In today’s complex economic landscape, financial education is no longer a luxury but a necessity. Understanding the basics of money management, investment, and financial planning empowers individuals to make informed decisions that can safeguard their future and promote long-term financial well-being. Despite its importance, a significant portion of the global population lacks adequate financial literacy. According to the Global Financial Literacy Excellence Center (GFLEC), only 33% of adults worldwide are financially literate—a statistic that underscores the urgent need for systematic financial education.

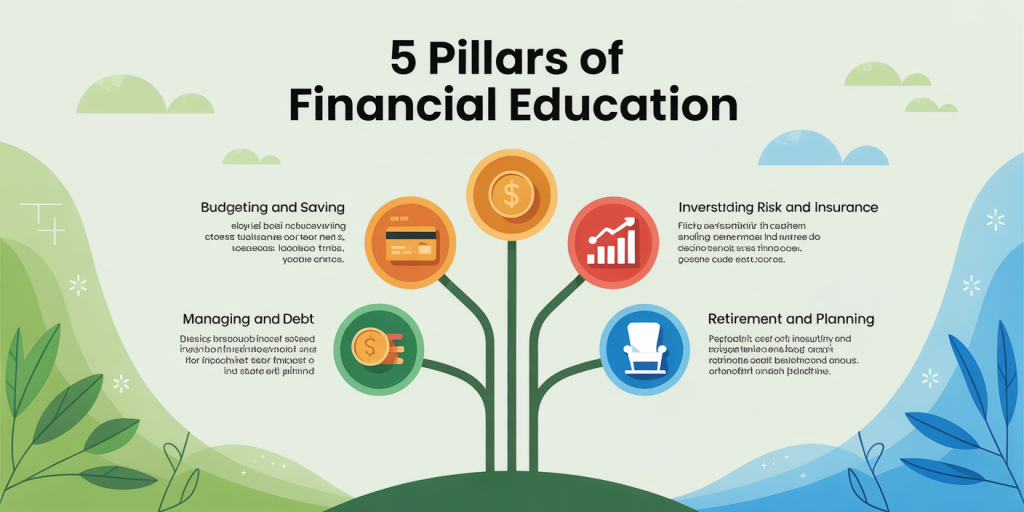

By focusing on five foundational pillars, individuals can develop a holistic approach to handling their finances. These pillars are essential components that serve as building blocks for robust financial knowledge. They are budgeting and saving, managing debt, investing wisely, understanding risk and insurance, and retirement and estate planning.

Budgeting and Saving: The Foundation of Financial Stability

Budgeting is the cornerstone of any effective financial strategy. It involves tracking income and expenses to ensure that spending aligns with priorities and financial goals. A well-constructed budget helps prevent overspending and promotes savings—a critical buffer in uncertain times.

Consider a practical example: Jane, a 35-year-old marketing manager, uses a simple budgeting app to categorize her monthly expenses. By allocating specific amounts to essentials like rent, groceries, and utilities, Jane identifies that she spends around 20% of her income on dining out. Recognizing this, she cuts back and redirects that money into a high-yield savings account, growing her emergency fund to cover six months of expenses within a year.

Saving is intimately tied to budgeting. According to the Federal Reserve’s 2023 report, nearly 40% of American adults would struggle to cover an unexpected $400 expense without borrowing or selling assets, spotlighting the relevance of a strong savings habit.

| Expense Category | Average Monthly Spend (%) | Recommended Spend (%) |

|---|---|---|

| Housing (Rent/Mortgage) | 30 | 25-30 |

| Food | 15 | 10-15 |

| Transportation | 10 | 10-15 |

| Entertainment | 8 | 5-10 |

| Savings | 5 | 15-20 |

By adhering to budgeting disciplines and prioritizing savings, individuals build a safety net that allows them to pursue other financial goals with confidence.

Managing Debt: Strategies to Reduce and Avoid Financial Burdens

Debt can be an effective tool when used responsibly, such as taking a mortgage to buy a home or a student loan to invest in education. However, unmanaged debt can escalate quickly, creating a cycle of financial stress. Managing debt involves understanding the types, costs, and strategies to reduce and control borrowing.

