound Growth

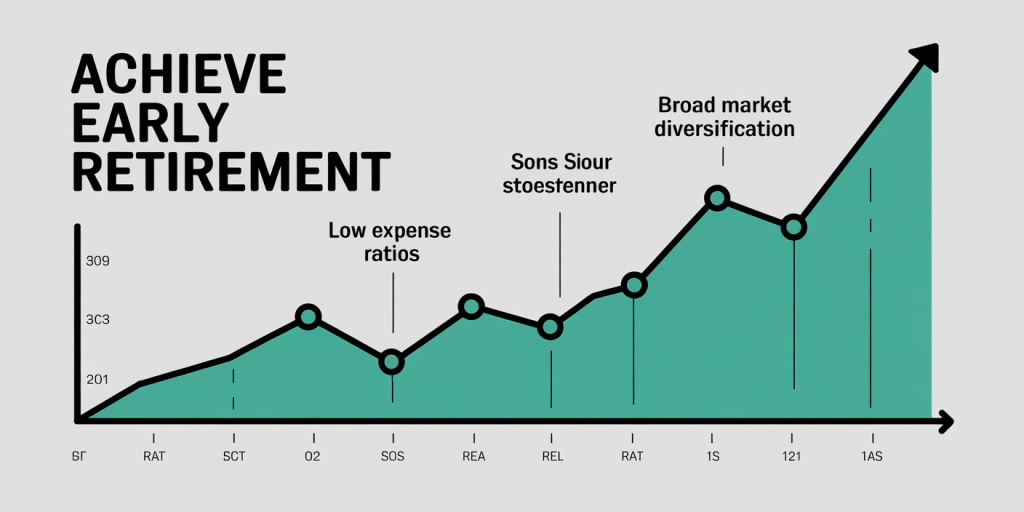

Index funds track a market index — such as the S&P 500 or the Total Stock Market Index — and are passively managed. This passive management translates to substantially lower expense ratios, often between 0.03% to 0.10%, compared to actively managed mutual funds that may charge 1% or more annually. Over decades, even a 1% difference in fees can erode the investment’s value by hundreds of thousands of dollars.

For example, a $100,000 investment growing at an average annual rate of 7% will be worth approximately $761,225 after 30 years at a 0.10% expense ratio. At a 1% fee, the same investment would grow to $552,304. The $208,921 difference underscores why low-cost index funds amplify compounding returns, a cornerstone for building FIRE wealth.

Market Diversification Reduces Risk

Index funds provide instant diversification by holding all or most securities in a given market index. For instance, the Vanguard Total Stock Market Index Fund (VTSAX) invests in over 3,500 U.S. stocks spanning large, mid, and small-cap companies. Diversification lowers the risk of significant losses from any single company or sector downturn.

During the 2008 financial crisis, for example, diversified index funds experienced sharp declines but rebounded alongside the overall market. An investor holding a broad index fund who maintained discipline during that period would have recouped losses long before assets tied to individual equities or funds more exposed to sector risk.

Below is a comparative snapshot of popular investment options relevant to FIRE investors:

| Investment Type | Average Annual Return (Last 20 Years) | Expense Ratio | Diversification Level | Volatility Risk |

|---|---|---|---|---|

| S&P 500 Index Fund | ~9.8% | 0.04% – 0.10% | High (500 large caps) | Moderate |

| Actively Managed Fund | ~6% – 8% | 0.8% – 1.2% | Varies | Variable |

| Individual Stocks | Variable | N/A | Low | High |

| Bonds (Aggregate Index) | ~3%-4% | 0.05%-0.15% | Moderate | Low to Moderate |

*Data sourced from Morningstar and Vanguard reports*

Practical Applications: Index Funds in Your FIRE Portfolio

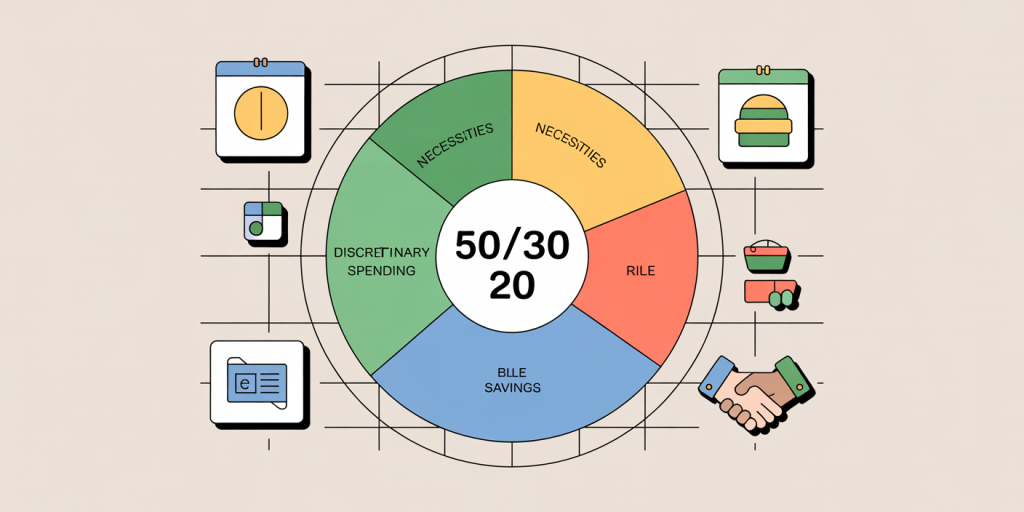

Most FIRE practitioners follow a three-pronged investment approach: maximize tax-advantaged accounts (such as IRAs and 401(k)s), invest in taxable brokerage accounts for flexibility, and maintain an emergency fund. Index funds fit naturally into these pillars.