An illustrative case is Robert, who accumulated $25,000 in credit card debt with an average interest rate of 18%. He switched to the debt avalanche method, prioritizing payments on the highest interest cards first while making minimum payments on others. Within two years, Robert eliminated his debt, saving thousands in interest.

Managing debt also entails being mindful of the consequences of poor credit. According to Experian’s 2023 report, Americans carry an average credit card balance of $5,240, and those with poor credit scores pay about 20% more in interest rates on loans, increasing their repayment burdens.

| Debt Type | Average APR (%) | Recommended Strategy |

|---|---|---|

| Credit cards | 15-25 | Pay full balance monthly; use low-interest cards |

| Student loans | 4-8 | Consider refinancing options |

| Mortgages | 3-6 | Lock fixed rates for budget stability |

| Personal loans | 10-15 | Avoid unless for urgent needs |

By understanding and managing debt effectively, individuals can maintain healthier credit scores and reduce financial anxiety.

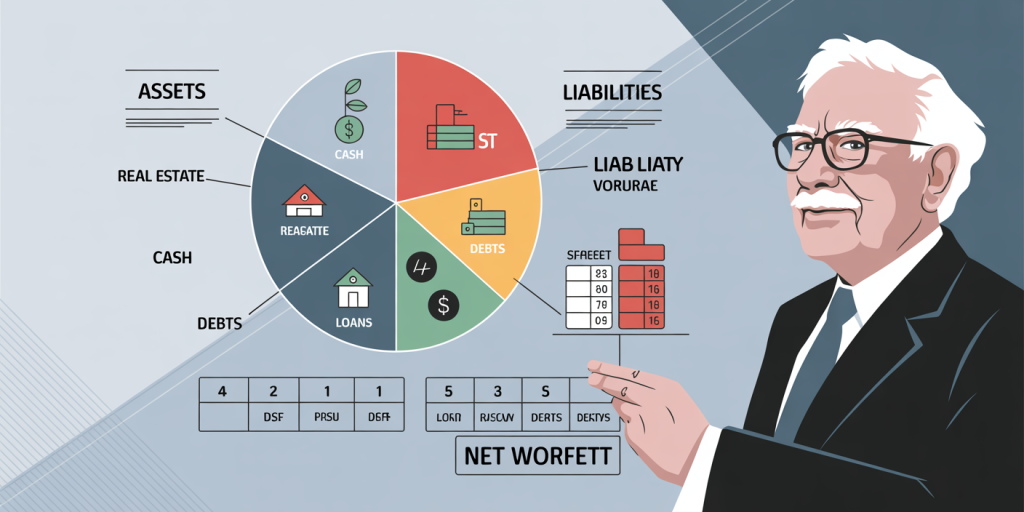

Investing Wisely: Building Wealth Through Smart Decisions

Investing is often perceived as complex and risky, yet it is a crucial pillar for wealth-building beyond basic saving. With inflation averaging around 3% annually in recent decades, simply saving money without investment risks eroding purchasing power over time.

Take the example of Samantha, who started investing $200 monthly in a diversified exchange-traded fund (ETF) at age 30. Assuming a historical average return of 7% per year, Samantha’s portfolio could grow to over $61,000 in 15 years, illustrating the power of compounding.

Investors must be familiar with various asset classes—stocks, bonds, real estate, and mutual funds—and balancing their portfolios according to their risk tolerance and time horizon. For instance, younger investors generally lean toward equities to maximize growth potential, while retirees often prioritize bonds for stability.

| Investment Type | Expected Annual Return (%) | Risk Level |

|---|---|---|

| Stocks | 7-10 | High |

| Bonds | 2-5 | Moderate |

| Real Estate | 4-7 | Moderate |

| Mutual Funds/ETFs | 5-8 | Variable |

| Savings Accounts | 0.5-2 | Low |

Education on fees, diversification, and investment vehicles empowers individuals to make informed decisions, reducing the likelihood of costly errors and panic selling during market volatility.

Understanding Risk and Insurance: Protection Against Uncertainty

Financial education is incomplete without understanding risk management. Life is full of uncertainties—from natural disasters to health crises—that can disrupt finances. Insurance is a vital tool to mitigate these risks, transferring potential financial losses to insurers in exchange for premiums.

For example, consider a family living in a hurricane-prone region. A lack of adequate homeowners insurance can lead to devastating financial losses after a disaster. An effective insurance plan balances coverage and cost, ensuring protection without overpaying.

Health insurance is another critical area. According to the Kaiser Family Foundation’s 2023 survey, medical debt affects approximately 18% of Americans, despite most having insurance, highlighting the importance of choosing comprehensive plans.

| Insurance Type | Purpose | Key Considerations |

|---|---|---|

| Health Insurance | Covers medical expenses | Deductibles, copays, network coverage |

| Life Insurance | Provides financial support to dependents | Term vs. whole life policies |

| Property Insurance | Protects against loss/damage to property | Coverage limits, natural disaster clauses |

| Disability Insurance | Income replacement if unable to work | Benefit period, waiting period |

By understanding how different insurance policies work, individuals can safeguard their financial health against unforeseen events.

Planning for Retirement and Estate: Securing Your Long-Term Legacy

Retirement planning is a crucial component of financial education, aiming to ensure individuals can maintain their lifestyles when their regular income ceases. Given increasing life expectancies—averaging 77 years globally according to WHO—planning for potentially 20-30 years of retirement income is essential.

For instance, Mark, a 45-year-old engineer, contributes regularly to a 401(k) plan and an individual retirement account (IRA), maximizing employer matches and tax advantages. By utilizing retirement calculators and financial advisors, he projects needing $1.5 million in savings at retirement to support his desired lifestyle.

Estate planning complements retirement by ensuring assets are distributed according to wishes, minimizing taxes and legal complications. Surprisingly, a 2022 Gallup Poll found that 60% of Americans do not have a will, putting heirs at risk of legal disputes and financial loss.

| Retirement Account Type | Tax Treatment | Contribution Limits 2024 |

|---|---|---|

| 401(k) | Pre-tax contributions | $23,000 (under 50), $30,500 (50+) |

| Roth IRA | Post-tax contributions | $6,500 (under 50), $7,500 (50+) |

| Traditional IRA | Potential tax deduction | $6,500 (under 50), $7,500 (50+) |

Effective retirement planning involves disciplined savings, diversified investments, and estate planning mechanisms such as wills, trusts, and powers of attorney.

Future Perspectives: Evolving Trends in Financial Education

Financial education is evolving to address the challenges of a digital economy and growing financial product complexity. Fintech innovations, including robo-advisors and budgeting apps, provide individuals with accessible tools to manage and grow their finances efficiently.

Moreover, the rise of cryptocurrencies and decentralized finance (DeFi) introduces new opportunities and risks. As of 2023, over 300 million people worldwide own some form of cryptocurrency, yet many lack deep understanding—heightening the need for targeted education to avoid scams and significant losses.

Governments and organizations increasingly recognize this need. For example, the OECD’s International Network on Financial Education (INFE) promotes global cooperation to enhance financial literacy programs tailored to different demographics.

A forward-looking approach also emphasizes personalized financial education, integrating artificial intelligence and data analytics to deliver customized advice and learning. Educational institutions are incorporating financial literacy curricula at earlier stages, helping younger generations build competence over time.

In sum, financial education is not static. It must continually adapt to economic conditions, technological advancements, and demographic changes to empower individuals effectively.

Mastering the five pillars of financial education lays the groundwork for financial security and independence. Through budgeting and saving, managing debt, investing wisely, understanding risk and insurance, and diligent retirement and estate planning, individuals can navigate the financial complexities of modern life with confidence. The future promises both challenges and innovations in financial education, making lifelong learning in this domain more vital than ever.