Consider the case of Jane and Mark, a couple in their mid-30s pursuing FIRE. They earn a combined $120,000 but save aggressively, funneling 50% of their income into their investment accounts. Their $401(k) primarily holds an S&P 500 index fund, while their brokerage account focuses on a Total Stock Market index fund plus some bond index funds for balance.

Over 15 years, their portfolio, averaging 7% annual growth net of fees, has grown to over $700,000. Their broad index fund strategy harnesses market gains while minimizing transaction taxes and fees, enabling them to project early retirement in their late 40s.

Tax-efficient index funds suited for taxable accounts, such as those tracking U.S. total market or international markets, optimize capital gains taxes. For instance, the tax efficiency of ETFs (exchange-traded funds) that track indexes often surpasses actively managed funds due to reduced turnover.

Managing Risks and Market Volatility with Index Funds

The threat of market downturns is an undeniable challenge in the FIRE roadmap. However, index funds allow investors to ride out volatility more confidently because they reflect entire market behaviors rather than speculative bets on single securities.

An example can be drawn from the COVID-19 pandemic market drop in March 2020 when the S&P 500 plunged nearly 34% in a month. Investors in broad index funds experienced this downturn but benefited from the subsequent rapid recovery. Those with diversified index funds avoided catastrophic losses seen in narrower or individual stock portfolios.

Moreover, investors can mitigate risk by diversifying globally via index funds tracking international stocks and bonds. The Vanguard FTSE All-World ex-US ETF (VEU), for example, spreads exposure across developed and emerging markets outside the U.S.

Balancing equity index funds with bond index funds also tempers portfolio volatility. While equities fuel growth, bonds provide stability and consistent income during recessions, enabling a more predictable withdrawal strategy post-FIRE.

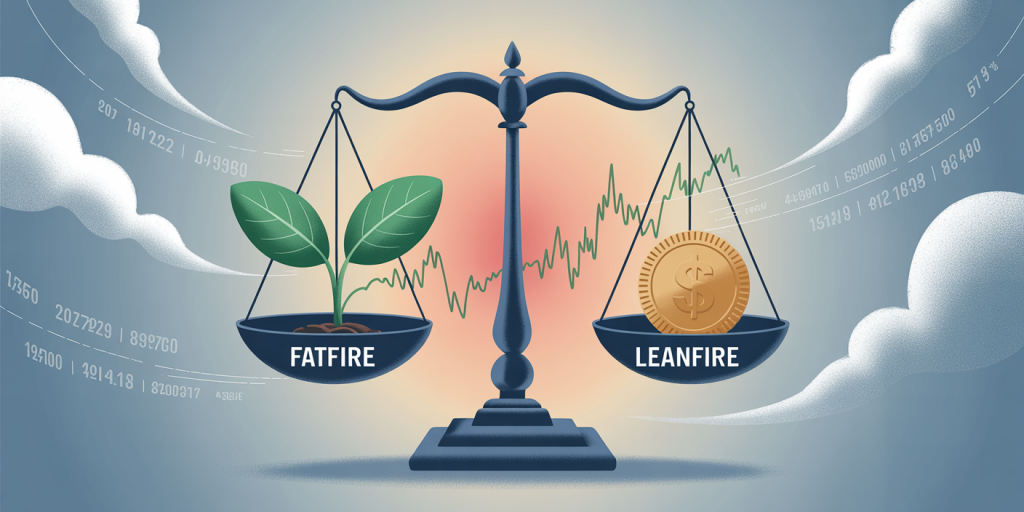

Comparing Index Funds with Other FIRE Investment Strategies

Beyond index funds, some FIRE aspirants explore real estate, individual stock picking, or business investments. Each carries unique benefits and drawbacks, making index funds appealing for specific reasons.

| Strategy | Potential Returns | Liquidity | Risk Level | Time Commitment | Ideal For |

|---|---|---|---|---|---|

| Index Funds | Moderate to High | High | Moderate | Low | Disciplined, long-term savers |

| Real Estate | High | Low to Moderate | High | High | Experienced investors seeking cash flow |

| Individual Stocks | Variable | High | High | High | Skilled investors with risk tolerance |

| Owning a Business | Potentially Very High | Low | Very High | Very High | Entrepreneurial individuals |

In practice, many FIRE proponents combine these strategies but maintain index funds as the portfolio’s backbone due to ease of management, low costs, and consistent performance.

Future Perspectives: Index Funds Amidst Evolving Markets and FIRE Trends

As financial markets evolve, so too does the utility of index funds in a FIRE strategy. Emerging trends like sector-based index funds (technology, healthcare), thematic ETFs, and socially responsible investing (ESG) funds introduce customization options. However, the oldest and broadest index funds continue to offer unmatched balance between growth and risk.

Automation and robo-advisors that select index funds for portfolios based on risk tolerance simplify FIRE investing, attracting beginners. Additionally, as FIRE concepts expand globally, international index funds become a vital component to hedge against domestic economic risks.

Data from BlackRock indicates global ETF assets reached $10 trillion in early 2024, driven largely by index fund popularity. This growth enhances liquidity and lowers fees further, which benefits FIRE investors by reducing investment drag.

Furthermore, with rising concerns about inflation and interest rate changes, shifting allocations between stock index funds and bond index funds will remain a key tactical decision for those in or near FIRE. Strategic rebalancing in index fund portfolios can lock in gains and reduce exposure to overvalued sectors.

In summary, index funds will continue to be indispensable for FIRE practitioners. They offer a proven, efficient, and scalable avenue to build the wealth required for early financial independence, adapting smoothly with changing investment environments and individual goals.